Understanding SUI and the Sui Blockchain Network

During the cryptocurrency market bull run, the Sui blockchain network’s SUI tokens emerged as a notable gainer, rising nearly 100% in just one month. With the Sui Foundation expanding its use cases and developers developing its cutting-edge technology, SUI appears to be a promising token. This article will take a detailed look at the Sui blockchain network, its tokenomics, and its utility.

What is the Sui Blockchain?

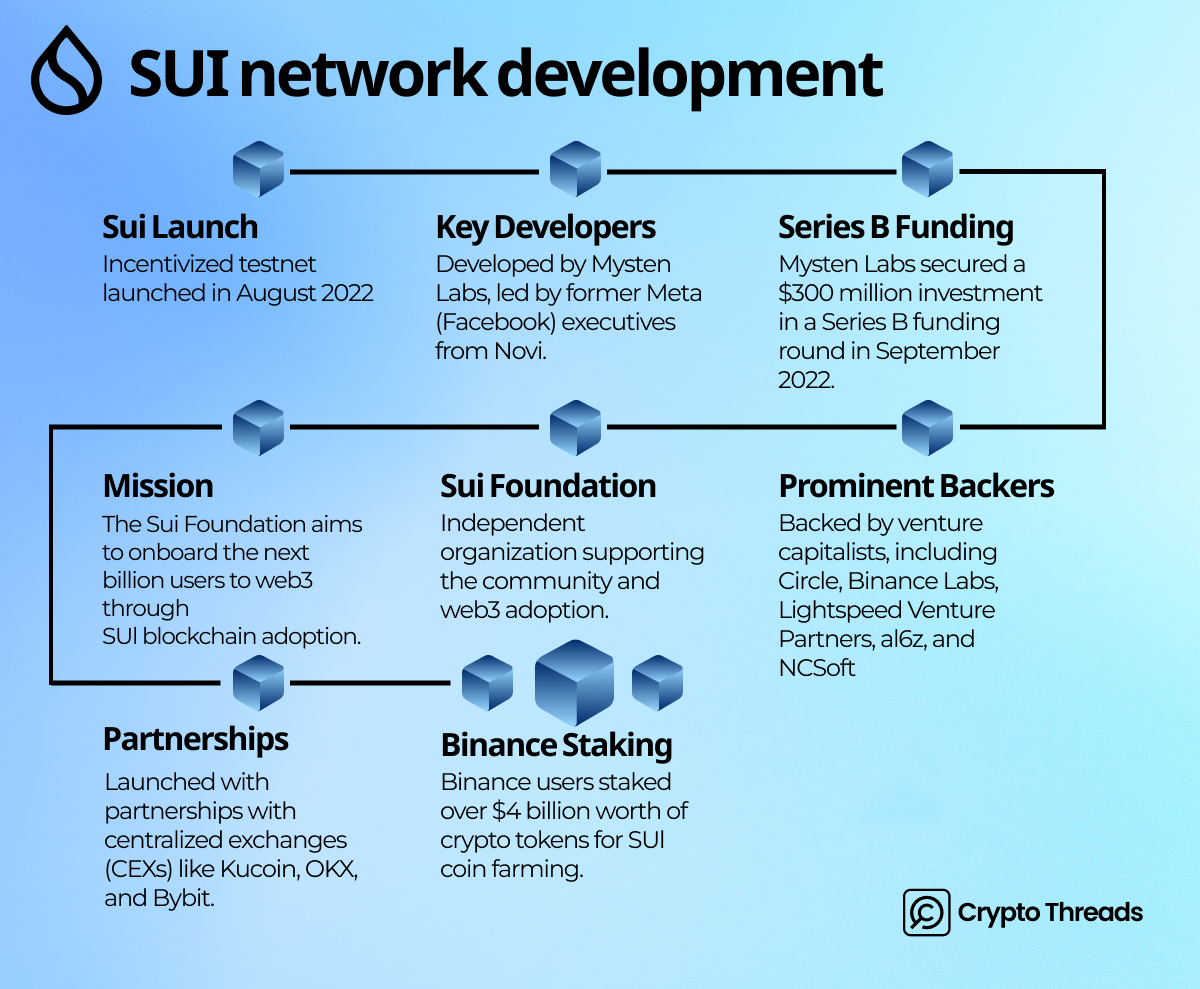

The History of Sui Blockchain

The Sui blockchain is a permissionless layer 1 (L1) blockchain that is perfect for apps that serve millions of users since it has low latency, high throughput, and few transaction costs. The infrastructure is scalable, fast, safe, and cheap, with the transaction processing speed being 297,000 TPS, and the finality time on average is ~400 ms. At the moment, 32.1 million active accounts and 7.4 billion completed transactions are made on the Sui Network, with a total value locked (TVL) of $1.55 billion.

How Does the Sui Blockchain Work?

Like Solana and Ethereum, the Sui network is built to be infinitely expandable while preserving the same strong security. This is accomplished by means of advanced technologies like distributed computing, parallel transaction execution, object ownership, and the Move programming language.

The Move programming language is an open-source language derived from Rust and originally developed by Meta for the Diem blockchain. It enhances blockchain security by addressing Rust’s weaknesses and allowing libraries, tools, and developer communities to be shared across multiple blockchains. Move on Sui is made especially to handle programmable items as assets at the user level. Object-centric global storage, globally unique object IDs, addresses as object IDs, module initializers, and object references as inputs to entry points are some of the main changes. Efficiency is increased by enabling simultaneous transaction scheduling with non-overlapping inputs thanks to these modifications.

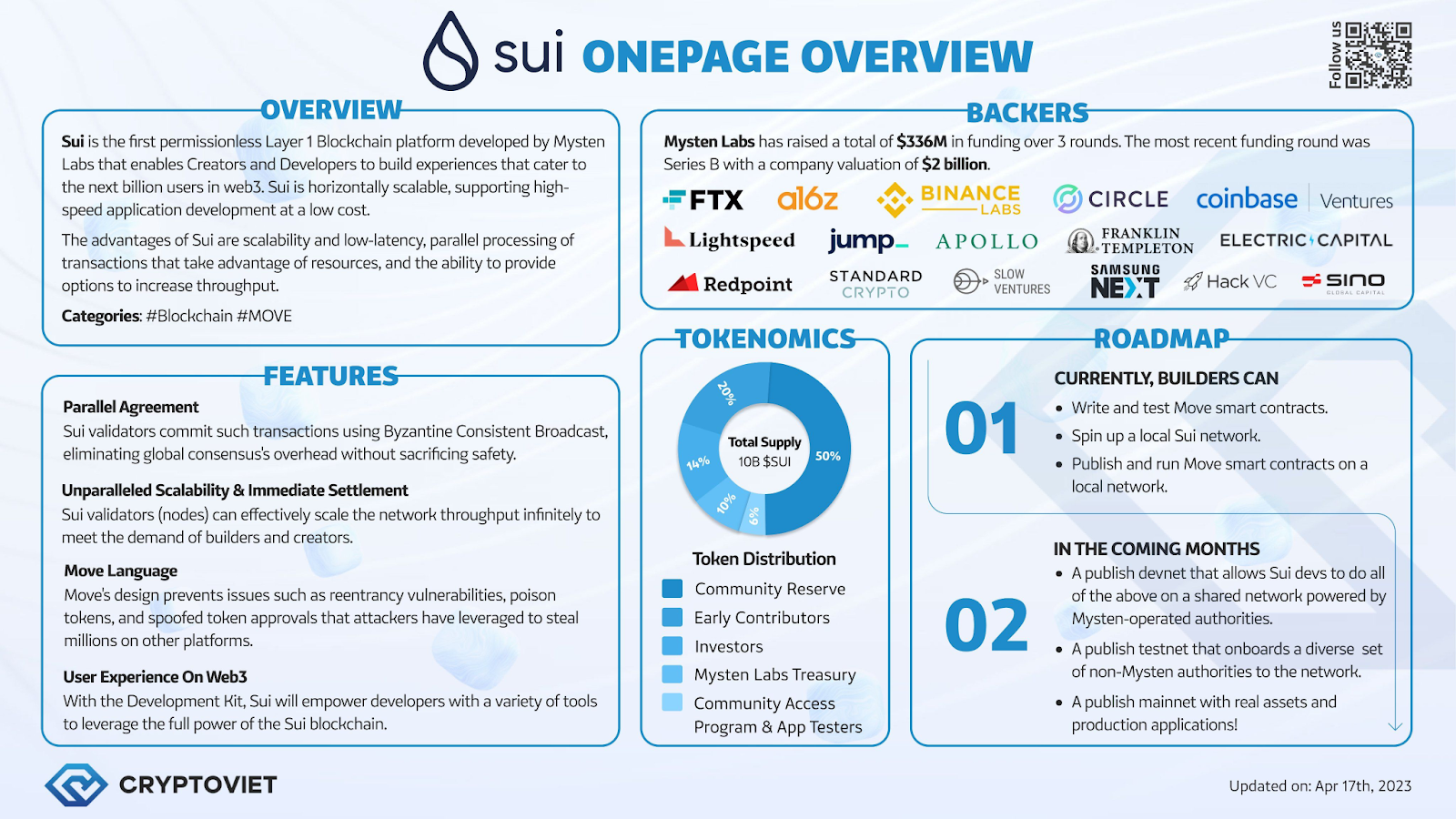

Sui Onepage Overview (Source: Cryptoviet)

Through staking pools, network users elect trusted delegates in Sui’s Delegated Proof-of-Stake (DPoS) consensus mechanism. This democratic approach rewards validators based on their reliability and performance. Currently, the Sui network is secured by around 100 validators. Furthermore, the network’s parallel processing architecture allocates resources efficiently by using multiple CPUs to execute transactions concurrently. Sui achieves a high throughput of 297,000 TPS by ensuring that unrelated transactions involving the same entity are processed concurrently. Sui’s fundamental storage unit, objects, contain special characteristics like ownership, type, and version that aid in effectively managing transaction execution.

The SUI Token: Sui Tokenomics

Tokenomics defines the economic foundation of blockchain networks. The SUI tokenomics comprise several key components.

The native token of the Sui platform, SUI, has a capped supply of 10 billion tokens, with 2.93 billion currently in circulation. Half of the total supply is allocated to the community reserve, intended for initiatives such as delegation programs, research, development, and validator subsidies. The remaining 14% of resources is reserved for the investors, and the remaining 20% for the pioneer believers who participated in testing stages of the network. SUI has several roles, including governance with on-chain voting, payment for gas fees for transactions and storage, a liquidity asset for decentralized applications (dApps), and involvement in a DPo infarct mechanism.

All network functions, such as transaction execution and validator rewards, are gated by gas prices for the purpose of combating spam and ensuring network security. In compute and storage charges, Sui charges allocate compute and storage charges to the front end and are designed to cover long-term data storage. Through the support of the validators, these costs ensure the network’s stability and fairness. One of the ways that SUI holders participate in governance is voting on proposals to improve the network.

Main Use Cases of the Sui Blockchain Network

A Deep Dive in Sui’s Ecosystem Development and Layout (Source: Gate.io)

The Sui Network supports low gas fees, making transactions accessible and affordable. Approximately 0.00249895 SUI, or less than $0.0096, is the average transaction fee. These fees are computed using a transaction validation reference fee that has been modified by validators in the present day. Generally speaking, simpler transactions are less expensive than more complicated ones.

Sui is especially well-suited to revolutionize Web3 gaming because of its scalability and fast throughput. Strong in-game economies and dynamic NFTs supported by the network enable immersive and participatory gaming experiences. Peer-to-peer payments and safe asset transfers are made possible by Sui, which also establishes the groundwork for sophisticated financial services. It also contributes to the development of decentralized social networks, which let users manage their connections and content. The platform Polymedia Chat, which promotes genuine online conversations that are impervious to censorship, is an ideal illustration.

While the number of NFT projects on Sui is currently limited, the network is set to grow significantly. This will likely fuel the growing digital collectibles scene, spur innovation, and expand the scope of what the Sui blockchain can achieve. With these diverse use cases, Sui proves its potential as a powerful and flexible blockchain network.