10 Crypto Options Trading Strategies to Maximize Profits

What Are Crypto Options?

Crypto options are derivative contracts that derive their value from an underlying cryptocurrency. These contracts give traders the right—but not the obligation—to buy or sell a specific cryptocurrency at a pre-set price, on or before a predetermined date.

Crypto options generally come in two forms: call options and put options. A call option allows the holder to buy an asset at a specific price (strike price) on a set date, while a put option gives the holder the right to sell the asset at a predetermined price within a specific time frame.

These financial instruments offer versatile strategies, adaptable to various market conditions and trading goals. In this article, we will explore the top 10 strategies for trading crypto options, highlighting their mechanics, benefits, and risks.

10 Crypto Trading Strategies for Crypto Options

1. Long Call

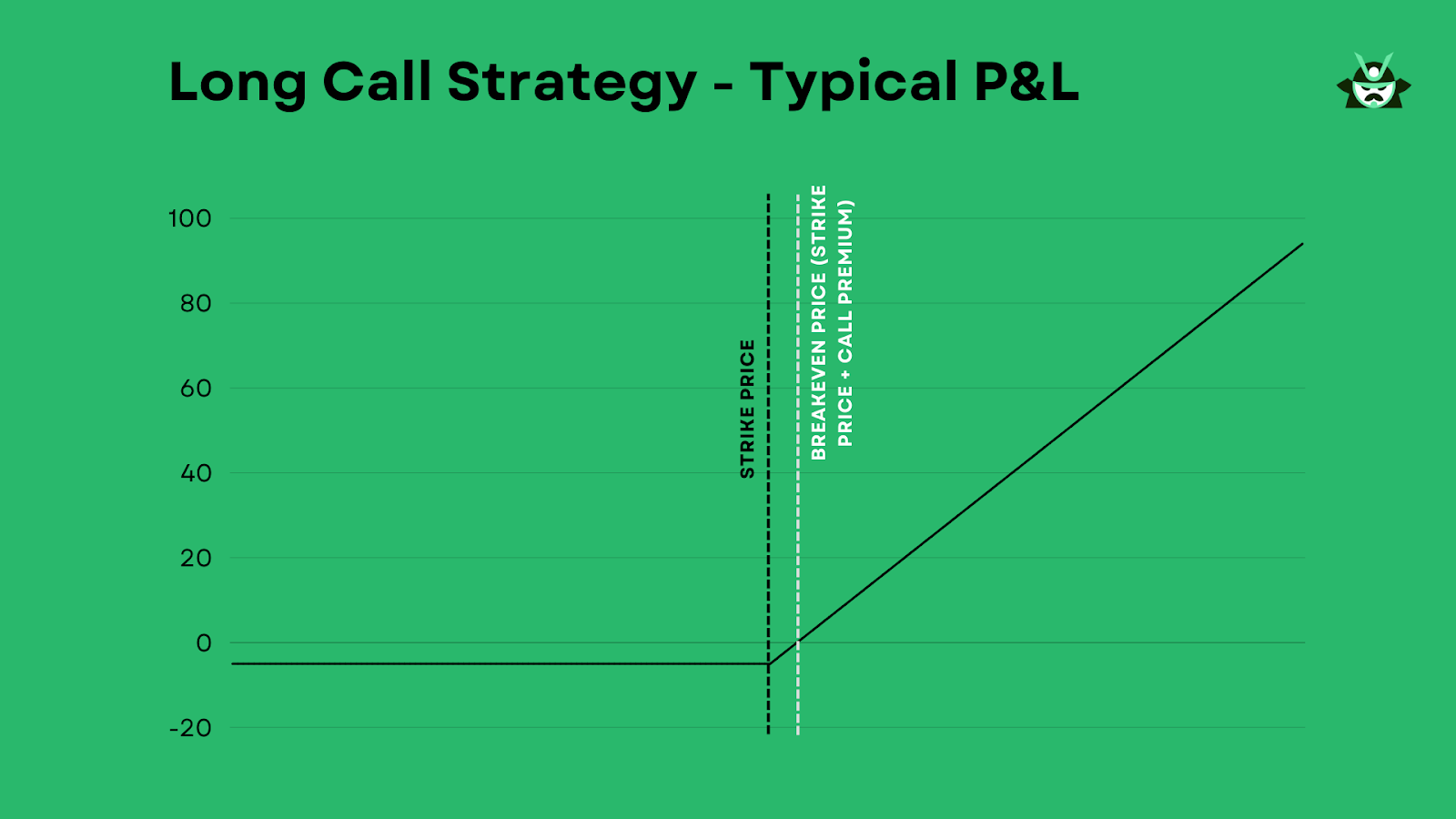

The long call strategy is used when a trader expects the price of a cryptocurrency to rise significantly. By purchasing a call option, traders gain the right to buy the underlying cryptocurrency at the strike price before the option expires.

Long call options strategy for cryptocurrency trading.

Advantages:

Risks:

2. Long Put

A long put strategy is used when a trader expects the price of a cryptocurrency to decline. In this strategy, the trader purchases a put option, which gives the right to sell the asset at the strike price.

Advantages:

Risks:

3. Covered Call

A covered call strategy involves holding a long position in a cryptocurrency while simultaneously selling a call option on the same asset. The goal is to generate additional income through the premiums received from selling the call.

Advantages:

Risks:

4. Protective Put

A protective put strategy involves holding a long position in a cryptocurrency while purchasing a put option for protection against significant price declines.

Advantages:

Risks:

5. Straddle

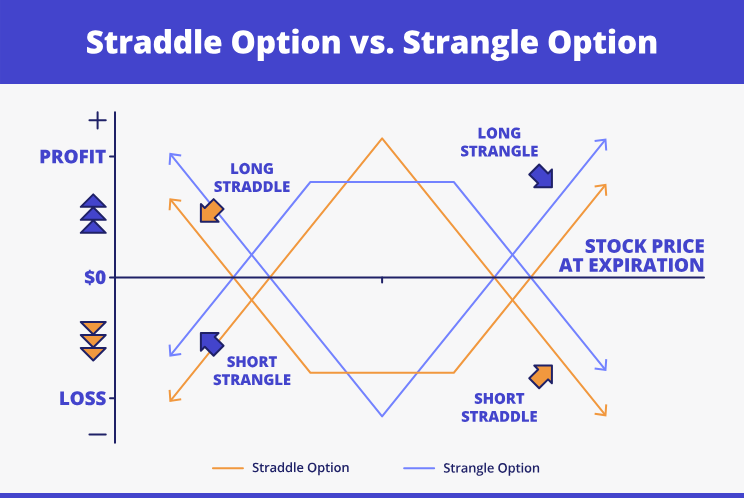

A straddle involves buying both a call and a put option with the same strike price and expiration date. This strategy is employed when traders expect significant price movements but are uncertain of the direction.

Advantages:

Risks:

6. Strangle

The strangle strategy is similar to a straddle, but with different strike prices for the call and put options. Traders buy a call option with a higher strike price and a put option with a lower strike price, both with the same expiration date.

Advantages:

Risks:

The way the straddle strategy and strangle strategy work

7. Iron Condor

An iron condor strategy involves selling a lower-strike put, buying a higher-strike put, selling a lower-strike call, and buying a higher-strike call, all with the same expiration date. Traders expect the price to remain within a certain range and aim to profit from low volatility.

Advantages:

Risks:

8. Butterfly Spread

A butterfly spread involves buying a call (or put) at a lower strike price, selling two calls (or puts) at a middle strike price, and buying another call (or put) at a higher strike price. This strategy is ideal when a trader expects low volatility and the price to remain near the middle strike price.

Advantages:

Risks:

9. Calendar Spread

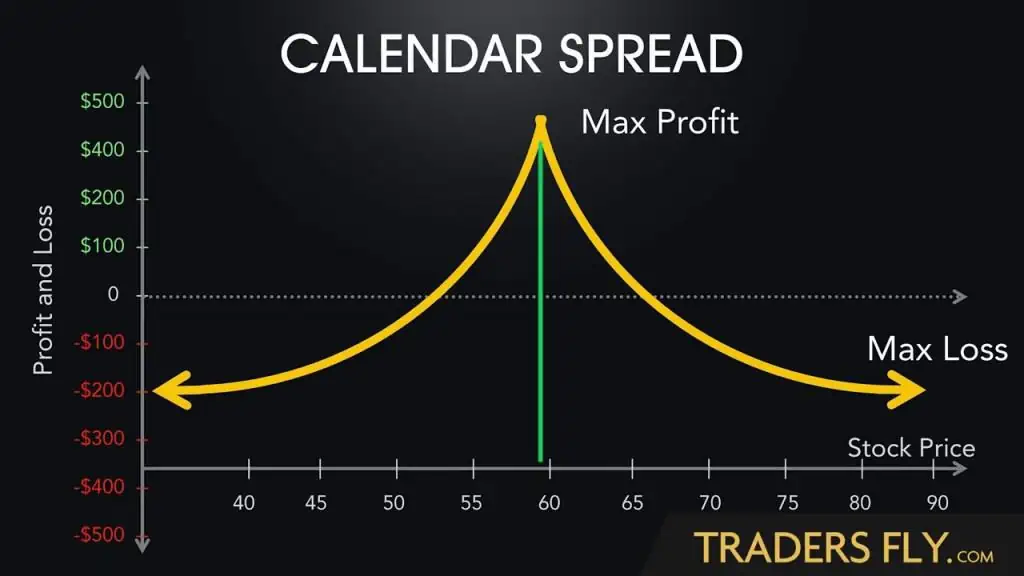

A calendar spread strategy involves buying and selling options of the same type (either calls or puts) with the same strike price but different expiration dates. Traders use this strategy when they expect low short-term volatility but anticipate more significant long-term price fluctuations.

A calendar spread explained.

Advantages:

Risks:

10. Diagonal Spread

A diagonal spread combines elements of both a calendar spread and a vertical spread. This strategy involves buying and selling options of the same type but with different strike prices and expiration dates.

Advantages:

Risks:

Conclusion

Crypto options provide a wide range of strategies to suit different market conditions and trading objectives. Understanding the nuances of each strategy, from long calls and puts to more advanced approaches like the iron condor and butterfly spreads, allows traders to adapt to evolving market conditions and manage risk effectively.

By employing the right strategy, traders can capitalize on price volatility, hedge risks, and potentially maximize profits in the dynamic world of cryptocurrency trading. Always ensure to assess the risks and market conditions before committing to any strategy.