From DeFi to CeFi – Rise, Collapse, and Lessons

Introduction: The Convergence of Three Financial Worlds

The global financial system is undergoing a tectonic transformation, shaped by the convergence of three distinct yet increasingly interconnected domains: traditional finance (TradFi) with its centuries-old infrastructure and compliance, centralized crypto finance (CeFi) that acted as a bridge for mainstream adoption, and decentralized finance (DeFi) – the frontier of permissionless innovation on blockchain.

This article traces how the experiments of DeFi Summer, the subsequent crises, and the spectacular failures of CeFi created the conditions for TradFi’s strategic awakening. Part 1 focuses on the rise of DeFi and the collapse of CeFi, while Part 2 will continue with TradFi’s entry, the tokenization of real-world assets, and the emergence of integrated finance.

Chapter 1: The DeFi Summer – When Garages Replaced Wall Street

1.1. Andre Cronje’s Story: An Archetype of DeFi Spirit

We have to look at Andre Cronje’s story, a South African developer, who has come to symbolize the spirit of DeFi Summer 2020. His creation of Yearn Finance (yearn.finance) was a pivotal moment, showing how a single developer could build financial infrastructure with global impact. Yearn operated as a yield aggregator, automatically reallocating user funds across protocols such as Aave and Compound to optimize returns. This innovation, known as yield farming, simplified a complex process and made advanced strategies accessible to users with limited technical expertise.

Although descriptions of Cronje as an “overnight billionaire” are likely exaggerated, Yearn’s impact is undeniable. Its influence was reinforced by the fair launch of the YFI governance token. With no pre-mining or developer allocation, the full initial supply was distributed to liquidity providers, echoing Bitcoin’s ethos of openness. This approach fostered strong community trust and participation, quickly making YFI one of the most valuable assets in the market.

At the same time, Cronje’s story also highlighted the risks of DeFi’s experimental culture. His philosophy of “testing in production” enabled rapid progress but also exposed users to significant losses. The Eminence (EMN) incident, where investors committed capital to an unaudited and incomplete smart contract based only on Cronje’s hints, underscored a harsh reality of early DeFi: the pace of innovation often outstripped security, leaving users as unwitting participants in live experiments.

1.2. The Catalysts: From Suitable Protocols to Explosive Growth

The foundation for DeFi Summer had been laid years earlier. In 2017, MakerDAO pioneered overcollateralized decentralized lending, enabling users to generate the stablecoin DAI by locking Ether as collateral. This introduced one of DeFi’s core building blocks: creating stable on-chain debt without reliance on traditional intermediaries.

However, the true catalyst for the 2020 boom was Compound Finance’s launch of its governance token, COMP, on June 15, 2020. Unlike previous models that only paid interest to lenders while charging borrowers, Compound distributed COMP tokens to both sides of the market. This mechanism, known as liquidity mining, created a powerful feedback loop: in some cases, users could effectively earn money by borrowing, as the value of COMP rewards exceeded interest owed. This breakthrough in token economics ignited the yield farming frenzy and drew unprecedented capital into the ecosystem.

1.3. Quantifying the Explosion: TVL Data Analysis

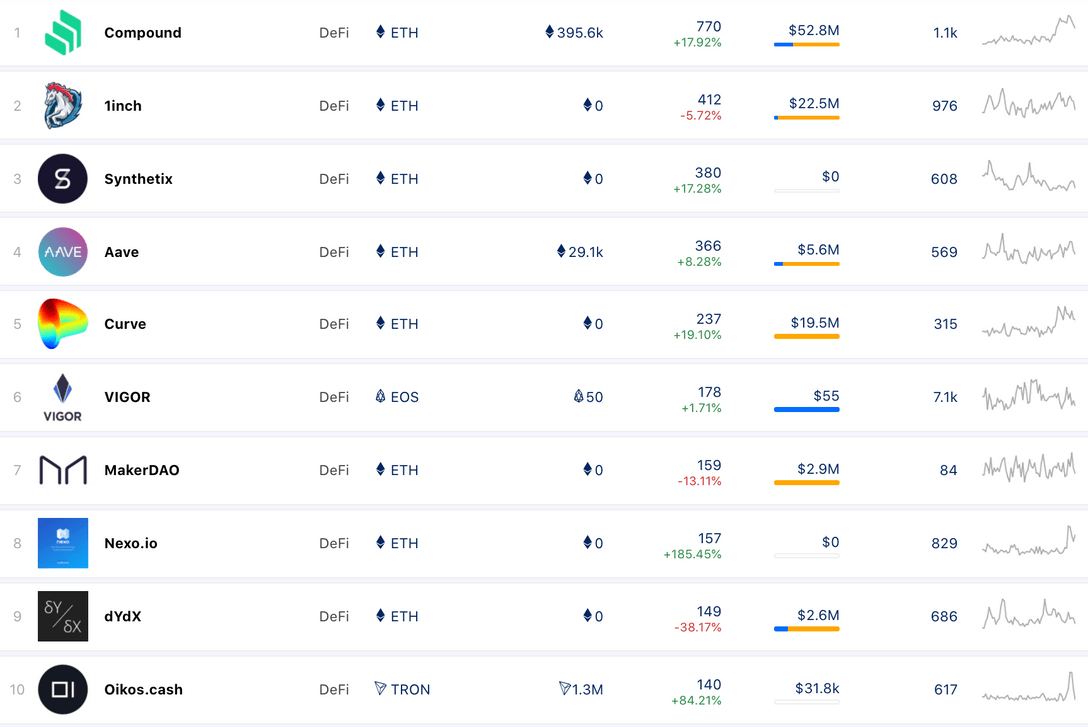

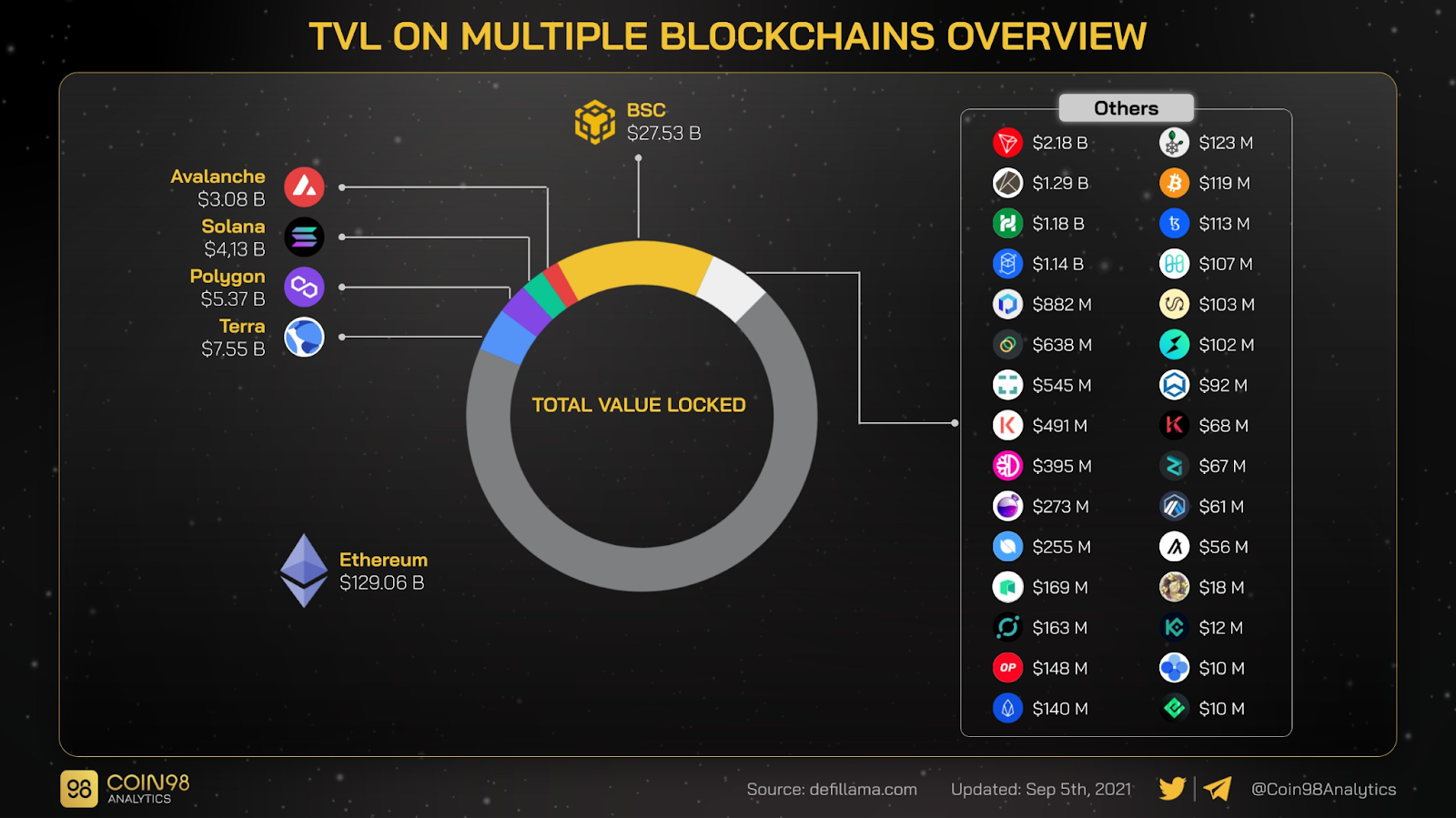

The introduction of liquidity mining caused exponential growth in Total Value Locked (TVL), a key metric measuring the total capital deposited in DeFi protocols. Data confirms that TVL across the entire DeFi ecosystem skyrocketed from approximately $1 billion in early June 2020 to over $15 billion by October 2020, an increase of about 15-20 times in just four months. Other sources also recorded similar growth, with TVL reaching $11.3 billion in mid-October and $14.1 billion in mid-November.

Data tracking platforms like DeFi Pulse became crucial information sources during this period, providing metrics and rankings trusted by the industry to monitor this growth. While newer platforms like DeFiLlama later became industry standard, DeFi Pulse was the dominant analytical tool that captured the historic rise of DeFi Summer.

Table 1: DeFi Total Value Locked (TVL) Growth (June – October 2020)

| Month (2020) | Total Value Locked (USD) | Key Catalysts/Events |

| June | ~$1 billion | Launch of Compound’s COMP token, beginning of yield farming |

| July | ~$4 billion | Launch of Yearn.finance’s YFI token, popularizing yield aggregators |

| August | ~$9 billion | Launch of SushiSwap and “vampire attack” on Uniswap |

| September | ~$11 billion | Uniswap’s UNI token airdrop in response to SushiSwap |

| October | ~$15 billion | Peak of yield farming and retail investor participation |

This table clearly illustrates the causal relationship between token economics innovations and capital inflows. Each major token launch such as COMP, YFI, SUSHI, and UNI, corresponded to a significant jump in TVL, showing that this growth was not random but purposefully driven by carefully designed incentive mechanisms.

1.4. The AMM Revolution: Uniswap vs Traditional Exchanges

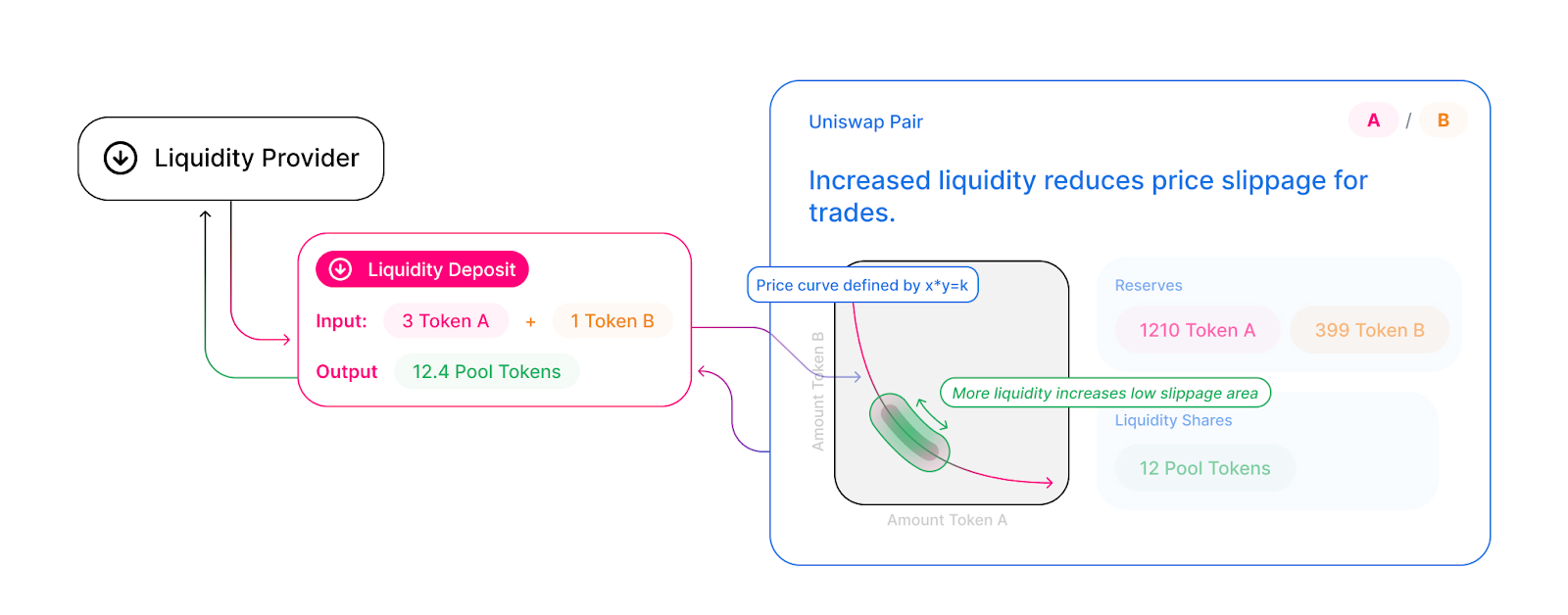

While lending protocols drove capital inflow, decentralized exchanges (DEXs) provided the infrastructure to trade these newly created assets. Uniswap, founded by Hayden Adams, emerged as an undisputed leader. Unlike traditional exchanges relying on order books, Uniswap pioneered the Automated Market Maker (AMM) model, using a simple mathematical formula, x⋅y=k, to determine asset prices based on the ratio of two assets in a liquidity pool.

This model was revolutionary because it allowed anyone to create a market for any token pair without permission, and anyone could earn fees by providing liquidity. It completely eliminated the need for traditional market makers and centralized infrastructure.

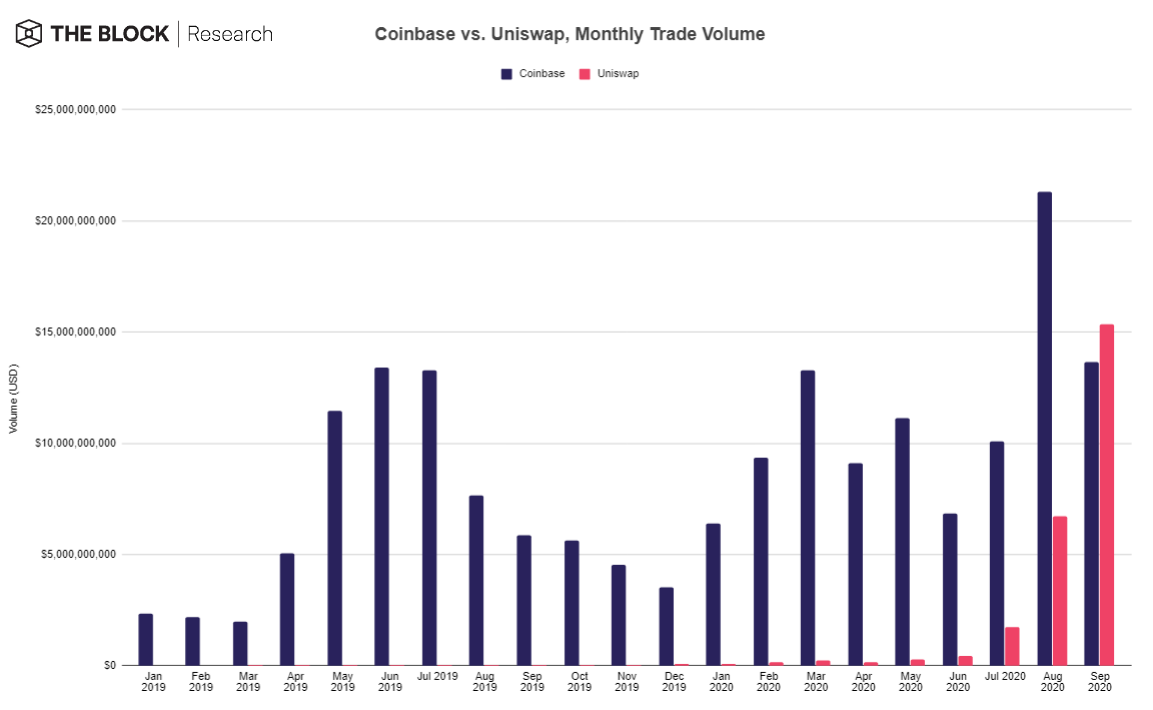

The breakthrough nature of this model became clear in September 2020, when Uniswap’s monthly trading volume surpassed Coinbase, the largest and most heavily regulated cryptocurrency exchange in the US at the time. Market data showed Uniswap processed approximately $15.4 billion in trading volume in September, compared to Coinbase’s $13.6 billion. This comparison became even more impressive considering the operational efficiency difference. Uniswap achieved this with a team of fewer than a dozen employees, while Coinbase had over 1,200 employees. The 10x difference in revenue per employee ($14.9 million vs $1.38 million, according to a 2022 analysis) highlighted the fundamental advantage of automated protocols over traditional corporate structures. This trading volume data is typically aggregated and verified by on-chain analytics platforms like Dune Analytics, a respected and widely used industry source.

1.5. The First Fork War: SushiSwap’s “Vampire Attack”

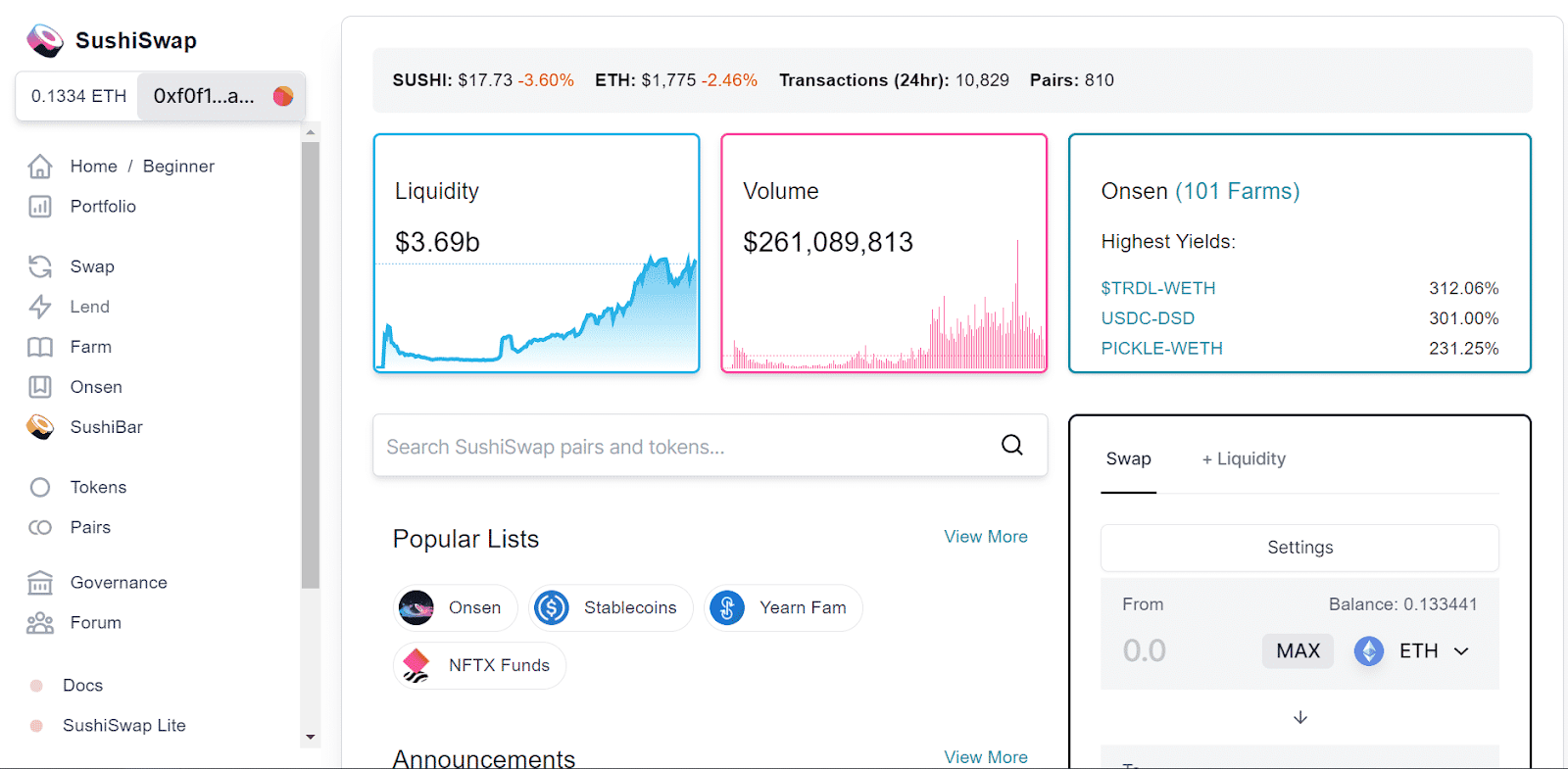

Uniswap’s success also highlighted a key characteristic of DeFi: its open-source nature. Since Uniswap’s code was publicly accessible, anyone could copy (fork) it. This is exactly what an anonymous developer named Chef Nomi did when launching SushiSwap in late August 2020.

SushiSwap was a nearly identical copy of Uniswap but with one crucial difference: the SUSHI token. The protocol rewarded liquidity providers with SUSHI tokens, creating an additional incentive layer that Uniswap lacked at the time. SushiSwap’s strategy was a clearly designed “vampire attack”: it incentivized Uniswap’s liquidity providers to transfer their LP tokens to SushiSwap to earn SUSHI. After an initial period, a smart contract would automatically migrate all underlying liquidity from Uniswap to SushiSwap’s pools.

This strategy was remarkably successful, attracting over $1 billion in liquidity from Uniswap within days. However, the story took a dark turn when Chef Nomi suddenly sold all his developer SUSHI tokens for approximately $13 million in ETH, causing a price collapse and a major confidence crisis.

What happened next became one of DeFi’s defining moments. Rather than letting the project die, the community rallied. Sam Bankman-Fried (SBF), then CEO of FTX and considered a respected figure in the industry, stepped in to broker a transfer of control. The community voted to transfer governance to a group of new developers. SushiSwap not only survived but thrived, proving that a decentralized protocol could be more resilient than even its founder’s wrongdoing. This event forced Uniswap to act, leading to their launch and airdrop of their own UNI token to previous users, a move that consolidated their market leadership and set a new standard for user retention in the DeFi space.

Chapter 2: Disasters and Lessons – When Math Met Greed

2.1. The Collapse of Algorithmic Stablecoins: A Cautionary Tale

If DeFi Summer 2020 was a testament to permissionless innovation, the 2021-2022 period exposed the systemic risks lurking in its most experimental designs, particularly algorithmic stablecoins.

Iron Finance / TITAN

One of the first high-profile collapses involving a celebrity figure was the Iron Finance collapse in June 2021. Billionaire investor Mark Cuban had publicly endorsed the protocol on his blog, praising its attractive yields just days before it collapsed. Iron Finance attempted to create a stablecoin, IRON, partially collateralized by asset-backed stablecoin (USDC) and partially by its own volatile governance token, TITAN.

This mechanism created a classic “death spiral.” When confidence in TITAN began to wane, its price dropped sharply. This prompted users to redeem their IRON for the USDC portion. By the protocol’s design, this redemption process minted more TITAN, increasing supply and adding further downward pressure. This negative feedback loop accelerated rapidly, and within less than 24 hours, TITAN’s price fell from over $60 to near zero, wiping out over $2 billion in value. Cuban later publicly acknowledged on Twitter that he had been “rugged” and learned an expensive lesson about smart contract risks. This event attracted mainstream media attention, marking one of the first times a prominent investor publicly admitted significant DeFi losses.

Terra / LUNA

The Iron Finance disaster was a harbinger of a much larger event: the collapse of the Terra ecosystem in May 2022. Founded by Do Kwon, Terra built a $60 billion ecosystem around its algorithmic stablecoin, TerraUSD (UST), and its balancing token, LUNA.

Similar to Iron Finance, UST maintained its stability through an arbitrage mechanism with LUNA. Users could always exchange 1 UST for $1 worth of LUNA, and vice versa. To drive demand for UST, Do Kwon created Anchor Protocol, a lending platform promising an unrealistic and unsustainable annual percentage yield (APY) of nearly 20% for UST deposits. This yield, significantly higher than anything available in traditional finance, attracted billions of dollars to the ecosystem. However, analysis from institutions like JPMorgan and on-chain analytics firms like Nansen showed that this yield was heavily subsidized, funded by Terra’s treasury, and burning through millions of dollars daily.

The collapse began when large sell orders against UST on decentralized exchanges broke its peg, pushing the price below $1. This triggered panic and a massive bank run from Anchor Protocol. As users rushed to exchange their UST for LUNA, LUNA’s supply increased exponentially, causing hyperinflation and making its price collapse. Within a week, both tokens became virtually worthless, wiping out over $45 billion in market capitalization and causing devastating losses for investors worldwide. Do Kwon, from a prominent figure in the crypto industry, became a fugitive and was eventually arrested.

2.2. Infrastructure Vulnerabilities: The Poly Network Hack

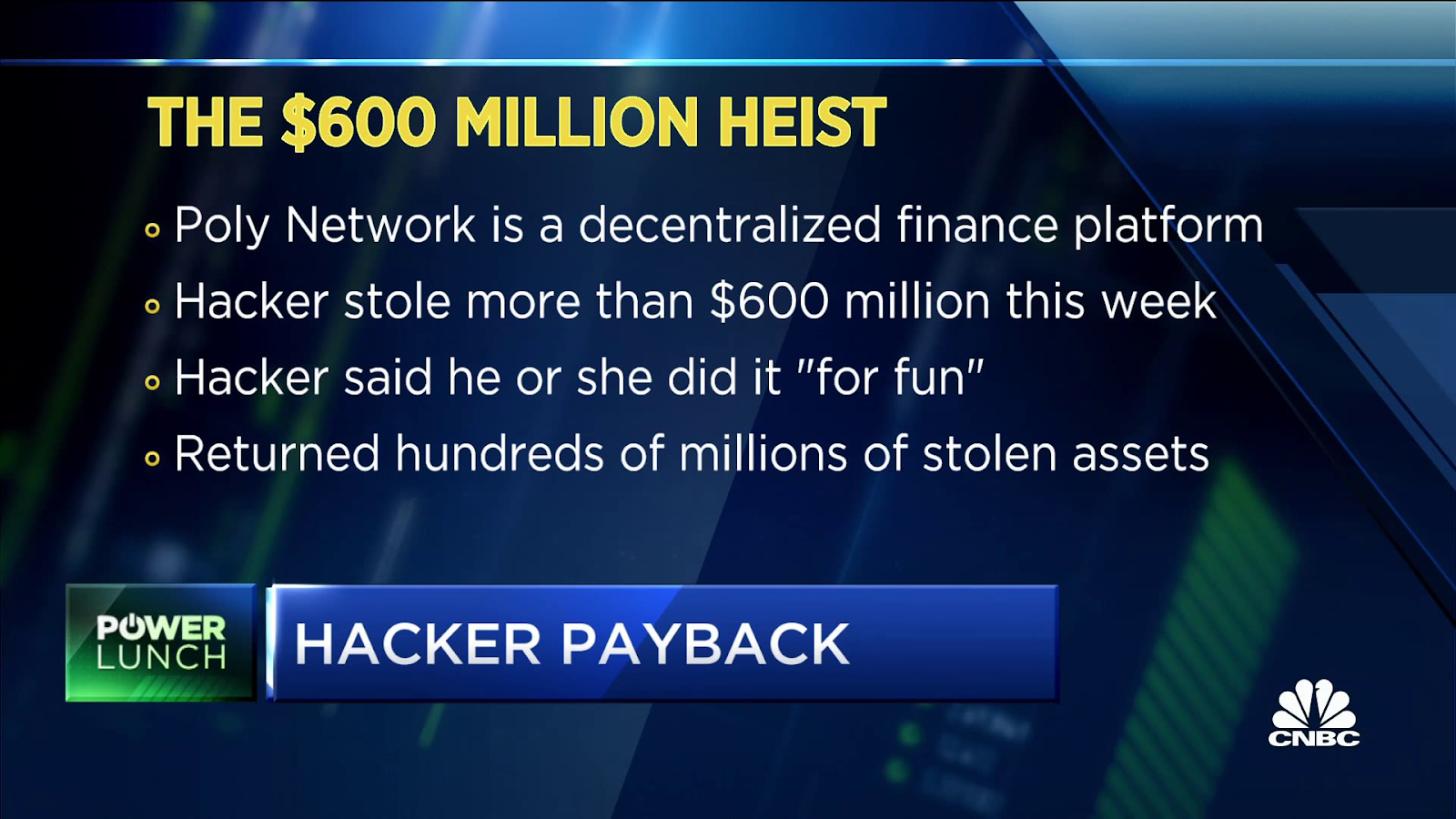

Beyond token economics design risks, 2021 also exposed vulnerabilities in DeFi’s core infrastructure. The Poly Network hack in August 2021 was a prime example. Poly Network, a cross-chain interoperability protocol designed to allow asset transfers between different blockchains, had a smart contract vulnerability exploited, resulting in the theft of $611 million worth of cryptocurrency, one of the largest thefts in DeFi history.

The incident had an unusual twist when the hacker, later dubbed “Mr. White Hat” by the community, began communicating and returning the stolen funds. The hacker claimed the attack was conducted “for fun” and to expose serious security vulnerabilities before they could be exploited by malicious actors. After negotiations, in which Poly Network offered a $500,000 bug bounty, all funds were returned.

According to analysis by leading blockchain security firms like Chainalysis, this incident highlighted both DeFi’s weaknesses and strengths. The weakness was the complexity and risk of smart contracts, especially cross-chain bridges, where a single bug could lead to catastrophic losses. The strength was blockchain’s transparency, allowing analysts to track stolen funds in real-time, making money laundering difficult.

2.3. The Contagion: From LUNA to Industry-Wide Insolvency

Terra’s collapse was not an isolated event; it triggered a devastating contagion wave across the crypto industry, particularly in centralized lending.

Cryptocurrency hedge fund Three Arrows Capital (3AC), led by Su Zhu and Kyle Davies, was one of the first major casualties. 3AC had large, highly leveraged investments in the Terra ecosystem. When LUNA and UST collapsed, the fund faced insurmountable losses and couldn’t meet margin calls, leading to insolvency and eventual liquidation in June 2022.

3AC’s collapse created a domino effect. Major CeFi lending platforms like Voyager Digital, Celsius Network, and BlockFi all had large, often under-collateralized loans to 3AC. For example, Voyager had lent 3AC over $660 million. When 3AC defaulted, these platforms faced massive holes in their balance sheets. This triggered bank runs from their own users, forcing them to halt withdrawals and eventually file for bankruptcy in subsequent months.

Table 2: 2022 Crypto Contagion

| Entity | Date of Failure/Withdrawal Halt | Primary Cause of Failure | Key Risk Factor/Loss |

| Terra/LUNA | May 2022 | Algorithmic death spiral | Unsustainable Anchor Protocol yields |

| Three Arrows Capital (3AC) | June 2022 | Insolvency & Liquidation | Massive leverage exposure to LUNA/UST |

| Voyager Digital | July 2022 | Bankruptcy | ~$660M+ uncollateralized loan to 3AC |

| Celsius Network | July 2022 | Bankruptcy | 3AC exposure and risky DeFi strategies |

| BlockFi | November 2022 | Bankruptcy | 3AC and FTX exposure |

This table clearly illustrates the causal chain that spread throughout the industry. It shows that the collapses were not a series of unrelated events, but a systemic crisis originating from a single point of failure (Terra) and amplified by high-leverage, opaque lending practices and poor risk management across the entire CeFi sector.

Notably, throughout this crisis, core DeFi protocols like Uniswap, Aave, and MakerDAO continued to operate as designed. Over-collateralized loans were liquidated automatically, exchanges continued functioning, and no intervention or bailouts were necessary. This period created a stark contrast, proving that while many companies and applications in the crypto space proved fragile, the underlying decentralized infrastructure showed a remarkable degree of antifragility. Each disaster, while painful, provided valuable lessons, leading to better security practices and a more resilient overall ecosystem.

Chapter 3: Centralized Crypto Finance – A Tale of Ambition, Success, and Collapse

3.1. The FTX/Alameda Collapse: A Timeline of Downfall

The biggest disaster in centralized cryptocurrency finance (CeFi) history was not caused by a technical vulnerability or algorithmic death spiral, but by a deliberately orchestrated large-scale financial fraud. The collapse of FTX, one of the world’s largest exchanges, together with its sister firm Alameda Research, marked the most damaging failure in centralized cryptocurrency finance (CeFi). Unlike earlier crises driven by technical flaws or unstable algorithms, this was a case of deliberate, large-scale fraud that shook the industry.

FTX – A $32 Billion Empire Collapsed in 9 days. Source: CoinDCX

The chain of events began with a CoinDesk investigation on November 2, 2022. A leaked Alameda balance sheet showed that much of its assets were tied to FTT, the utility token issued by FTX itself. The revelation raised immediate concerns about the close and risky relationship between the two entities founded by Sam Bankman-Fried (SBF). In effect, Alameda had been using an illiquid token created by its own affiliate as collateral.

Tension escalated when Changpeng Zhao (CZ), CEO of Binance, announced on November 6 that his exchange would liquidate all FTT holdings. The announcement triggered a bank run. Within 72 hours, customers attempted to withdraw more than $6 billion. By November 8, FTX could no longer process withdrawals and frozen customer accounts, confirming insolvency fears.

Subsequent bankruptcy filings exposed the depth of the misconduct. FTX had secretly diverted billions in customer deposits to Alameda, funding speculative trades and other expenses. This directly violated both its terms of service and SBF’s repeated public assurances. On-chain analysis by Nansen confirmed suspicious transfers between FTX and Alameda wallets, strengthening the case for misuse of funds.

On November 11, 2022, FTX filed for Chapter 11 bankruptcy. The newly appointed CEO, John J. Ray III, who previously oversaw Enron’s liquidation, described the situation as a “complete failure of corporate controls” and the worst breakdown of oversight he had ever encountered.

3.2. Justice for SBF: Legal Retribution

FTX’s collapse quickly transitioned from a financial crisis to a high-profile criminal case. Sam Bankman-Fried was arrested in the Bahamas on December 12, 2022, and subsequently extradited to the US to face a series of criminal charges.

His trial began in October 2023. Prosecutors accused SBF of orchestrating one of the largest financial frauds in US history, stealing customer funds to finance risky investments, purchase luxury real estate, and make political donations. Key members of his inner circle, including Alameda CEO Caroline Ellison, pleaded guilty and cooperated with the government, providing damning testimony against SBF.

On November 2, 2023, after a month-long trial, the jury took only hours to find SBF guilty on all seven counts, including wire fraud, securities fraud conspiracy, and money laundering. On March 28, 2024, SBF was sentenced to 25 years in prison and ordered to pay $11 billion in forfeiture. This sentence sent a strong message to the crypto industry that fraudulent behavior would face serious consequences.

3.3. The Dichotomy of Centralization and the Revival of “Not Your Keys, Not Your Coins”

The rise and fall of CeFi during this period revealed a clear dichotomy. On one side, platforms such as Coinbase and Binance were crucial in driving mainstream adoption. They offered user-friendly interfaces, simple fiat on/off ramps, and a level of familiarity that resembled online banking. This accessibility was critical in attracting millions of new participants to the ecosystem.

On the other hand, the collapse of FTX exposed the hidden cost of that convenience: counterparty risk. By entrusting assets to a centralized entity, users had surrendered control and relied entirely on the operator’s integrity. FTX’s downfall was a stark reminder that such trust could be catastrophically broken.

The crisis triggered a cultural reset within the community. The early Bitcoin maxim, “Not your keys, not your coins”, resurfaced with renewed urgency. Many users came to recognize that genuine sovereignty required self-custody, where private keys remained under their control. Hardware wallet sales increased, and interest in self-custody solutions rose sharply.

Yet CeFi did not disappear. Instead, it was forced to adapt. Exchanges began implementing Proof of Reserves, a cryptographic method to demonstrate one-to-one backing of customer deposits. Combined with greater regulatory scrutiny, these measures gradually shifted CeFi from an unregulated frontier to a more transparent and accountable sector. Paradoxically, while FTX’s collapse was destructive, it also became a catalyst—pushing the industry to confront the balance between convenience and security, and accelerating the development of more resilient hybrid models.

Conclusion

The evolution from DeFi’s rapid emergence to CeFi’s collapse reflects a familiar pattern in financial history: innovation followed by excess, and ultimately, correction. While disruptive, these episodes established the groundwork for a more resilient industry. They also compelled both market participants and regulators to take blockchain-based finance seriously, creating the conditions for broader institutional involvement.

In part 2, we will examine how traditional finance has begun integrating blockchain, the role of real-world asset tokenization, and the emergence of a multi-dimensional financial system.