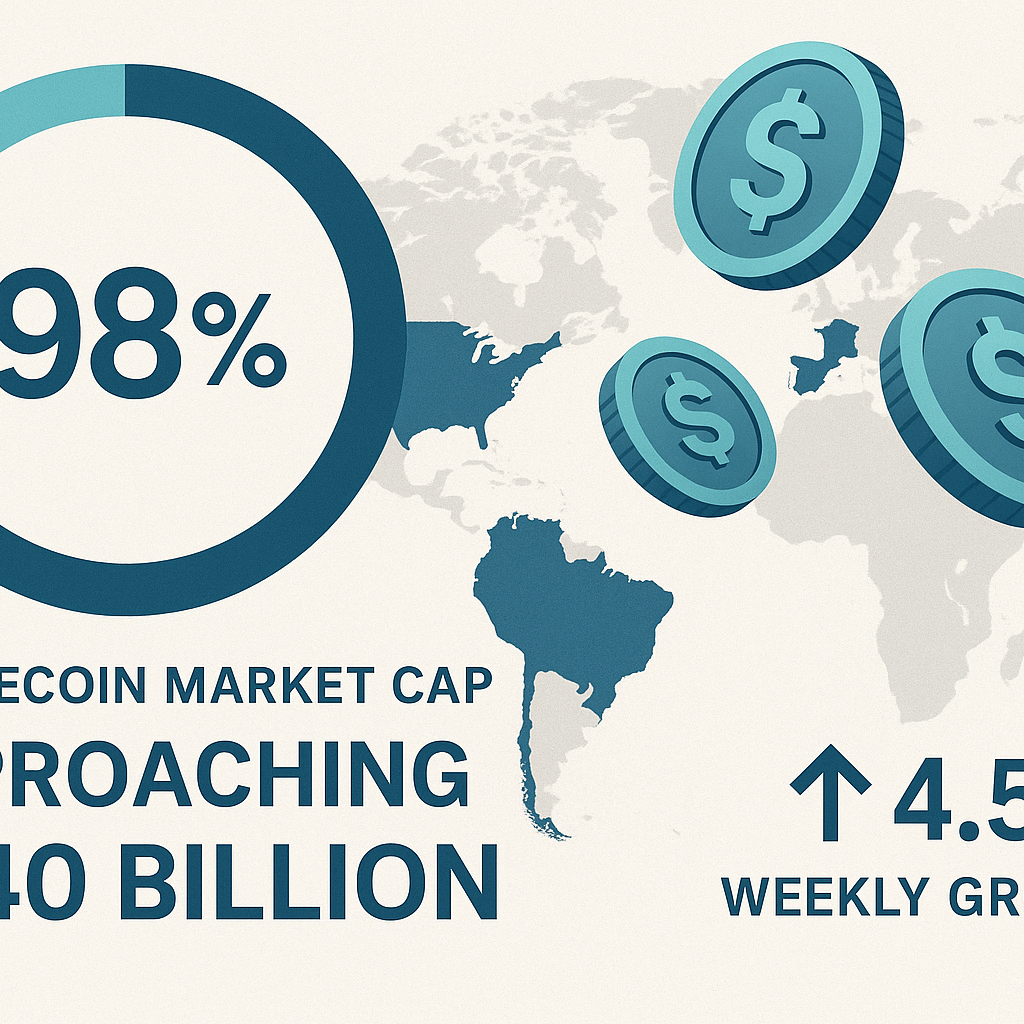

Stablecoin Market Surges by $4.58 Billion in One Week, Approaching $240 Billion Milestone

The digital asset ecosystem witnesses remarkable growth as the stablecoin market expands dramatically, adding nearly $5 billion to its total market capitalization in just seven days. This surge reflects increasing institutional adoption and growing confidence in blockchain-based payment solutions.

Market Overview

The stablecoin sector continues its impressive trajectory, recording a substantial growth of $4.58 billion in just one week. With this latest surge, the total stablecoin market capitalization is rapidly approaching the $240 billion milestone, signaling strong momentum in the digital assets space.

Key Players Driving Growth

Tether (USDT) Maintains Dominance

Tether remains the undisputed leader in the stablecoin arena, accounting for approximately 71% of the total stablecoin market. USDT’s market cap now exceeds $167 billion, reflecting continued trust despite past controversies regarding its reserves. The stablecoin has seen particularly strong adoption in emerging markets and cross-border transactions.

Circle’s USDC Solidifies Position

USD Coin (USDC), developed by Circle, maintains its position as the second-largest stablecoin with a market capitalization of approximately $34 billion. USDC has strengthened its reputation as a regulated alternative to USDT, particularly among institutional investors and businesses seeking compliant payment solutions.

Emerging Contenders

USDS (Sperax USD)

USDS has gained significant traction as a partially collateralized algorithmic stablecoin on the Arbitrum network. Its innovative model, combining over-collateralization with algorithmic stability mechanisms, has attracted users looking for alternatives to traditional fully-backed stablecoins.

RLUSD (Real USD)

Real USD (RLUSD) has emerged as a noteworthy player in the stablecoin space, positioning itself as a transparent, fully collateralized stablecoin. Its growth reflects the market’s demand for stablecoins with robust backing and regular audits.

Market Implications

This extraordinary growth in the stablecoin sector indicates several important trends:

- Increased DeFi Activity: The surge suggests heightened activity across decentralized finance protocols, where stablecoins serve as essential liquidity vehicles.

- Institutional Adoption: Traditional financial institutions are increasingly integrating stablecoins into their operational frameworks, driving up demand.

- Cross-Border Payment Growth: Stablecoins continue to gain popularity for international transfers, offering faster and cheaper alternatives to traditional banking rails.

- Regulatory Clarity: Improved regulatory frameworks in several jurisdictions have provided better operating environments for stablecoin issuers.

Future Outlook

Analysts project continued growth for the stablecoin market throughout 2025, with several factors potentially accelerating adoption:

- Further integration with traditional payment systems

- Development of central bank digital currencies (CBDCs) creating more awareness around digital currencies

- Growing demand in regions experiencing currency instability

- Expansion of use cases beyond trading into lending, payroll, and everyday commerce

As the stablecoin market approaches the $240 billion mark, it solidifies its position as one of the most significant and practical applications of blockchain technology in the global financial system.

This market analysis captures the stablecoin landscape as of April 28, 2025. Market conditions are subject to change rapidly in the digital asset ecosystem.