Memecoins Losing Relevance as Hype Fades and Market Shifts

Memecoins have undergone multiple boom-and-bust cycles from mid-2022 to 2025, but the overall trend has been one of decline. Despite brief periods of speculative interest, memecoins have struggled to sustain momentum, with their dominance in the crypto market steadily eroding.

Declining Market Dominance Signals a Shift

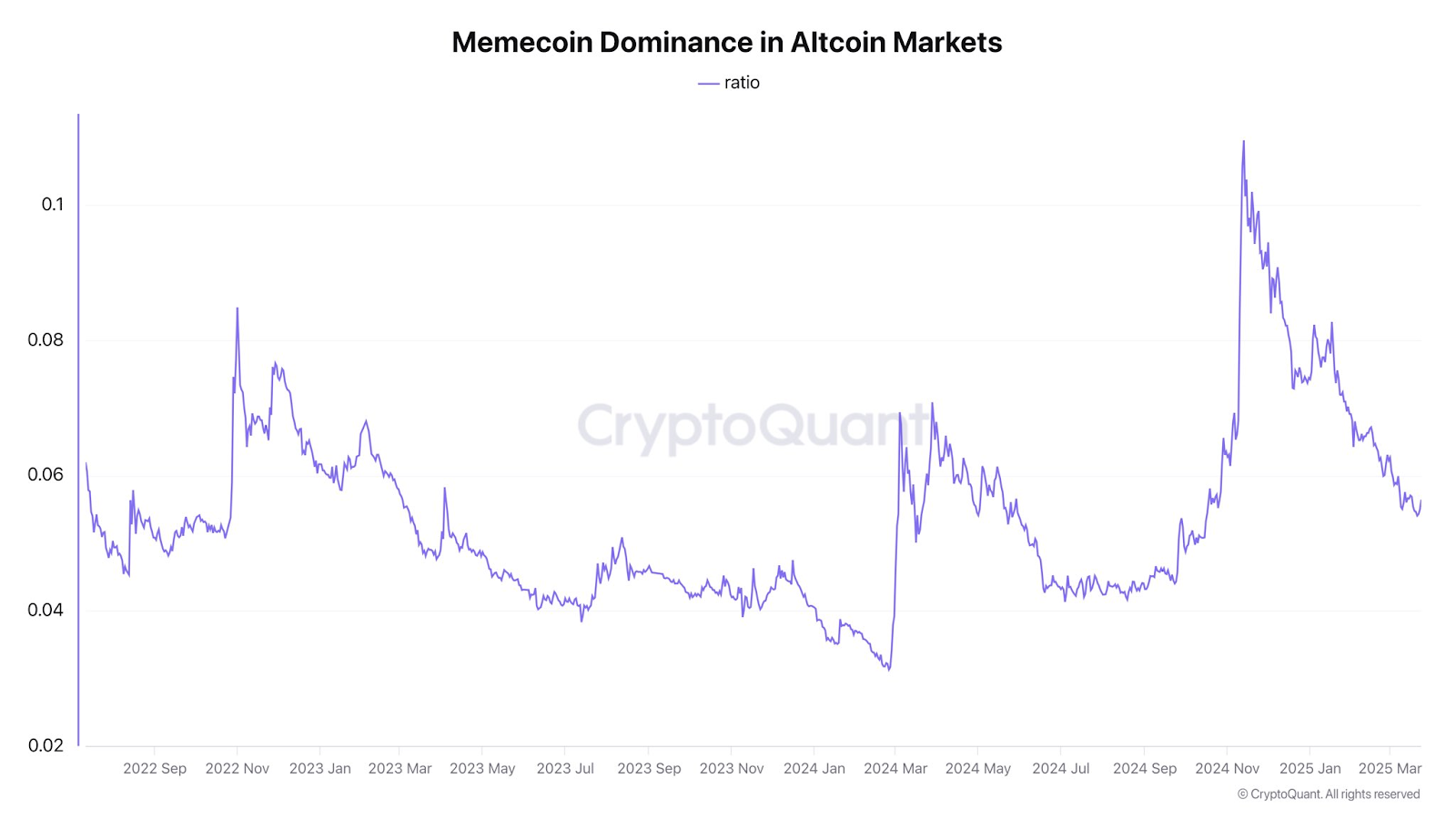

Data indicates that memecoin dominance fluctuated significantly over the past three years. In mid-2022, it hovered around 0.02 before briefly spiking to 0.08 later that year due to a surge in speculative activity. However, by early 2023, this dominance corrected to 0.04, and the downward trend continued throughout the year, stabilizing between 0.03 and 0.04.

Memecoin Dominance in Altcoin Markets (Source: CryptoQuant)

A sharp decline in late 2023 pushed dominance back to 0.02, reflecting diminishing investor interest. While a temporary resurgence in early 2024 saw memecoin dominance climb to 0.06, the rally quickly lost steam. By December 2024, a sharp downturn set in, and by March 2025, memecoin dominance remained stagnant at 0.02, underscoring its underperformance relative to the broader altcoin market.

Memecoins’ Performance

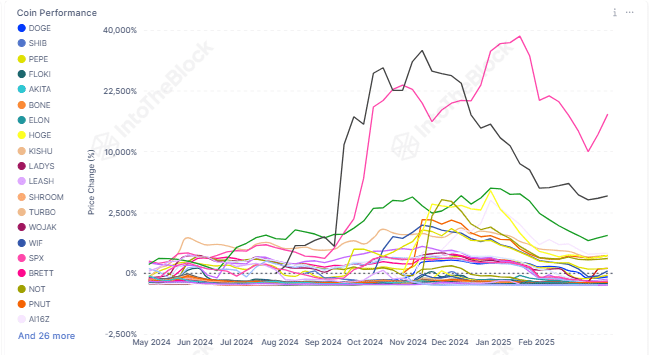

The decline in memecoin dominance is mirrored in the performance of major tokens such as Dogecoin (DOGE) and Shiba Inu (SHIB).

Coin Performance Chart (Source: Into The Block)

Other memecoins, including PEPE and FLOKI, exhibited comparable volatility, with prices erasing earlier gains and hovering around 0% or negative returns. Unlike previous market cycles, where speculative hype led to periodic rebounds, the current downturn has shown no signs of recovery.

Factors Driving the Decline

Several key factors have contributed to the diminishing appeal of memecoins, making a sustained resurgence unlikely. One of the primary reasons is market oversaturation. The rapid influx of new memecoins has diluted investor interest, making it difficult for any single token to maintain dominance. Unlike previous cycles where a few standout memecoins captured widespread attention, the market is now flooded with similar projects, leading to diminishing returns for speculative traders.

At the same time, trading activity has plummeted, signaling a broader disinterest in the sector. Platforms like Pump.fun, which once facilitated high levels of memecoin speculation, have experienced a 94% drop in trading volume since January 2025. This sharp decline suggests that the short-lived excitement surrounding memecoins has faded, and traders are moving away from highly volatile assets with no underlying utility.

Additionally, increased regulatory scrutiny has placed further pressure on memecoins. Unlike utility-driven crypto assets such as AI and DeFi tokens, which offer tangible use cases, memecoins primarily rely on hype and social media-driven speculation. As global regulators tighten their oversight on speculative digital assets, memecoins face growing challenges in sustaining their market position.

Investor sentiment has also shifted significantly, with both institutional and retail investors now favoring projects with strong fundamentals. Rather than chasing short-term gains from speculative assets, market participants are allocating capital to cryptocurrencies that offer real-world applications and long-term viability. This shift has left memecoins struggling to compete in an increasingly mature and utility-driven crypto landscape.

Finally, the overall memecoin market capitalization has suffered a steep decline, dropping 30% in 2025 alone. This downturn further reinforces the sector’s struggles, as fewer investors are willing to bet on memecoins amid a broader industry movement toward assets with sustainable value. With no clear signs of recovery and investor sentiment continuing to weaken, memecoins appear to be losing their relevance in the evolving cryptocurrency market.

A Changing Landscape for Crypto Investors

The data suggests that memecoins are losing relevance in an evolving crypto market. While past cycles were fueled by retail-driven speculation, current market conditions indicate a shift toward assets with tangible use cases.

With no clear reversal pattern and investor sentiment increasingly cautious, memecoins may continue to fade as the cryptocurrency market matures. Unless new utility-driven innovations emerge, memecoins are likely to remain a relic of past speculative frenzies rather than a driving force in the next phase of blockchain adoption.