Altcoins Following Bitcoin May Signal Market Shifts

Altcoins are once again mirroring Bitcoin (BTC) and Ethereum (ETH), reinforcing a high-correlation market environment. While this alignment may seem like a sign of stability, history suggests it often precedes sharp volatility or local market peaks.

Most altcoins remain in downtrends, making premature entries risky. Timing is crucial—watch for signs of accumulation and structural shifts before re-entering the market with confidence.

Understanding Market Correlation and Trends

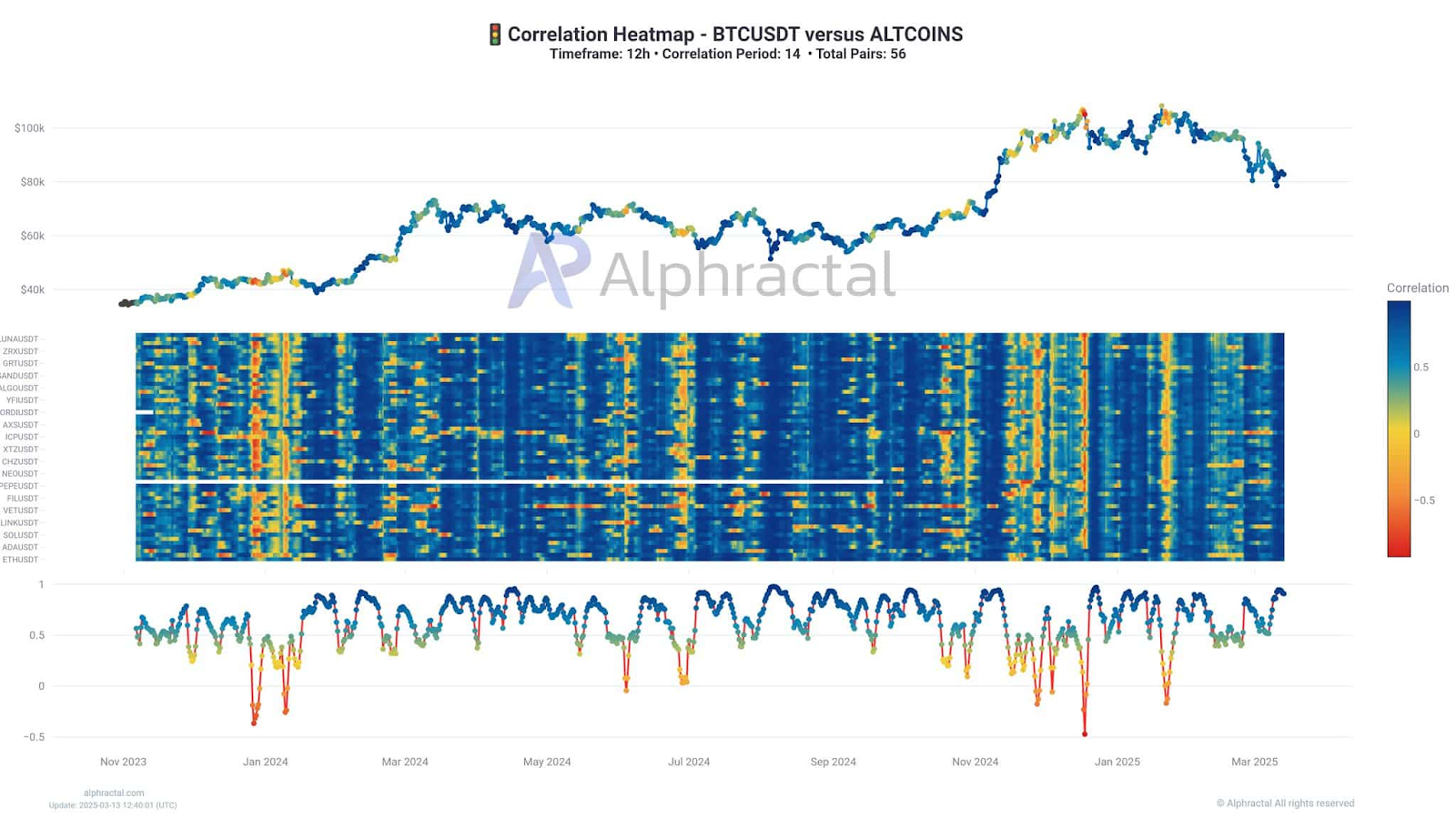

Recent market data shows a strong correlation between altcoins and BTCUSDT, indicated by dense blue bands across multiple altcoin pairs. This suggests macro trends are dominating the market, limiting individual altcoin narratives from gaining traction.

Historically, periods of low correlation—where heatmaps turn scattered or red—have often signaled impending volatility or market peaks. Currently, the tight clustering of price action implies that altcoins are unlikely to break out independently unless Bitcoin and Ethereum initiate a significant rally.

The Correlation between Altcoins and BTCUSDT (Source: Alphractal)

The Three Phases of Altcoin Price Cycles

Altcoin price movements typically follow three phases:

At this stage, patience is key. Recognizing accumulation and structural changes can increase conviction when re-entering the market.

Identifying Key Levels for Re-Entry

As altcoins begin to stabilize, focus on range lows—historically, these are zones where sellers weaken and buyers accumulate. These levels often act as foundations for trend reversals.

Structural signals such as higher lows or decisive breakouts can indicate the early stages of a bullish shift. Past cycles show that such setups often align with broader market recoveries. While not every range formation leads to a breakout, firm support at key levels often reflects growing confidence among market participants.

For now, Bitcoin and Ethereum remain the primary market drivers. Altcoins are likely to follow only if momentum from these leading assets sustains a rally.