Berachain Complete Guide: A Proof-of-Liquidity Layer 1 Blockchain

Berachain has just made a boom in the crypto market when it announced the $632M BERA airdrop set alongside the launch of its mainnet. Bera officially launched its mainnet on February 6, 2025 – proposing a new EVM-identical network with the Proof-of-Liquidity consensus protocol that is set to compete with Ethereum and Solana.

In this article, we’ll explore Berachain comprehensively to see why there is such hype in this meme-and-NFT-origin blockchain project.

What is Berachain?

Berachain is a high-performance EVM-Identical Layer 1 blockchain utilizing Proof-of-Liquidity (PoL) developed based on the modular EVM-focused consensus client framework BeaconKit.

Berachain has been developed by a team of pseudonymous creators – Homme Bera, Dev Bear, Papa Bear, and Smokey the Bera – since 2021 from the original NFT collection Bong Bears. Bong Bears quickly gained traction since its introduction thanks to its unique rebase mechanism that allowed users to get additional NFTs when new releases dropped. The NFT community drew in leading experts from the NFT and DeFi space, motivating the creators to launch their own blockchain project – the Berachain.

Source: Berachain

On April 20, 2023, Berachain announced a fundraising that brought the foundation $42M at a $420.69M valuation. A year later, this number increased to $1.5B when the chain closed another round at $69 million.

Key Features of Berachain

EVM-identical

Berachain’s execution layer is identical to the Ethereum Virtual Machine (EVM) runtime environment on the Ethereum Mainnet. Because of that, whenever that EVM is upgraded, Berachain can adopt the latest version – for instance, the Dencun upgrade – right away. This ensures full compatibility with all RPC namespaces and endpoints, allowing any enhancements to execution clients to be instantly applied to Berachain.

In addition to network advancements, developers can seamlessly deploy any protocols or decentralized applications (dApps) designed for EVM-compatible chains directly on Berachain.

Proof-of-Liquidity

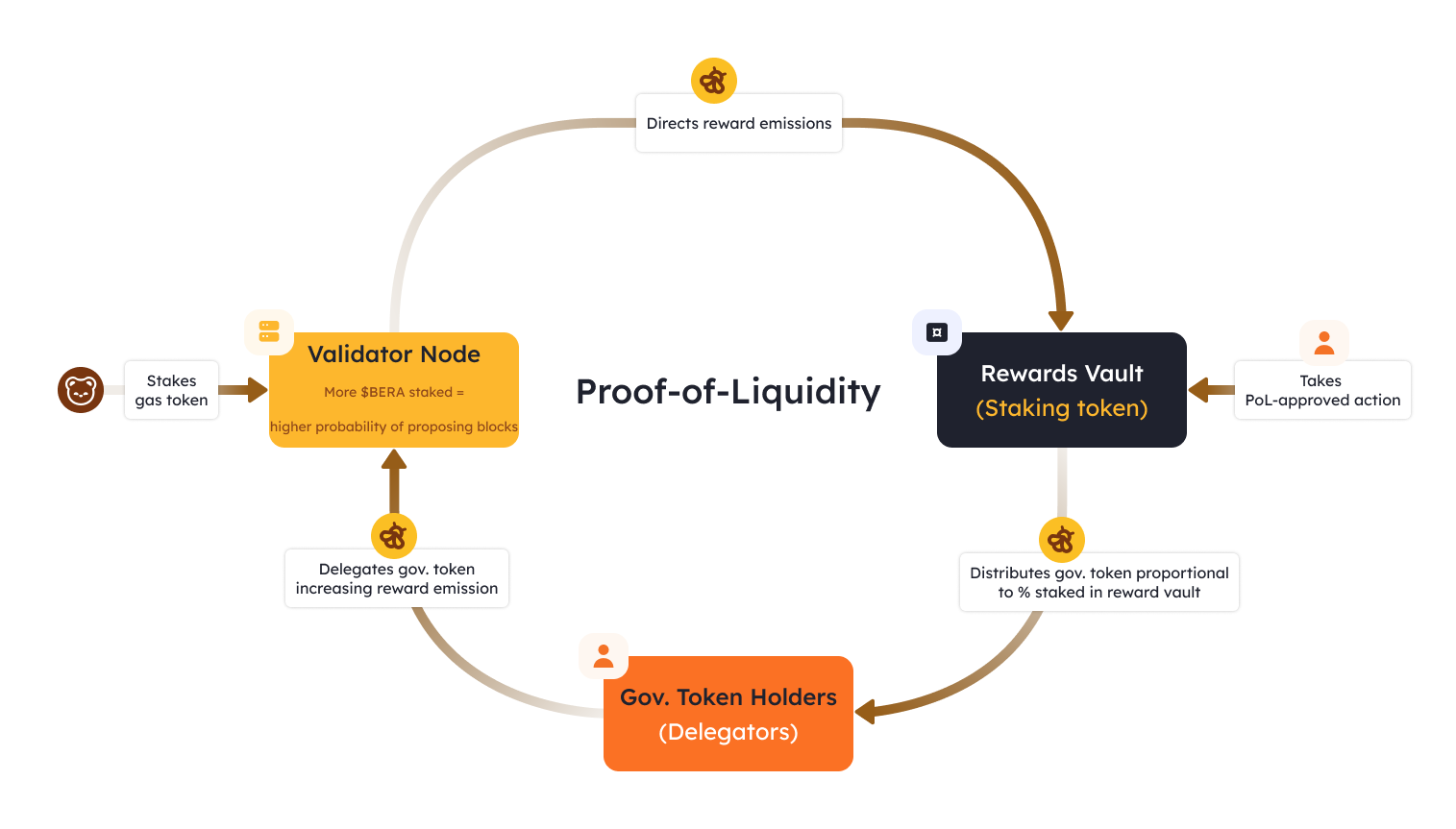

Instead of replicating the Proof-of-Stake consensus on Ethereum, Berachain employs Proof-of-Liquidity that radically changes the structure of L1 economics, prioritizing ecosystem participants and applications over validator rewards.

In fact, Proof-of-Liquidity (PoL) is an extended version of the original PoS that restructures economic incentives among validators, applications, and users. This is achieved through a two-token model:

Validators secure the network by staking the native gas token $BERA. From top down, top N (now 69) validators ranked by stake are selected to the Berachain’s Active Set of validators (validators participating in consensus). Within the Active Set, a validator now has the chance to propose a block, and this probability of proposing is proportional to their staked $BERA – higher stakes increase the chances of block proposal. The selection criteria follow:

$BGT is a soulbound governance token distributed by validators for proposing new blocks, which is eventually rewarded to participants providing ecosystem liquidity.

Source: Berachain

When a validator produces a block, $BGT tokens are emitted. Validators receive $BGT emissions based on the amount of $BGT delegated to them. Validators can direct these $BGT emissions to specific reward vaults and receive incentives from these protocols, often in the form of the protocol’s native tokens. They keep a commission from these incentives for themselves and pass onto their delegators, so that both can benefit from the validating activities.

Berachain Tokens

BERA

Source: Berachain

$BERA serves as the native gas and staking token of Berachain. It is used for paying transaction fees on the Berachain network and by validators to operate a node. The total supply of the token at Genesis is 500,000,000 BERA.

BGT

Source: Berachain

While BERA serves as the native gas, $BGT facilitates governance and economic incentives.

Users can earn BGT by performing actions in dApps with whitelisted Reward Vaults. Most activities are related to providing liquidity but not limited to this kind of action. For example, users deposit liquidity in the native BeraSwap for an LP pair whitelisted to earn BGT emissions or supply assets to a lending market and stake the interest-bearing receipt tokens in a reward vault.

With BGT tokens, holders can perform important tasks:

HONEY

HONEY is Berachain’s native stablecoin and is fully collateralized and soft-pegged to the US dollar. Users use HONEY in the same ways as other stablecoins, such as for payments or remittances or as a hedge fund.

HONEY can be minted by depositing whitelisted collateral into a vault and minting against it via the HoneySwap dApp. The minting rates for each collateral type are governed by BGT holders and can be adjusted accordingly.

Alternatively, users can also obtain HONEY by swapping other assets on BeraSwap.

Berachain Ecosystem

Bera Native dApps

BeraHub

BeraHub is the place where users can access and manage all the activities of the Berachain network, including Swap, Pools, Reward Vaults, Validators, or Governance.

Users can simply click on the items on the menu bar or the interfaces on the website to access different features. If you want to access Bera’s decentralized exchange, choose Swap and start exchanging some tokens. Otherwise, choose Pools if you seek some sort of investment or Reward Vaults if you want to customize how their rewards are distributed across different vaults.

BeraHub

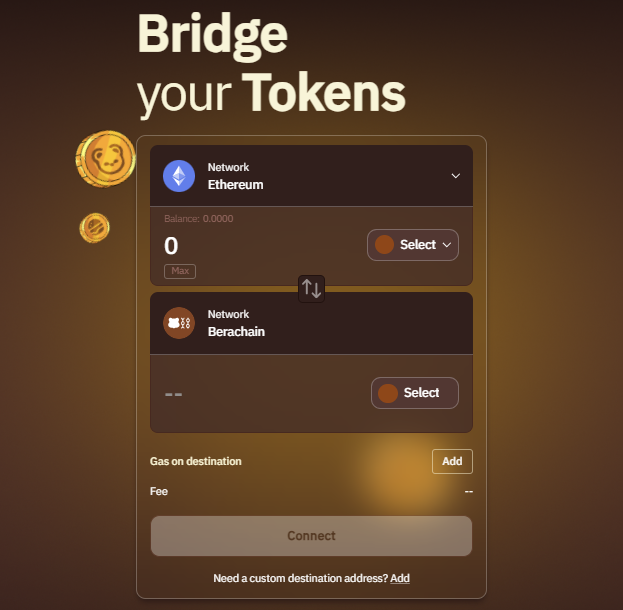

Token Bridge

BeraBridge is a decentralized cross-chain bridge within the Berachain ecosystem. It is built on the LayerZero protocol and is designed to facilitate the seamless transfer of assets between Berachain and other major blockchains, initially focusing on Ethereum.

NFT Bridge

It provides a user-friendly interface that guides users through the process of connecting their wallets, selecting the source and destination chains, and specifying the assets and amounts to transfer. The bridge supports all assets included in Uniswap’s token list. However, if a native version of an asset doesn’t exist on Berachain, it will need to be deployed first, and this can also be done on the platform.

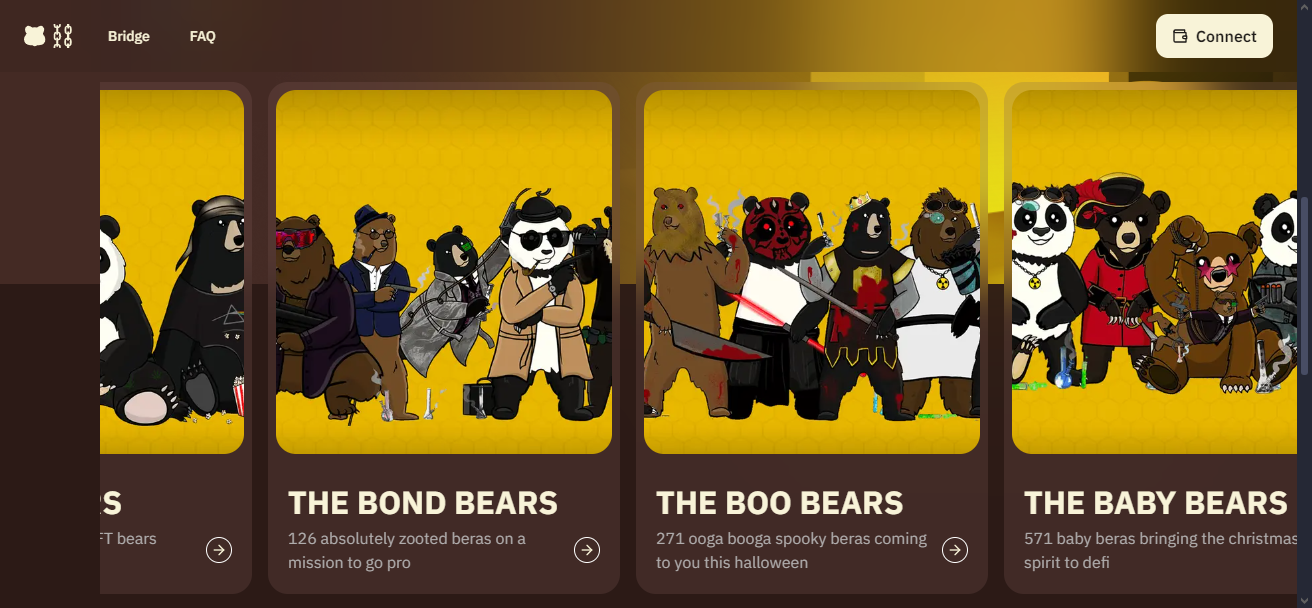

NFT Bridge

The Berachain NFT Bridge enables secure transfers of Bera-native NFTs from Ethereum to the Berachain blockchain network. These NFTs include Bong Beras and all of their rebases:

NFT Bridge

Please note that this NFT Bridge is a one-way transfer mechanism, meaning that once you bridge an NFT from Ethereum to Berachain, you cannot reverse this process. You can also opt for the multi-bridging feature to bridge all of your NFTs in a single transaction.

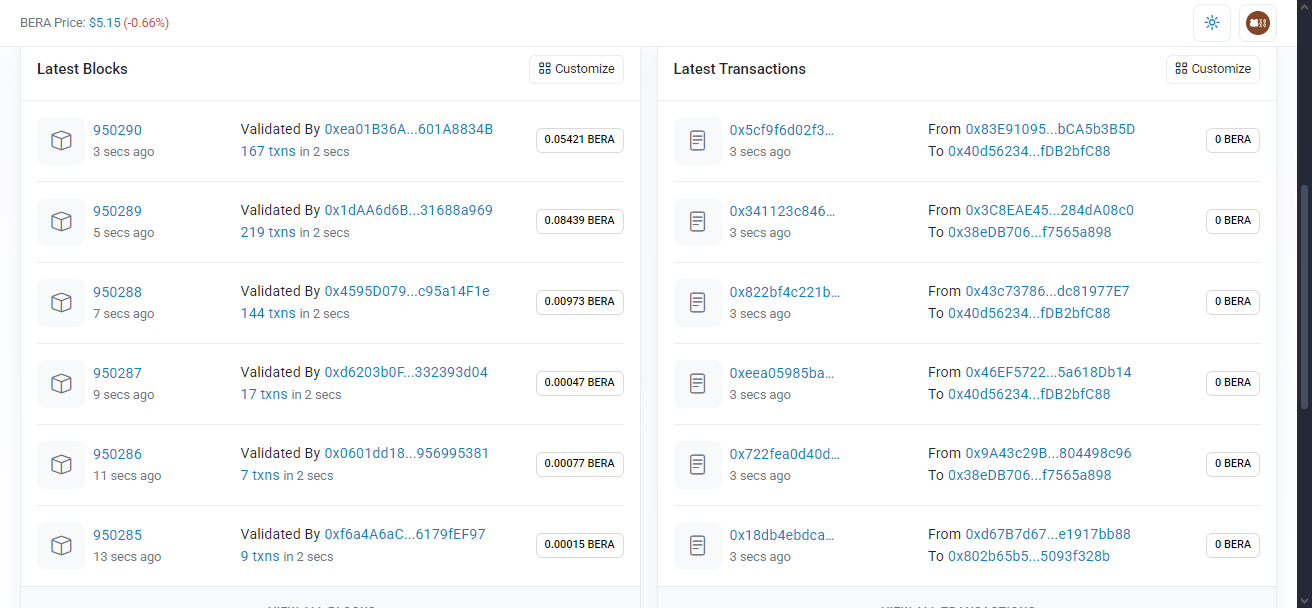

BeraScan Block Explorer

BeraScan Block Explorer

Similar to Ethereum or the Sui blockchain, the Bera network offers a scan explorer with real-time statistics on the $BERA price, the token market cap, number of transactions, and the latest block. Holders can also view all transactions and block generation on the chain here.

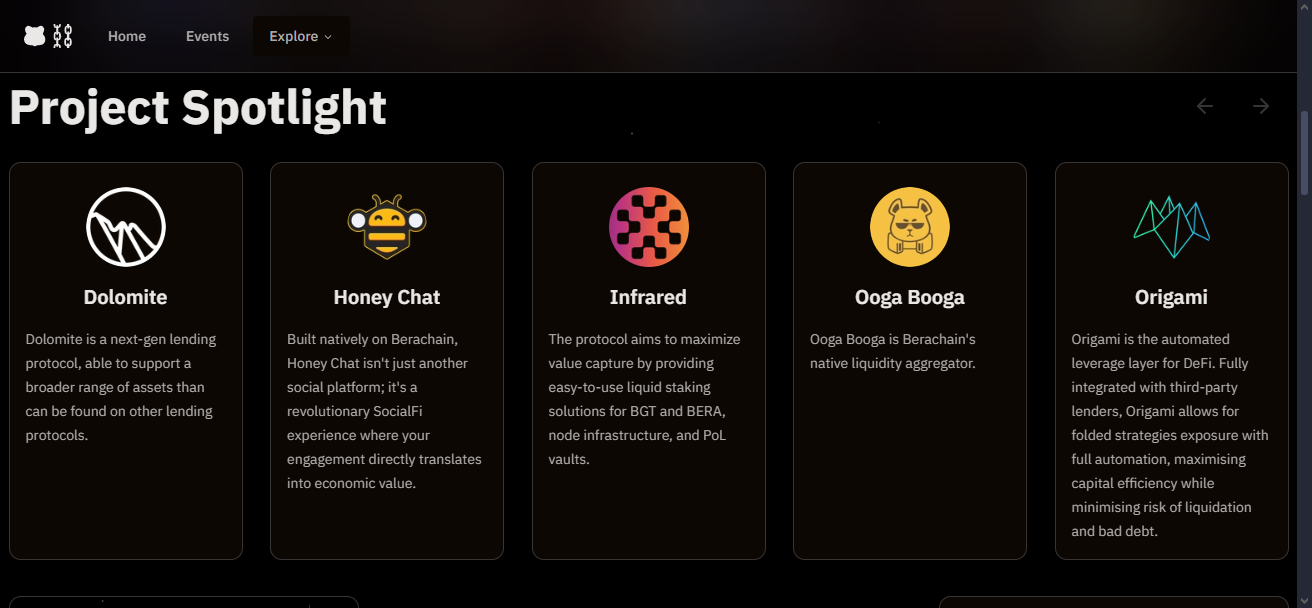

Projects Deployed on Berachain

Currently, there are about 100 projects and dApps deployed on Berachain, spanning several categories, including DeFi, RWA, GameFi, SocialFi, and more. These projects leverage Berachain’s high performance, EVM-compatible blockchain, which operates on the innovative Proof-of-Liquidity consensus mechanism.

Projects Deployed on Berachain

Some highlighted projects within the Berachain Ecosystem call for Dolomite – a next-generation lending protocol with total borrowed value of over $38.5M, Honey Chat – a native SocialFi platform on Berachain that transforms user engagement into economic value, or Origami – an automated leverage layer for DeFi that integrates with third-party lenders to offer folded strategies with full automation, enhancing capital efficiency while minimizing risks.