BlackRock’s BUIDL Hits New Highs on CeDeFi and Euler Activations

BlackRock’s blockchain-focused BUIDL ETF has reached new all-time highs this week, bolstered by significant institutional adoption and strategic activations across multiple decentralized finance platforms.

Record Performance Amid Market Uncertainty

The BUIDL ETF (ticker: BLDR) surged to $87.26 per share on Tuesday, representing a 12.7% increase over the past month and outperforming the broader crypto market. This milestone comes despite persistent macroeconomic uncertainties and volatile market conditions affecting traditional financial assets.

“The ETF’s performance demonstrates increasing institutional confidence in blockchain infrastructure beyond just cryptocurrency exposure,” said Amanda Chen, senior blockchain analyst at Digital Asset Research. “We’re seeing a decoupling between traditional crypto volatility and blockchain technology investments.”

CeDeFi Integration Drives Growth

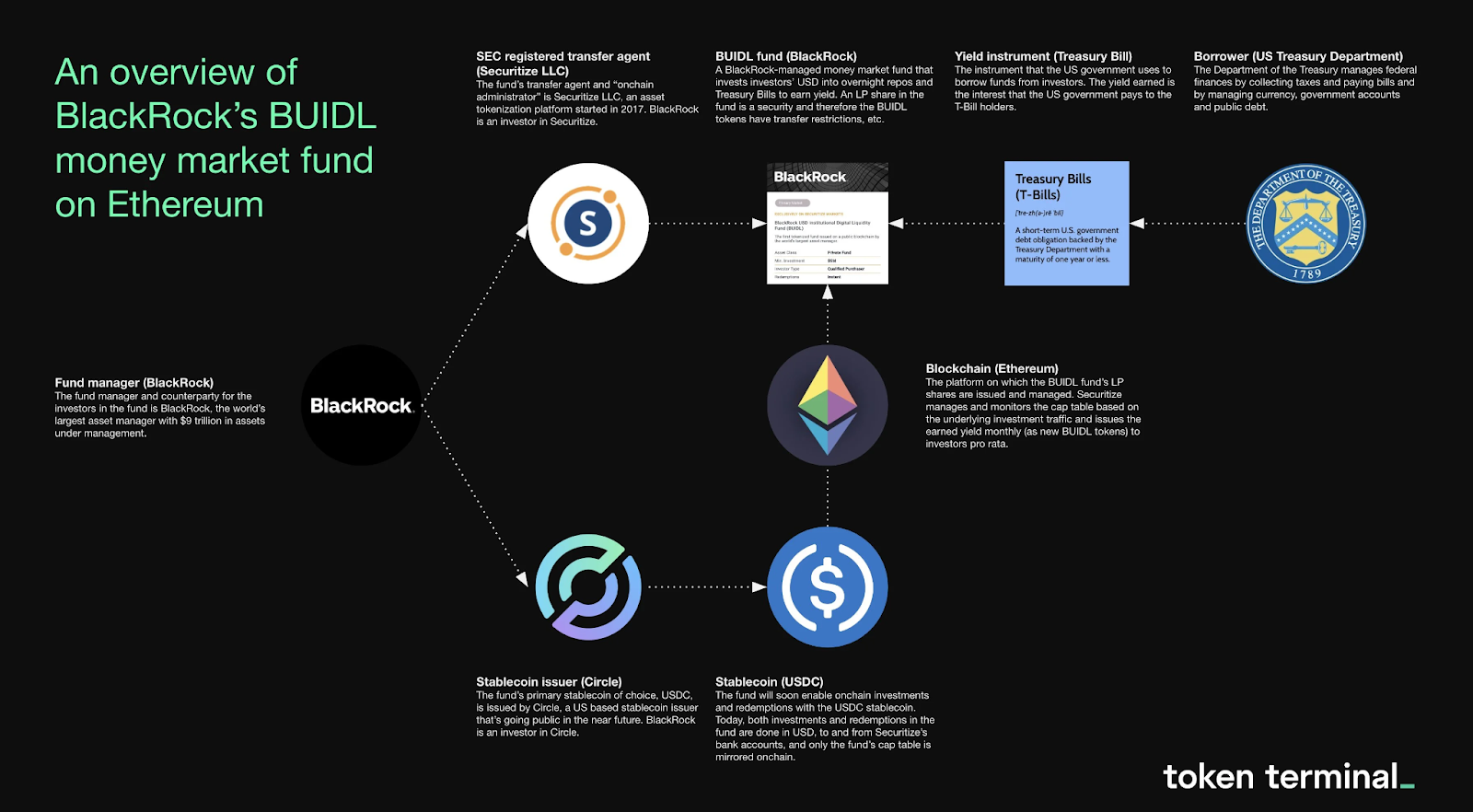

BlackRock’s centralized-decentralized finance (CeDeFi) integration strategy has been a key catalyst for the ETF’s recent performance. Last month, the asset manager announced partnerships with five major financial institutions to bridge traditional finance with decentralized protocols.

These partnerships allow institutional clients to access DeFi yields while maintaining regulatory compliance, effectively creating a hybrid model that appeals to cautious institutional investors.

“CeDeFi represents the natural evolution of financial infrastructure,” explained BlackRock’s head of digital assets, Marcus Watkins. “We’re building systems that combine the efficiency and innovation of decentralized protocols with the security and regulatory frameworks institutions require.”

Euler Finance Activations Boost Holdings

A significant factor in BUIDL’s recent gains has been BlackRock’s strategic activation on Euler Finance, a leading lending protocol. BlackRock has deployed approximately $215 million in liquidity across Euler’s permissionless lending markets, focusing primarily on stablecoin and ETH pairs.

This marks BlackRock’s third major DeFi integration, following earlier activations on Aave and Compound protocols. The Euler deployment has already generated over $8.3 million in protocol fees since April, benefiting both the protocol and BUIDL ETF holders.

“Euler’s risk management framework and permissionless architecture make it an ideal partner for our institutional clients,” said Watkins. “We’re particularly impressed with their EIP-4626 tokenized vault implementations, which align with our infrastructure-first approach.”

Institutional Adoption Accelerates

Market data shows institutional wallet addresses associated with BlackRock’s digital asset division have increased their on-chain activity by 43% since January, with transaction volumes reaching $1.2 billion monthly.

This substantial growth reflects broader institutional adoption trends, with BlackRock leading traditional financial institutions in blockchain integration. The firm now manages over $6.8 billion in digital assets across various vehicles, with BUIDL representing their flagship blockchain offering.

“What we’re witnessing is the culmination of years of careful infrastructure building,” said Daniel Murray, blockchain strategist at Institutional DeFi Partners. “BlackRock didn’t rush into crypto speculation—they methodically built the rails for institutional participation in DeFi.”

Future Outlook

Industry analysts remain bullish on BUIDL’s prospects, with consensus price targets averaging $105 by year-end. The ETF’s diversified exposure to both infrastructure and yield-generating protocols positions it favorably in the evolving digital asset landscape.

BlackRock is reportedly exploring additional protocol integrations, with sources familiar with the matter suggesting layer-2 scaling solutions and cross-chain infrastructure projects are next on the company’s roadmap.

“The real innovation isn’t just in deploying capital to these protocols, but in creating the compliance and risk management frameworks that make institutional participation possible,” concluded Chen. “BlackRock’s approach could become the blueprint for Wall Street’s blockchain strategy.”

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research before making any investment decisions.