Stablecoin Dominance at 7.04% – Warning or Rebound Ahead?

Record-breaking stablecoin inflows in February suggest investors are either seeking safety or gearing up for the next big move.

The latest market data indicates that traders are shifting into stablecoins, but the reason behind this trend remains uncertain. While rising stablecoin dominance is often a cautionary sign, strong liquidity levels could hint at an upcoming rally.

Stablecoins as a Market Barometer

Stablecoins, often considered a leading indicator of market sentiment, are flashing a key signal. The dominance of USDT and USDC has rebounded from a critical trendline—a pattern that has historically preceded market downturns.

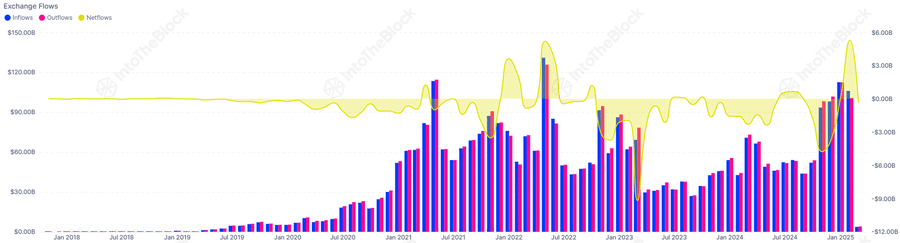

At the same time, February recorded an all-time high in net stablecoin inflows to exchanges. This raises the question: Are investors fleeing risk assets, or are they preparing to buy back in?

Market Caution or Strategic Positioning?

Stablecoin Ratio Channel Long-term (Source: Alpharactal)

The recent surge in stablecoin dominance, as seen in the USDT.D + USDC.D chart, suggests shifting market sentiment. After testing a long-term trendline, dominance rebounded sharply to 7.04%—a level previously linked to major market corrections.

This pattern signals a move toward safety, as traders park funds in stablecoins ahead of potential downturns. Additionally, the stablecoin ratio channel, which tracks overbought and oversold conditions, is pulling back from a high level. In previous cycles, this has either marked a temporary reset or signaled deeper liquidity stress.

Unprecedented Stablecoin Inflows

February’s net stablecoin inflows set a new record, exceeding peaks seen during the May 2021 crash and the November 2022 FTX collapse. This movement suggests two possible scenarios:

Defensive Hedging: Traders may be shifting into stablecoins to mitigate risk, mirroring past deleveraging phases. If both stablecoin dominance and inflows continue rising, it could signal broader risk aversion, potentially increasing downside pressure on Bitcoin and altcoins.

Exchange Flows (Source: IntoTheBlock)

Liquidity Accumulation for Re-Entry: Unlike past panic-driven exits, this surge in stablecoin holdings is accumulating on exchanges rather than leaving the market. Historically, such buildups have preceded renewed buying activity, suggesting investors may be preparing for a strategic re-entry.

What’s Next?

The broader stablecoin market cap remains in an uptrend, indicating that liquidity is intact. However, a decline in USDT or USDC supply could signal capital flight, weakening market stability.

For now, the data presents a mixed picture. Rising stablecoin dominance suggests caution, yet record-breaking inflows indicate capital is being repositioned rather than withdrawn.

If stablecoin supply remains steady and dominance levels off, the market may be gearing up for a rebound. However, if dominance continues climbing alongside falling liquidity, further downside pressure could follow.

The next move will depend on whether traders stay on the sidelines or decide to re-enter the market with force.