92 Crypto ETFs Await SEC Approval as Market Anticipates Regulatory Floodgates

Key Takeaways

• 92 cryptocurrency exchange-traded products currently pending SEC review, representing trillions in market value • Solana leads with 8 ETF applications, followed by XRP with 7 pending requests • BlackRock dominates existing crypto ETF market with $58.28B in Bitcoin fund inflows • Additional 20 ETF filings submitted in past four months, signaling accelerating institutional interest • Analysts predict broader altcoin rally contingent on expanded ETF approvals

The cryptocurrency exchange-traded fund landscape stands at a pivotal moment, with at least 92 crypto-related exchange-traded products currently awaiting regulatory decisions from the Securities and Exchange Commission.

Recent data from Bloomberg Intelligence reveals that Solana and XRP emerge as the most coveted digital assets among fund managers. Solana commands eight pending ETF applications, while XRP follows closely with seven applications under review. This concentration reflects institutional confidence in these particular blockchain ecosystems and their long-term viability.

Growing Pipeline of Applications

The regulatory pipeline has expanded significantly over recent months. While 72 crypto-related ETFs were pending SEC review as of earlier this year, an additional 20 applications have been submitted in the subsequent four-month period, demonstrating accelerating institutional momentum.

Among the pending applications, three funds propose combined exposure to Bitcoin and Ethereum, while the majority target alternative cryptocurrencies beyond these established leaders. This diversification strategy suggests fund managers recognize investor appetite for broader cryptocurrency exposure.

Staking and Trust Conversions

The pending applications include sophisticated product structures beyond simple spot exposure. Both 21Shares and Grayscale have submitted proposals for Ethereum staking ETFs, capitalizing on recent regulatory clarity regarding liquid staking activities falling outside certain SEC oversight parameters.

Grayscale’s strategy extends to converting five existing trusts into ETF structures, encompassing both publicly and privately traded funds. These conversion targets include exposure vehicles for Litecoin, Solana, Dogecoin, XRP, and Avalanche, potentially unlocking significant trapped value in existing trust structures.

Market Implications

Industry observers anticipate substantial market impacts once regulatory approvals accelerate. Investment professionals suggest that altcoin markets await broader ETF approval before experiencing significant rally momentum.

The potential approval of numerous cryptocurrency ETFs could fundamentally alter how institutional and retail investors access digital asset exposure, moving beyond the current Bitcoin and Ethereum options to encompass a wider spectrum of blockchain technologies and use cases.

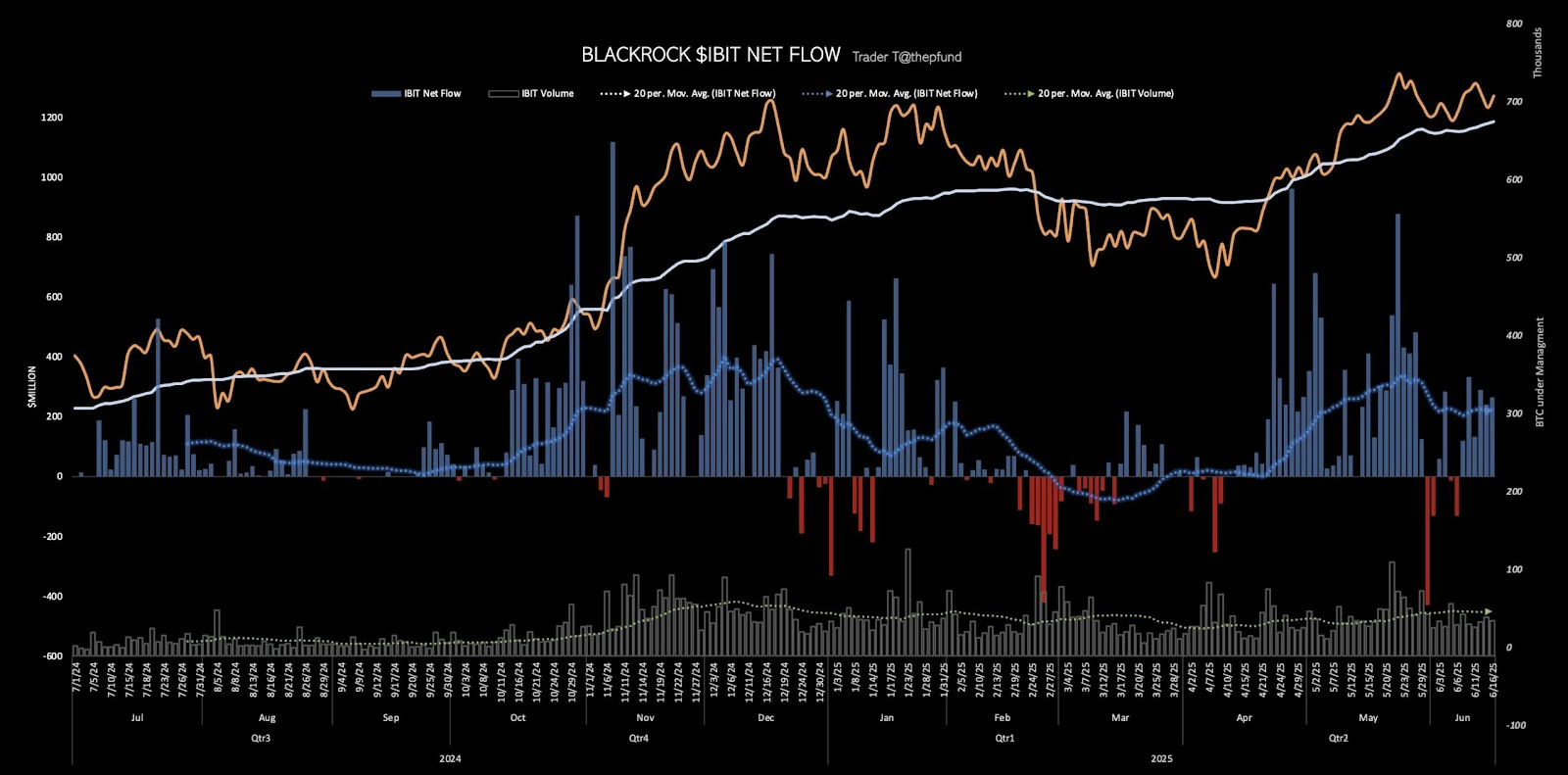

BlackRock’s Market Leadership

BlackRock maintains commanding market position within existing crypto ETF offerings. The iShares Bitcoin Trust ETF has accumulated $58.28 billion in net inflows since launch, while its Ethereum counterpart has attracted $13.12 billion in investor capital.

Recent analysis suggests the Ethereum ETF may soon surpass major cryptocurrency exchanges in terms of total ETH holdings, highlighting the institutional preference for regulated investment vehicles over direct cryptocurrency custody.

The Bitcoin fund now controls more than 3% of Bitcoin’s total circulating supply, demonstrating the significant market impact of regulated cryptocurrency investment products.

Notably, BlackRock generates higher annual fees from its Bitcoin ETF compared to its flagship S&P 500 fund, despite the cryptocurrency product’s higher 0.25% expense ratio versus the traditional fund’s 0.03% fee structure.

Future Outlook

The substantial pipeline of pending applications suggests the cryptocurrency ETF market stands poised for dramatic expansion. As regulatory frameworks continue evolving and institutional adoption accelerates, these 92 pending products represent potential pathways for mainstream investment exposure across the broader digital asset ecosystem.

The convergence of regulatory clarity, institutional demand, and technological maturation positions the cryptocurrency ETF market for a transformative period, with implications extending far beyond individual product approvals to encompass fundamental shifts in how traditional finance interfaces with digital assets.