Avalanche Leads Blockchain Transaction Growth Amid US Government Implementation

Key Takeaways

- Avalanche topped all blockchain networks with 66% transaction growth this week

- US Department of Commerce will publish GDP data on nine blockchain networks starting July 2025

- Grayscale filed updated S-1 for spot Avalanche ETF with SEC

- Transaction surge driven by layer-1 growth and DeFi activity expansion

- Government adoption signals broader blockchain utility for federal data

Avalanche’s transaction growth surpassed all other blockchain networks this week, signaling increased investor interest in the smart-contract blockchain’s utility token amid growing governmental adoption and renewed institutional interest.

The smart contract blockchain, designed to improve scalability and usability, has emerged as one of the fastest-growing blockchain networks in the current market cycle.

Record Transaction Growth

Transactions on Avalanche rose over 66% during the past week, surpassing 11.9 million transactions across more than 181,300 active addresses, according to crypto intelligence platform Nansen.

The increased transaction activity may indicate growing investor interest in the Avalanche (AVAX) token, driven by recent governmental implementation announcements and renewed exchange-traded fund (ETF) applications for the altcoin.

Historic Government Blockchain Adoption

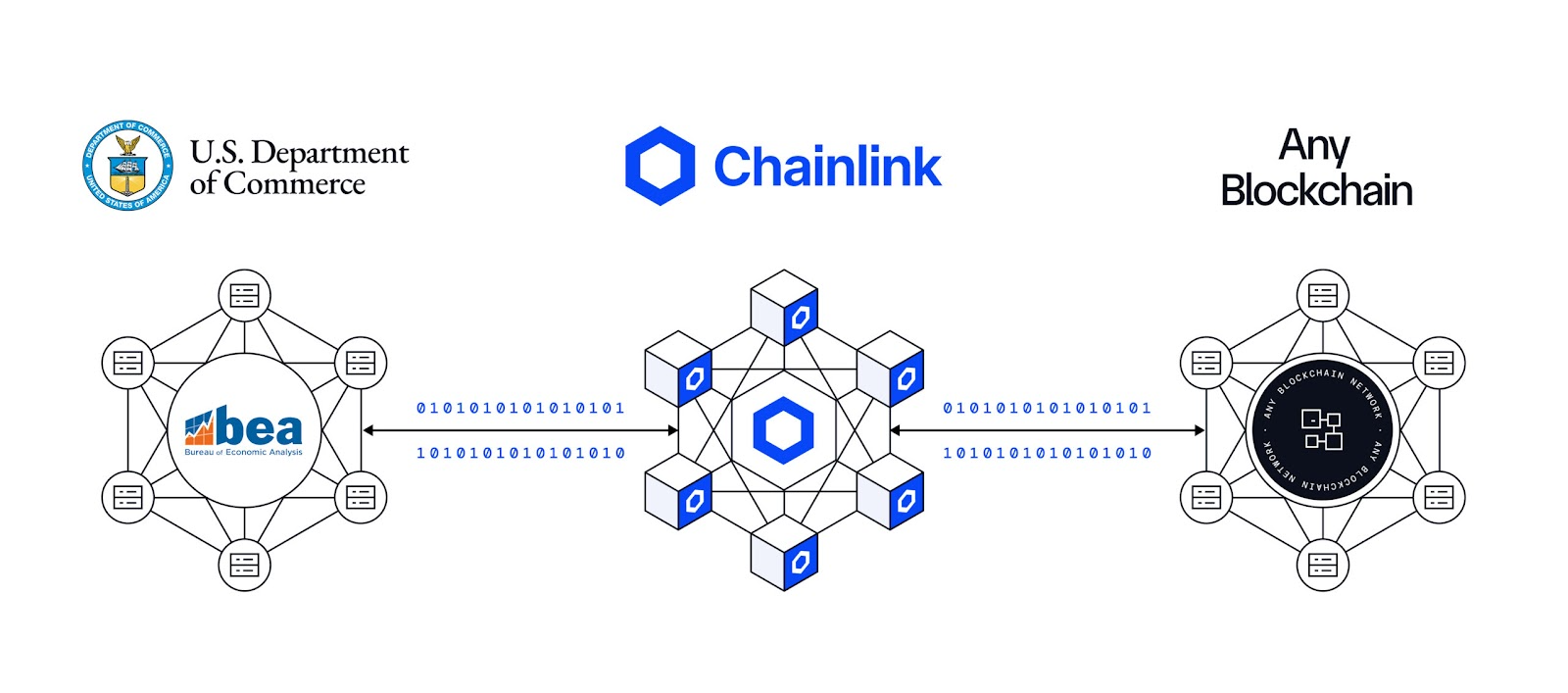

The US Department of Commerce announced it will begin publishing real gross domestic product (GDP) data on decentralized blockchains, including Avalanche, marking a significant milestone for blockchain adoption in federal operations.

Starting with July 2025 data, GDP reports will be published on nine public blockchain networks: Bitcoin, Ethereum, Avalanche, Solana, Tron, Stellar, Arbitrum One, Polygon PoS, and Optimism.

“This is the first time a federal agency has published economic statistical data like this on the blockchain, and the latest way the Department is utilizing innovative technology to protect federal data and promote public use,” the Department stated.

The Commerce Department described this as a “landmark effort” that may “demonstrate the wide utility of blockchain technology” and serve as a “proof-of-concept for all of government,” aligning with the current administration’s vision of establishing the US as the “blockchain capital of the world.”

Organic Growth Drivers

The rising activity appears more connected to organic growth in Avalanche’s layer-1 (L1) blockchains and expanding decentralized finance (DeFi) activities, according to Luigi D’Onorio DeMeo, chief strategy officer at Ava Labs, the company behind Avalanche’s development.

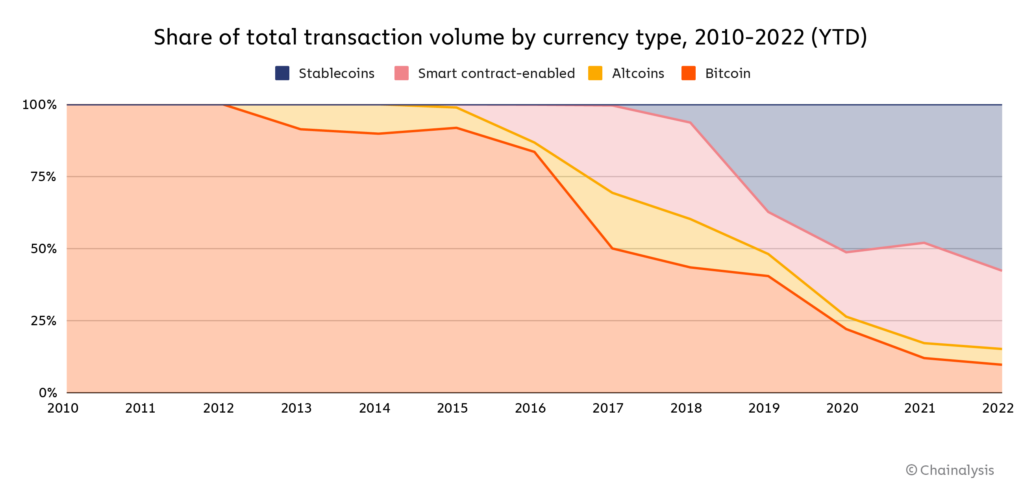

“It’s related to the growth of additional Avalanche L1s growing + new growth in terms of transactions on the Avalanche C-Chain related to payments growth of stablecoins and DeFi,” DeMeo explained.

ETF Development and Market Position

Additional catalyst for investor interest includes crypto investment firm Grayscale’s updated S-1 filing for a spot Avalanche exchange-traded fund, submitted to the US Securities and Exchange Commission, representing continued institutional interest in the blockchain network.

In the broader blockchain landscape, transactions on Starknet increased by 37%, securing second place, while the Viction network claimed third position with growth exceeding 35%.

The Base network ranked sixth in growth terms but maintained first position in absolute transaction count, processing over 64 million transactions during the past week.

Immutable Economic Data Vision

Publishing economic data on blockchain technology will make these reports “immutable,” according to US Secretary of Commerce Howard Lutnick, who emphasized the significance of this technological implementation.

“We are making America’s economic truth immutable and globally accessible like never before, cementing our role as the blockchain capital of the world,” Lutnick stated, highlighting the 3.3% GDP growth figure as particularly impressive.

The Secretary characterized the initiative as fitting for both the Commerce Department and the current administration’s pro-cryptocurrency stance, marking a historic step toward blockchain integration in federal data management.

Market Implications

The convergence of governmental adoption, institutional ETF interest, and organic network growth positions Avalanche as a significant player in the evolving blockchain ecosystem. The Department of Commerce’s decision to include Avalanche among nine selected networks validates the blockchain’s technical capabilities and reliability for critical government data publication.

This governmental endorsement, combined with sustained transaction growth and institutional investment interest, suggests Avalanche may be entering a new phase of mainstream adoption and utility recognition within the broader cryptocurrency market.