Dark Stablecoins: The Future of Censorship-Resistant Digital Currency, Says CryptoQuant CEO

As regulatory oversight intensifies in the cryptocurrency space, a new breed of financial tools may emerge to preserve user privacy and autonomy. CryptoQuant CEO Ki Young Ju predicts that “dark stablecoins” could be the next significant development in digital finance.

The Cypherpunk Origins vs. Centralized Bridges

Bitcoin was born from the cypherpunk movement with a clear mission: to create a censorship-resistant, stateless currency that no government could control. Its decentralized design has largely fulfilled this promise, allowing it to operate beyond the reach of traditional financial gatekeepers.

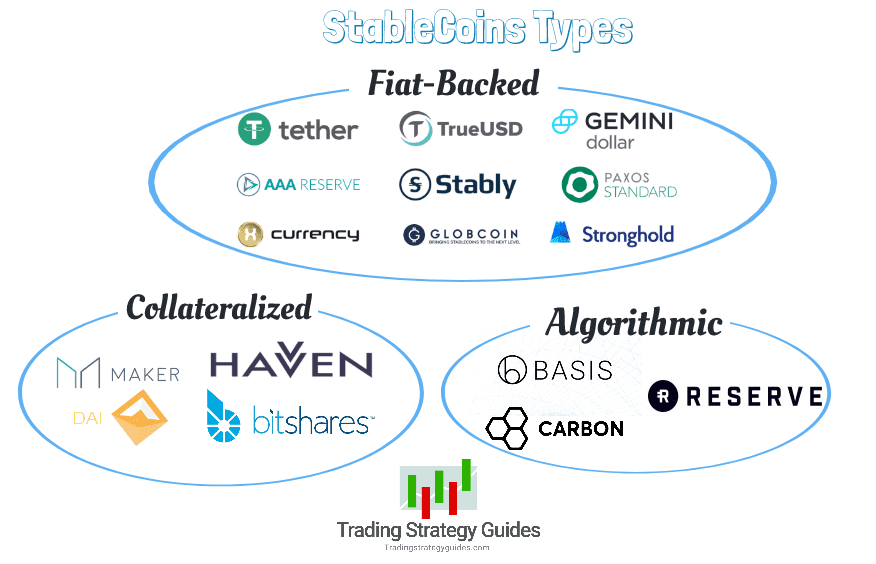

Stablecoins, however, serve a fundamentally different purpose. As Ki Young Ju explains, they function as “a bridge between the internet and the real world,” necessitating some form of centralized management. Companies like Tether and Circle have successfully established this bridge by maintaining cash reserves in traditional banks, backing their digital tokens with real-world assets.

“Stablecoins, however, act as a bridge between the internet and the real world, so they need someone to manage them,” noted Ki Young Ju in his recent statement on the social media platform X.

The Current Regulatory Landscape

Until recently, governments have largely permitted stablecoins to operate with minimal interference, primarily intervening only when money laundering concerns arise. This relatively hands-off approach has made stablecoins extremely valuable for various groups, including Chinese Bitcoin miners, who use them as stable assets for value storage and cross-border transfers.

As Ki Young Ju observed, “Governments, except when tackling money laundering, haven’t really interfered with stablecoins.” This regulatory gap has allowed stablecoins to flourish, creating an open financial ecosystem outside the traditional banking infrastructure.

Tightening the Regulatory Noose

The status quo appears to be changing rapidly. Ju predicts that government-approved stablecoins will soon face regulations comparable to traditional banking institutions. These could include:

- Automatic tax collection through smart contracts

- Government-mandated wallet freezes

- Mandatory KYC (Know Your Customer) procedures

- Increased transaction monitoring

These changes would effectively transform the open financial system that stablecoins currently offer into something closely resembling the current banking system, complete with its limitations on financial privacy and freedom.

The Emergence of Dark Stablecoins

In response to this growing censorship, Ki Young Ju anticipates the rise of “dark stablecoins” – privacy-focused alternatives designed to resist regulatory control. These could emerge in two primary forms:

- Algorithmic stablecoins that maintain stable value without government or corporate control

- Stablecoins issued by countries with minimal financial censorship policies

These options would provide users with greater financial privacy and freedom of transaction, particularly beneficial for those who require large international transfers without government scrutiny.