Four Phases of the Crypto Market Cycle: A Guide for Investors

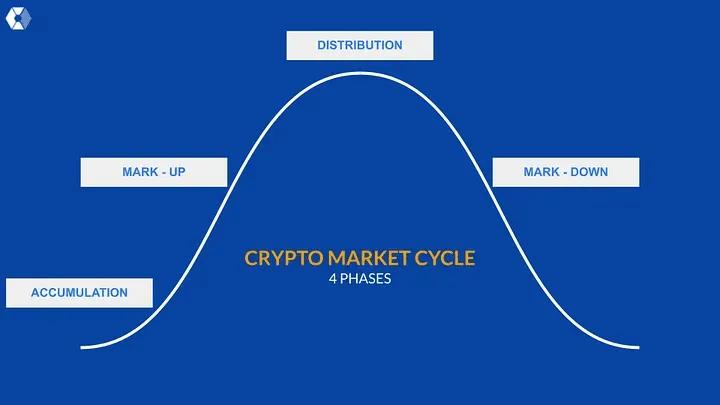

Market cycles reflect the natural ebb and flow of investor psychology and market behavior, driven by positive and negative feedback loops. These cycles, inherent in every market, emerge from factors such as crowd behaviors, economic indicators, regulatory changes, and technological advancements. The crypto market, despite its volatility, is no exception to these patterns of expansion and contraction.

Market cycles progress from greed to fear and vice versa. Source: FiCAS

By understanding these market cycles, investors can make informed decisions, optimize entry and exit points, and manage risks effectively. Here’s a detailed breakdown of the four key phases of the crypto market cycle.

Four phases in a crypto market cycle. Source: GX Block

1. Accumulation Phase

The accumulation phase marks the beginning of a new cycle after a market downturn. During this phase, prices stabilize at lower levels, and volatility decreases. This period often shows low public interest, as many investors are still recovering from previous losses.

Key Features:

For instance, after Bitcoin’s decline in 2018, it traded sideways between $3,000 and $4,000 for months before the bullish trend resumed in 2019.

2. Markup Phase (Bull Market)

Following accumulation, the market enters the markup phase, characterized by rising prices and increased public interest. This phase often attracts new investors, driven by optimism and fear of missing out (FOMO).

Key Features:

Notable examples include Bitcoin’s meteoric rise in 2017 from under $1,000 to nearly $20,000 and its 2020-2021 bull run that surpassed $60,000.

3. Distribution Phase

The distribution phase follows the bull market, characterized by heightened volatility and a battle between bullish and bearish sentiments. Prices fluctuate within a narrow range as traders lock in profits, while others hold out for further gains.

Key Features:

During the early months of 2018, Bitcoin’s price ranged between $15,000 and $20,000 before the bearish trend took over, illustrating the transition into the markdown phase.

4. Markdown Phase (Bear Market)

The markdown phase represents the downturn in the cycle, characterized by falling prices and negative sentiment. Investors often sell assets in panic, leading to significant losses.

Key Features:

An example is the bear market that began in late 2021, where Bitcoin plummeted from over $60,000 to around $30,000 within months, creating widespread fear and uncertainty.

Conclusion

The crypto market cycle comprises four phases: Accumulation, Markup (Bull Market), Distribution, and Markdown (Bear Market). Understanding these patterns helps investors navigate market fluctuations, optimize strategies, and mitigate risks.

As the cryptocurrency market evolves, staying informed about these cycles is crucial for long-term success. By recognizing and adapting to these phases, investors can make more calculated decisions and thrive in the dynamic world of digital assets.