Businesses Buy Bitcoin 4x Faster Than It’s Mined

Key Takeaways:

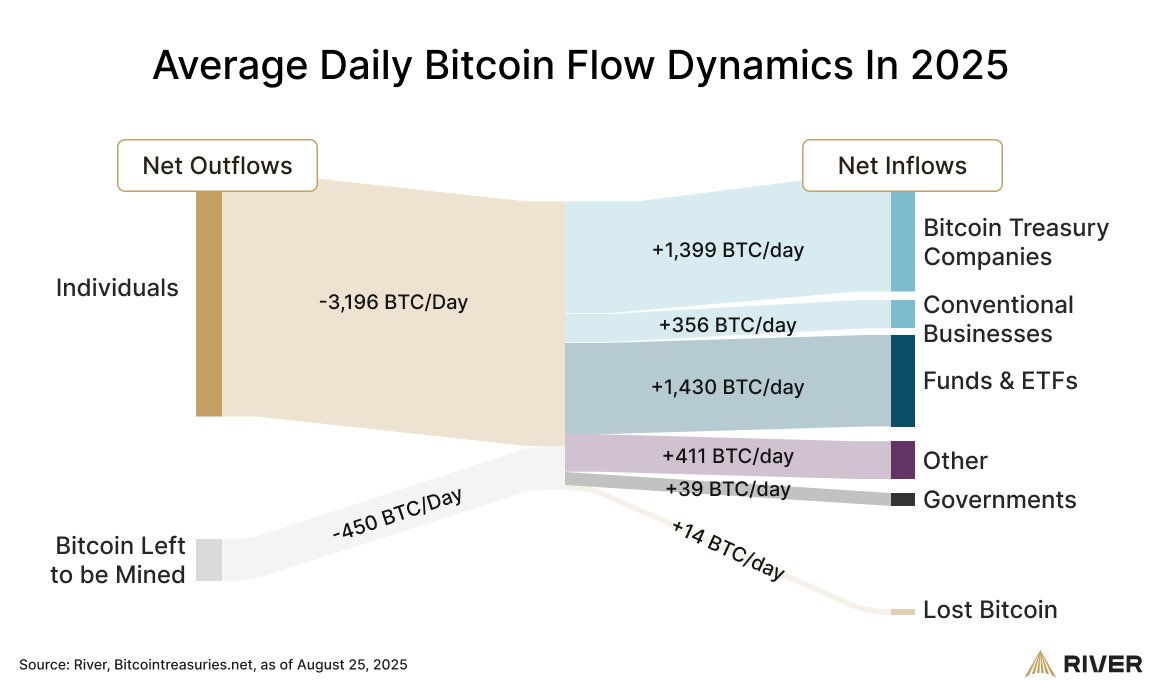

- Businesses purchased 1,755 BTC per day in 2025, far outpacing miner output.

- ETFs added an average of 1,430 BTC daily, while governments bought about 39 BTC.

- Miners produce only 450 BTC per day, creating risk of a supply crunch.

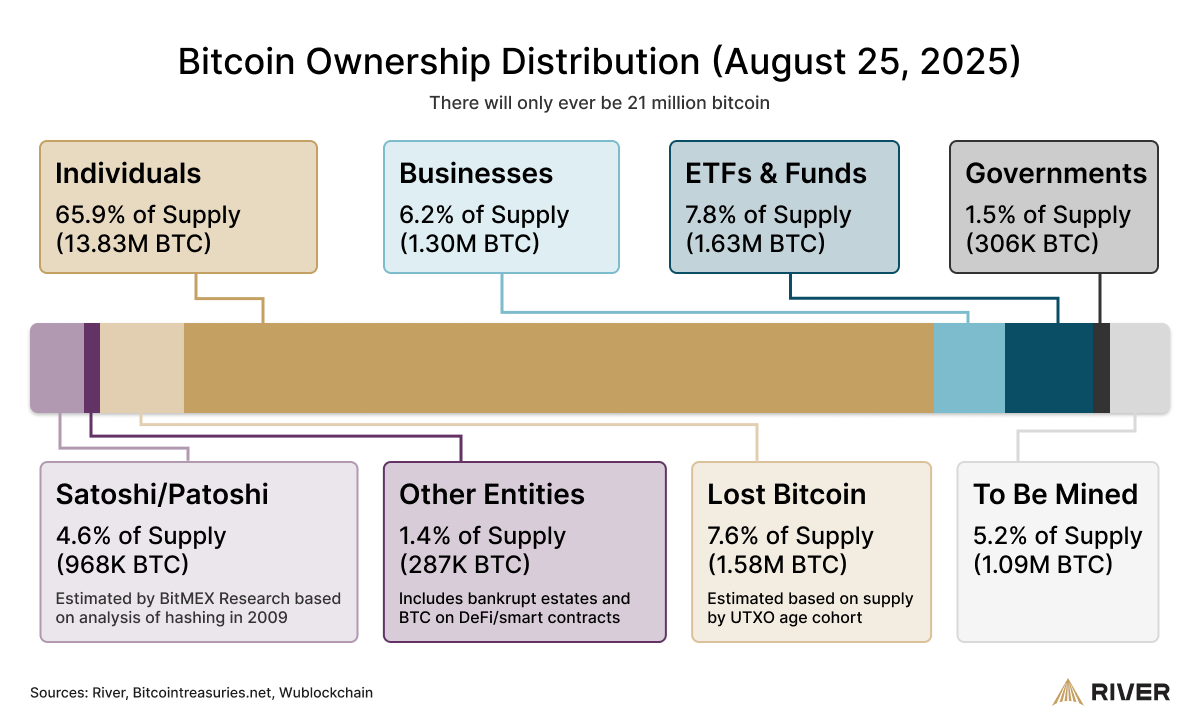

- Bitcoin treasury companies now hold over 1.3 million BTC.

- Strategy, led by Michael Saylor, remains the largest holder with 632,457 BTC.

Institutional and Corporate Demand Surges

Private businesses and publicly traded firms are absorbing Bitcoin at an unprecedented pace, purchasing nearly four times more BTC than miners are producing each day, according to a new report from financial services firm River.

River’s data shows that in 2025, corporate treasuries and private companies collectively acquired 1,755 BTC per day on average. This figure does not include demand from exchange-traded funds (ETFs), which purchased an additional 1,430 BTC daily. Governments also joined the buying spree, adding roughly 39 BTC per day.

By contrast, Bitcoin miners generate only around 450 new coins daily. This mismatch between new supply and market absorption is fueling speculation that Bitcoin could soon face a supply shock, particularly as exchange reserves continue to decline to multi-year lows.

Potential Supply Shock and Market Impact

Analysts argue that the ongoing imbalance between supply and demand could serve as a bullish catalyst for Bitcoin’s price. With businesses and institutions increasingly holding onto their BTC rather than circulating it back to exchanges, available supply for retail and new investors has diminished.

Exchange reserve data from CryptoQuant highlights this trend, showing that BTC balances on exchanges are at their lowest levels in years. Historically, such declines have been linked to upward price pressure, as fewer coins remain available for active trading.

Treasury Companies Drive Institutional Accumulation

Corporate Bitcoin treasury firms represent one of the largest sources of sustained demand. According to River, treasury companies purchased 159,107 BTC in the second quarter of 2025 alone, bringing total business-held Bitcoin reserves to around 1.3 million BTC.

Leading the pack is Michael Saylor’s company Strategy, which holds an extraordinary 632,457 BTC, making it the largest known corporate holder worldwide. This accumulation has led some analysts, including author Adam Livingston, to suggest that Strategy is effectively “synthetically halving Bitcoin” through its relentless purchasing pace.

Market Impact Remains Contained

Despite these massive acquisitions, Strategy maintains that its purchases do not distort short-term Bitcoin prices. Corporate treasury officer Shirish Jajodia explained that the firm executes most of its buys through over-the-counter (OTC) channels rather than on public exchanges.

“Bitcoin’s trading volume is over $50 billion in any 24 hours — that’s huge volume. So, if you are buying $1 billion over a couple of days, it’s not actually moving the market that much,” Jajodia noted.

By spreading purchases across private OTC transactions, Strategy minimizes direct pressure on spot markets, even while steadily increasing its long-term reserves.

The Bigger Picture of Institutional Bitcoin Adoption

The accelerating pace of institutional accumulation underscores Bitcoin’s evolving role as a strategic reserve asset. Businesses, ETFs, and governments are no longer treating BTC as a speculative instrument but as a core part of treasury and investment strategy.

If the current trajectory continues, Bitcoin’s scarcity could intensify. With miners introducing just 450 BTC per day against combined daily demand of more than 3,200 BTC from institutions, the supply squeeze narrative may become one of the dominant themes of the coming cycle.

Conclusion

The River report highlights a striking imbalance between Bitcoin supply and demand. Corporate treasuries, ETFs, and governments are collectively acquiring BTC at nearly four times the pace of mining output. Exchange reserves have dwindled, and institutional accumulation shows no sign of slowing down.

Whether this imbalance sparks a genuine supply shock remains to be seen, but the implications are clear: Bitcoin’s role as a strategic asset for businesses and investors is stronger than ever, and scarcity is once again emerging as the central narrative in its valuation.