Solana Faces 99 Percent Volume Drop as Accumulation Becomes Key

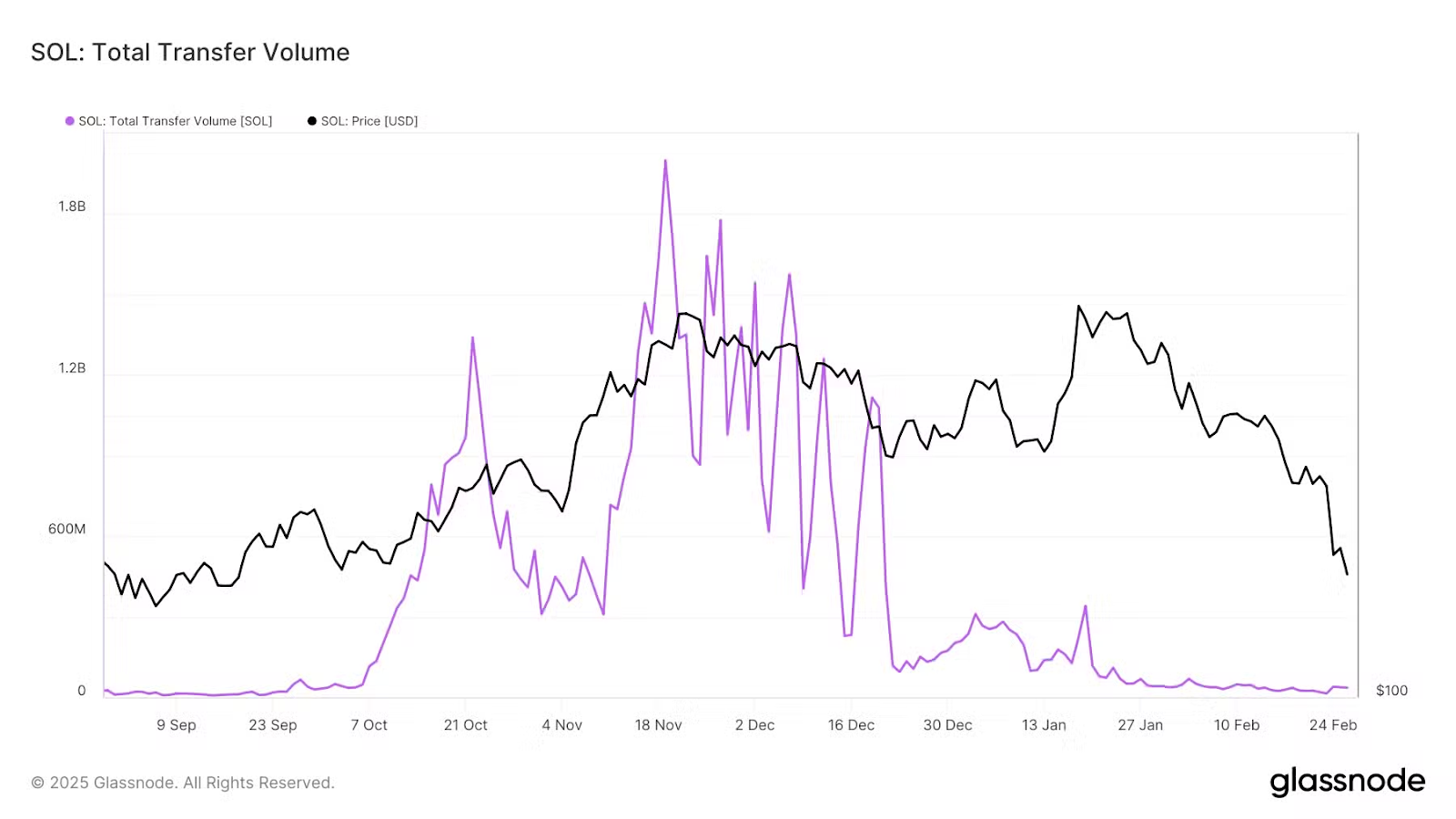

Solana (SOL) has faced a dramatic decline, with trading volume plunging from $1.99 billion in November to just $14.57 million—a staggering 99% drop. This downturn, coupled with a sharp 15.56% single-day price drop, has left SOL at a crucial juncture.

Solana’s Volume Hits a Make-or-Break Moment

SOL has now erased all its post-election gains, with its price breaking below the critical $150 support level. Currently trading at $139.70, the asset faces extreme downside risks, particularly as its market cap has already shrunk by nearly $40 billion this month.

Despite its previous high of $295.83—driven by the TRUMP memecoin rally—Solana has struggled to establish a strong support base. On-chain transfer volume has collapsed to levels not seen in months, raising concerns about further corrections if key support levels fail.

Total Transfer Volume of SOL (Source: Glassnode)

Crypto analyst Ali Martinez pointed to Solana’s weak volume metrics as a major concern, warning that continued declines could force long-term holders (LTHs) to capitulate. With nearly $1 billion in Total Value Locked (TVL) wiped out, the road to recovery appears challenging in the near term.

Can Solana Reverse Its Decline?

Historically, SOL has struggled to gain strong bullish support after major pullbacks. However, this pattern could indicate that weak hands have been shaken out, potentially setting the stage for a new upward cycle.

Exchange Activity of SOL (Source: View Trading)

Recent data suggests an uptick in on-chain volume, which has surged to $5.28 billion. While this signals some buying activity, confirmation is needed in the coming days to determine whether this is a sustainable trend reversal or merely a short-term profit-taking phase.

For a meaningful recovery, strong accumulation is essential. A supply shock—induced by aggressive buying—could help stabilize SOL and absorb the excess liquidity that has weighed it down.

The next few days will be crucial. Investors should keep a close eye on Solana’s volume metrics, as they will likely provide key insights into whether SOL is poised for a rebound or facing further downside risk.