US Bitcoin ETFs Emerge as Major Force in Cryptocurrency Trading Volume

Key Takeaways:

- US Bitcoin ETFs generate $5-10 billion daily trading volume on active days

- ETF trading represents 67% of Binance’s daily Bitcoin spot volume

- Recent Ethereum ETF inflows ($1.24B) outpaced Bitcoin ETFs ($571.6M) over four trading days

- ETFs now hold significant percentage of Bitcoin’s total supply, serving as gateway for institutional capital

United States-based spot Bitcoin exchange-traded funds have established themselves as a significant driver of daily cryptocurrency trading activity, reflecting the continued institutional embrace of digital assets.

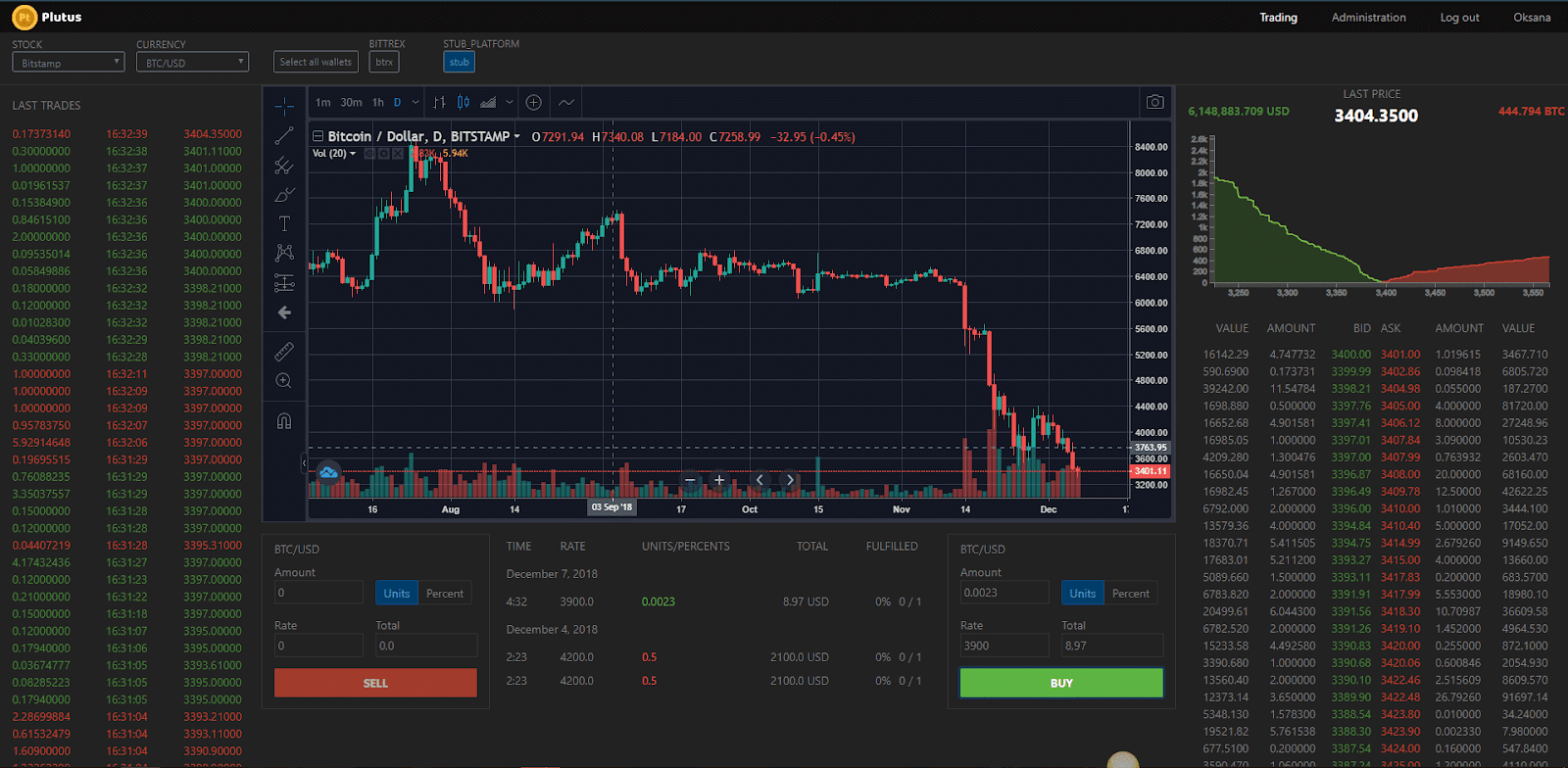

According to blockchain analytics firm CryptoQuant’s head of research, Julio Moreno, Bitcoin spot trading volumes through US-based ETFs have become a substantial source of investor exposure to the cryptocurrency market. These funds now consistently generate between $5 billion and $10 billion in daily volume during active trading periods, occasionally exceeding the volume of most cryptocurrency exchanges and demonstrating robust institutional demand.

Binance Maintains Market Leadership

Despite the impressive growth of ETF trading volumes, Binance continues to dominate spot trading activity across the cryptocurrency landscape. The world’s largest crypto exchange maintains its position with Bitcoin volumes reaching $18 billion and Ethereum volumes climbing as high as $11 billion during peak trading days.

Current data shows that the collective daily trading volume for all eleven US spot Bitcoin funds reaches approximately $2.77 billion, representing roughly 67% of Binance’s daily Bitcoin spot volume of $4.1 billion. Meanwhile, Binance’s total daily volume across all trading pairs approaches $22 billion.

Institutional Adoption Patterns

The emergence of US spot Bitcoin ETFs as a dominant market force highlights their critical role in both price discovery mechanisms and institutional cryptocurrency adoption. These products have fundamentally altered how traditional capital accesses the Bitcoin market, creating new pathways for investment that previously required direct cryptocurrency custody solutions.

Ethereum spot trading presents a different landscape, with activity primarily concentrated on Binance, followed by Crypto.com. ETFs currently rank sixth in Ethereum trading, capturing only 4% of total volume. This disparity underscores the more limited ETF participation in Ethereum spot trading and suggests slower institutional adoption compared to Bitcoin.

Recent Flow Dynamics Shift

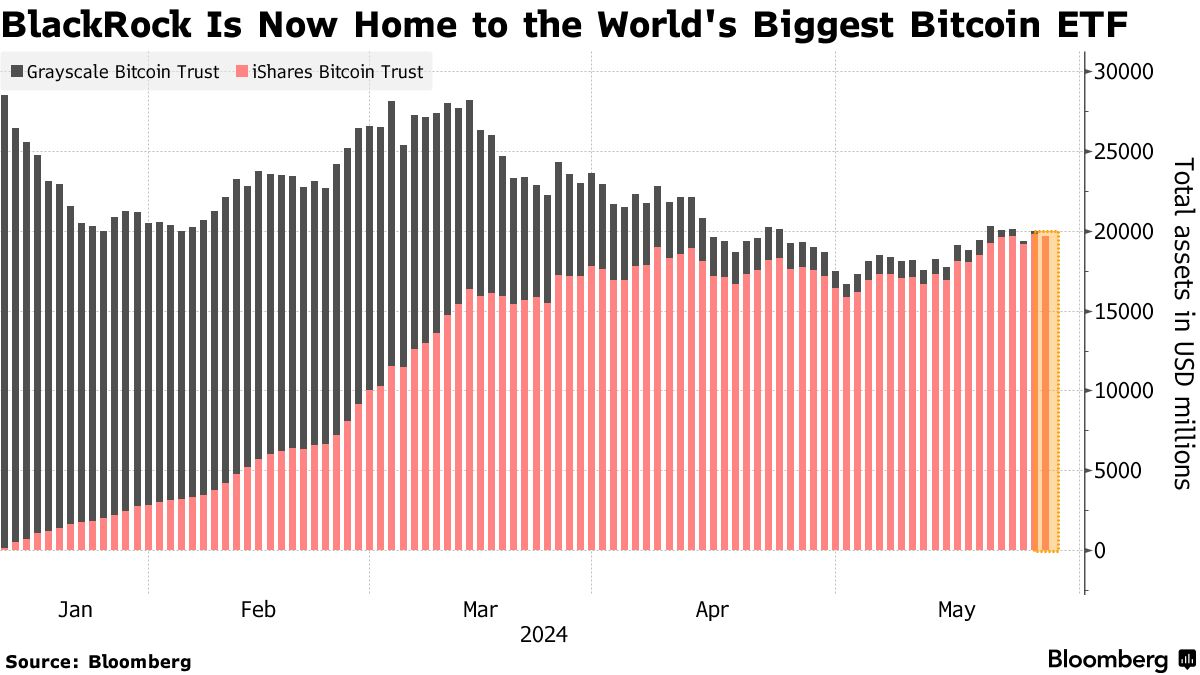

While Bitcoin ETF growth has been substantial, recent trading patterns reveal an interesting shift in investor sentiment. Inflows into the eleven spot Bitcoin ETFs have moderated this week, totaling $571.6 million over the past four trading sessions. The BlackRock iShares Bitcoin Trust leads these inflows with nearly 40%, accounting for $223.3 million since the beginning of the week.

This slowdown coincides with Bitcoin’s 2.5% decline since Monday, as the cryptocurrency retreated to approximately $111,600 amid cooling market sentiment.

In contrast, spot Ethereum ETFs have demonstrated stronger recent performance, attracting aggregate inflows of $1.24 billion—more than double Bitcoin fund inflows over the same four-day period. Ethereum funds have maintained positive net flows since late August and have accumulated over $4 billion in inflows this month alone, representing 30% of total inflows since their launch thirteen months ago.

Market Structure Evolution

The growing influence of ETF trading activity extends beyond simple volume metrics, actively reshaping spot market liquidity dynamics. Trading patterns within these funds increasingly correlate with underlying Bitcoin price movements, indicating their substantial impact on market structure.

Current flow dynamics demonstrate that ETFs are not merely supplementing existing market infrastructure but are fundamentally transforming how spot market liquidity operates. These products now represent a significant percentage of Bitcoin’s total supply, establishing ETFs as an essential gateway for traditional capital seeking cryptocurrency exposure.

The evolution of Bitcoin ETFs from novel investment vehicles to major market participants reflects the broader maturation of cryptocurrency markets and the increasing integration of digital assets into traditional financial systems. Their continued growth suggests that institutional adoption of cryptocurrency will likely accelerate through these regulated investment products.