US Senator Cynthia Lummis Proposes Standalone Cryptocurrency Tax Bill

Key Takeaways

- Small Transaction Tax Exemption: The bill proposes tax exemptions for transactions with capital gains of $300 or less, with an annual exemption of $5,000

- Deferred Taxes on Staking and Mining: Rewards from mining and staking would only be taxed when the assets are sold, not when they are initially received.

- Crypto Lending Tax Exemption: Cryptocurrency lending agreements and charitable contributions using digital assets will be tax-exempt

- Reduced Administrative Burden: The bill aims to cut complex reporting processes and create clarity for crypto users

- DeFi Support: Decentralized protocol developers will be exempt from tax reporting requirements like centralized exchanges

Summary

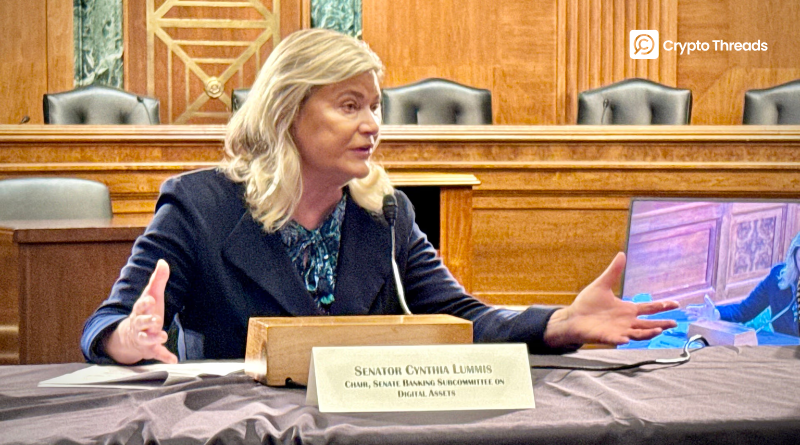

Seeking to end double taxation and provide clearer guidelines, Wyoming Senator Cynthia Lummis has introduced a standalone draft bill focused on reforming cryptocurrency taxation. This follows the failure of crypto tax amendments to be included in the recent federal budget package. The bill specifically targets clearer tax treatment for staking, mining, and cryptocurrency lending transactions.

Main Content

US Senator Cynthia Lummis has introduced a significant draft bill outlining multiple provisions to amend tax laws and provide specific exemptions for digital asset transactions. This move comes after proposed cryptocurrency amendments were notably absent from the recently passed federal budget package.

The bill proposes a de minimis exemption for digital asset transactions and capital gains of $300 or less, with an annual exemption of $5,000.

The Wyoming Senator has also outlined tax exemption provisions for cryptocurrency lending agreements and digital assets used in charitable contributions. Additionally, the bill proposes deferring taxes on mining and staking rewards until the underlying assets are sold.

Senator Lummis’s Statement

Lummis stated: “This groundbreaking legislation is fully paid for, cuts red tape, and establishes sensible rules that reflect how digital technology actually works in the real world. We cannot let our outdated tax policies stifle American innovation.”

She continued: “My bill ensures Americans can participate in the digital economy without inadvertently running afoul of the tax code.”

The standalone draft bill now represents the Wyoming Senator’s best opportunity to pass pro-cryptocurrency legislation she promised to the crypto community after Senators passed a spending bill that made no mention of digital assets.

Double Taxation and Unclear Policies Frustrate US Crypto Investors

The lack of clarity and perceived inefficiency in US digital asset taxation remains a major point of frustration for industry executives, investors, traders, and users. A major contentious topic is how to handle taxation for fully decentralized finance (DeFi) protocols and non-custodial platforms, where developers have no control over funds or consensus rules.

This challenge was partially addressed in June when US lawmakers proposed amendments to the Digital Asset Market Structure Transparency Act of 2025. Those amendments sought to exempt decentralized protocol developers from classification as money transmission services, which would also shield them from associated tax reporting obligations currently borne by centralized exchanges and traditional crypto businesses. Senator Lummis’s new tax bill directly incorporates this principle of DeFi developer exemption.

US lawmakers continue efforts to incorporate cryptocurrency-related provisions into must-pass legislation before the spending bill before it is presented to US President Donald Trump.