TradFi Awakening: From Wall Street to Integrated Finance

In our last article, we traced the arc from DeFi’s rapid experimentation to CeFi’s collapse, highlighting how innovation, excess, and correction reshaped the crypto landscape. Those failures paved the way for the TradFi Awakening, where traditional finance began stepping into blockchain.

In Part 2, we examine how global banks, asset managers, and payment giants are embracing blockchain. From JPMorgan’s Kinexys platform to BlackRock’s record-breaking Bitcoin ETF and the tokenization of real-world assets, this phase marks the fusion of TradFi, CeFi, and DeFi into a more resilient financial system.

Let’s explore how integrated finance is taking shape, and why the future of money is becoming unmistakably multi-dimensional.

Chapter 4: Traditional Finance Awakens – When Dinosaurs Learn to Fly

4.1. Institutional Pivot: From Skepticism to Infrastructure Building

The transformation of traditional financial institutions (TradFi) from crypto skeptics to active builders on blockchain technology is one of the most significant trends shaping the current financial landscape. This shift is not driven by speculation, but by recognition that distributed ledger technology (DLT) can solve real business problems, enhance efficiency, and create new revenue streams.

JPMorgan Chase

Under the leadership of CEO Jamie Dimon, who once dismissed Bitcoin as a “fraud,” JPMorgan has undergone a notable transformation. The bank has shifted its focus from skepticism to building practical blockchain infrastructure. Its enterprise platform, Kinexys (formerly Onyx), was created not for speculative trading but to modernize core financial operations and deliver efficiency at scale.

Key applications include:

- Digital Payments (JPM Coin): enabling instant, 24/7 cross-border wholesale payments between institutional clients, reducing both costs and settlement delays associated with traditional correspondent banking.

- Tokenized Collateral Network: allowing institutions to tokenize conventional assets, such as money market fund shares, and deploy them as collateral in near real time.

- On-chain Repo Finance: automating repo transactions and cutting settlement times from several days to just minutes.

Since its launch, Kinexys has processed more than $1.5 trillion in transaction volume, a milestone that highlights the scale of institutional adoption.

Goldman Sachs

Goldman Sachs has taken a similar strategic approach, focusing on building infrastructure to serve institutional client needs. Their Digital Asset Platform (GS DAP®) is a blockchain-based platform for issuing and managing tokenized assets. The platform has been used in high-profile transactions, such as issuing digital bonds for the European Investment Bank (EIB), proving its viability in real capital markets. Additionally, Goldman Sachs provides crypto trading and custody services to institutional clients and has developed proprietary analytical tools like the datonomy™ classification framework to help investors better understand digital asset markets.

BNY Mellon and Other Institutions

BNY Mellon’s entry into crypto custody, America’s oldest bank, was another significant milestone. By providing institutional-grade custody services, BNY Mellon provided a security and trust layer necessary for pension funds, endowments, and other large asset managers to safely participate in the market.

4.2. The ETF Turning Point: BlackRock Validates the Market

If banks’ infrastructure building was a foundational shift, the launch of spot Bitcoin ETFs in the US in January 2024 was a watershed moment, signaling mainstream acceptance. The most significant event was BlackRock’s participation, the world’s largest asset manager.

BlackRock’s iShares Bitcoin Trust (IBIT) witnessed one of the most successful launches in ETF history. The fund attracted tens of billions of dollars in inflows within its first months, breaking records for asset accumulation speed. IBIT’s success, alongside other ETFs from traditional financial firms like Fidelity (FBTC), provided a familiar, regulated, and accessible investment vehicle for both retail and institutional investors to gain Bitcoin exposure without worrying about self-custody complexities.

The shift in BlackRock CEO Larry Fink’s perspective from skeptic to Bitcoin advocate as “digital gold” provided invaluable validation for the entire asset class. BlackRock’s participation not only opened enormous capital but also signaled to investors and regulators worldwide that crypto had become a legitimate component of the global financial system.

Table 3: Comparison of Major Spot Bitcoin ETFs (as of mid-2024)

| ETF Ticker | Issuer | Assets Under Management (AUM) | Cumulative Net Inflows | Expense Ratio |

| IBIT | BlackRock | ~$54B+ | ~$37B+ | 0.25% |

| FBTC | Fidelity | ~$36B+ | ~$20B+ | 0.25% |

| BITB | Bitwise | ~$10B+ | ~$5B+ | 0.20% |

| ARKB | Ark/21Shares | ~$8B+ | ~$4B+ | 0.21% |

| GBTC | Grayscale | ~$40B+ | ~$-23B | 1.50% |

Note: AUM and flow figures are estimates based on available data from mid-2024-2025 and may vary. GBTC’s negative flows reflect investors moving to lower-cost ETF alternatives after its conversion from a trust structure.

This table quantifies the ETF “turning point moment.” It shows not only that ETFs were approved, but the absolute scale of capital that flowed into the market. By comparing inflows to new products like IBIT and FBTC with outflows from existing trust GBTC, it tells a story of capital rotation and market preference for more efficient, lower-cost ETF structures provided by TradFi giants.

4.3. Restructuring Payment Rails: Visa and Mastercard

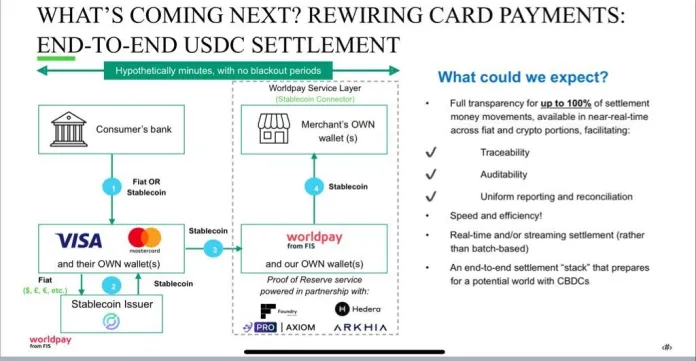

Beyond the investment realm, traditional payment giants are also actively integrating blockchain technology to modernize their payment rails. Rather than being replaced by crypto networks, companies like Visa and Mastercard are adopting the technology to enhance their existing network efficiency.

Visa

Visa has led in exploring stablecoin use cases. The company has expanded stablecoin payment capabilities, partnering with companies like Worldpay and Nuvei to enable USDC payments via high-performance blockchains like Solana. One of their most significant initiatives is a pilot program allowing payment partners to settle their obligations to Visa using USDC via the Ethereum blockchain, significantly reducing the time and complexity of international money transfer transactions. By using public blockchains as auxiliary payment rails, Visa is effectively integrating crypto’s speed and cost efficiency into its vast global network.

Mastercard

Mastercard is also pursuing a similar strategy, enabling stablecoin spending on its network through partnerships with major crypto exchanges and wallets. The company is actively working to integrate various stablecoins and is developing infrastructure, such as the Multi-Token Network, to facilitate seamless tokenized asset transactions.

The involvement of these payment giants shows a significant strategic shift. The original crypto narrative was about “disrupting” or replacing legacy payment networks. However, the ongoing reality is integration. TradFi networks are leveraging public blockchains and stablecoins as a new, more efficient auxiliary payment layer while maintaining their extensive merchant networks and user-facing products. This model is a powerful example of integrated finance at work, combining the best of both worlds to create a faster, cheaper, and more accessible global payment system.

Chapter 5: Integrated Finance – When Boundaries Disappear

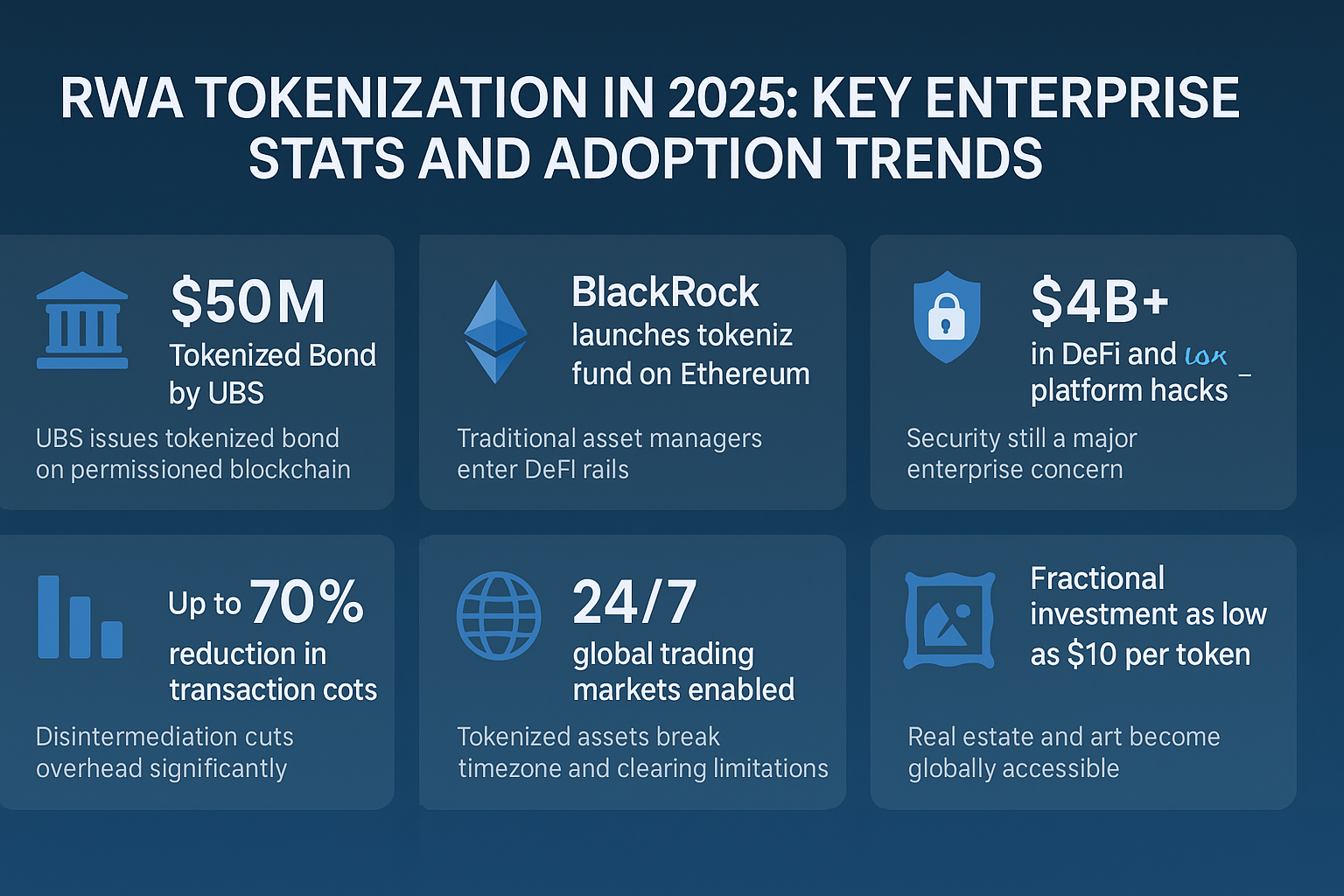

5.1. The RWA Revolution: Bringing Trillions On-Chain

The tokenization of Real-World Assets (RWA) represents one of the most significant frontiers in integrated finance, promising to bring trillions of dollars in value from traditional markets onto blockchain infrastructure. Industry forecasts are optimistic, with organizations like Boston Consulting Group predicting the tokenized RWA market could reach $16 trillion by 2030. Recent data shows significant growth, with the market (excluding stablecoins) growing from approximately $5 billion in 2022 to over $24 billion by mid-2025, led by private credit and treasury bonds.

Several key platforms are leading this space:

RealT: As one of the pioneers, RealT has democratized real estate investment by allowing global investors to buy tokenized ownership shares in US residential properties with as little as $50. Token holders receive rental income and can trade their tokens on secondary markets, bringing liquidity to an inherently illiquid asset class.

Maple Finance: This platform creates on-chain credit markets for uncollateralized loans to crypto institutions. It combines TradFi-style credit underwriting, performed by professional pool delegates, with the transparency and efficiency of blockchain smart contract execution.

Centrifuge: Centrifuge focuses on tokenizing structured credit assets, such as invoices and trade receivables. This allows small and medium businesses to access working capital from DeFi lenders by using their real-world cash flows as collateral, bridging a crucial gap between business finance and DeFi.

5.2. New Financial Plumbing: Scalability and Accessibility

The growth of integrated finance depends on blockchain infrastructure capable of handling high transaction volumes at low costs. Two key development areas are addressing this challenge.

Bitcoin’s Lightning Network: A Layer 2 solution for Bitcoin, the Lightning Network enables near-instant, extremely low-cost micro-transactions. Its adoption is growing significantly. By 2025, the network has approximately 1.5 million users through integrated applications and is processing billions of dollars in annual transaction volume. Payment processors like CoinGate have reported that the proportion of Bitcoin payments made via Lightning has more than doubled in two years, reaching over 16% in Q2 2024. This validates its role as a viable payment rail for daily use.

Ethereum Layer 2 Solutions: The Ethereum ecosystem has witnessed an explosion of Layer 2 (L2) scaling solutions like Arbitrum, Optimism, and Polygon. These networks process transactions off Ethereum’s main chain, then batch and submit them to the main chain, significantly reducing transaction fees and increasing throughput. L2 development is crucial for making DeFi and other decentralized applications accessible to mainstream users. Total value locked on L2 networks has reached tens of billions of dollars, showing significant migration of economic activity from Ethereum mainnet.

5.3. National Responses: Central Bank Digital Currencies (CBDCs)

As private cryptocurrencies and stablecoins gain popularity, central banks worldwide are exploring their own digital versions of national currencies, called Central Bank Digital Currencies (CBDCs). However, progress and approaches vary significantly across jurisdictions.

China’s e-CNY: China leads the world in CBDC deployment. Their digital yuan (e-CNY) pilot program is extensive and in advanced stages. As of mid-2024, cumulative transaction volume exceeded 7.3 trillion yuan (approximately $1 trillion USD), with over 325 million personal wallets opened by Q3 2024. China is actively promoting e-CNY use for cross-border trade, particularly through initiatives like the mBridge project, aiming to create an alternative to the US dollar-dominated payment system.

ECB’s Digital Euro: The European Central Bank (ECB) is taking a more cautious and methodical approach. The digital euro project is currently in a multi-year “preparation” phase (starting November 2023), focusing on finalizing rulebooks, addressing privacy concerns, and stakeholder consultation. A final decision on whether to issue is not expected before late 2025.

Nigeria’s eNaira: Launched in 2021, Nigeria’s eNaira was one of the world’s first CBDCs. However, it has struggled with adoption. Despite government efforts, usage remains very low, with eNaira accounting for less than 1% of total currency in circulation and a large proportion of created wallets remaining unused. This contrasts sharply with Nigerians’ widespread adoption of private cryptocurrencies and stablecoins for inflation hedging and remittances.

Caribbean Pilots (Sand Dollar & DCash): The Bahamas launched Sand Dollar in 2020, achieving modest growth with approximately $1.7 million in circulation and nearly 119,000 wallets by end-2023. The Eastern Caribbean Currency Union’s DCash pilot project, launched in 2021, encountered technical issues and was officially suspended in January 2024 for redevelopment into “DCash 2.0.”

Table 4: Status of Major CBDC Projects (as of 2024/2025)

| Region/Country | Project Name | Status | Key Statistics (Users/Wallets, Transaction Volume) | Notable Challenges/Successes |

| China | e-CNY | Advanced pilot stage | 325M+ wallets; 7.3T+ CNY (~$1T USD) cumulative volume | Successful adoption due to state promotion; being pushed for international trade |

| Eurozone | Digital Euro | Preparation phase | None | Slow, methodical approach focused on regulation and privacy; no issuance decision yet |

| Nigeria | eNaira | Launched | <1% of currency in circulation; high wallet inactivity rate | Very low adoption rate; strong competition from private crypto |

| Bahamas | Sand Dollar | Launched | ~119k wallets; ~$1.7M in circulation | Modest growth; focused on financial inclusion |

| Eastern Caribbean | DCash | Suspended for redevelopment | N/A | Technical issues encountered; being redesigned as “DCash 2.0” |

This table provides a comparative view of CBDC initiatives, showing that while the idea of CBDCs is global, implementation and adoption vary drastically. It highlights the contrast between China’s successful top-down, state-controlled approach, Nigeria’s struggle against a crypto-preferring population, and the EU’s slow, deliberate, regulation-first approach. This comparison provides a nuanced view of the geopolitical and socioeconomic factors influencing the future of digital currencies.

The emergence of comprehensive regulatory frameworks, such as the EU’s Markets in Crypto-Assets (MiCA) regulation, is creating a “regulatory moat.” These regulations, particularly those applying to stablecoin issuers from June 30, 2024, create high compliance barriers but also provide a legal pathway for regulated financial institutions to participate in the space. This could lead to a two-tier system where fully compliant, bank-issued stablecoins exist alongside existing stablecoins. This regulatory advantage will be a key battleground in the integrated financial system, as TradFi institutions may be able to offer products functionally similar to existing stablecoins but with the regulatory backing and approval that institutional and corporate clients demand.

Chapter 6: The Real-World Asset Revolution – When Every Asset Becomes Crypto

Real-world asset (RWA) tokenization is becoming one of the most important shifts in digital finance since Bitcoin. Unlike speculative tokens with no underlying value, RWA tokens are anchored in tangible assets, legal ownership, and cash flows. They deliver real returns through rent, dividends, or interest, making blockchain more than a speculative playground.

The scale of opportunity is extraordinary. Real estate is worth about $320 trillion, equities exceed $100 trillion, global bonds stand at $130 trillion, and commodities add another $20 trillion, with private assets estimated at $13 trillion. Tokenizing even a small fraction of this market would create trillions in on-chain value. Today, the RWA sector remains just $8 billion, a fraction of its potential.

Real estate has taken the lead. Platforms such as RealT allow investors to purchase tokenized shares of U.S. residential properties for as little as $50. More than $10 million has already been tokenized, with over a thousand investors receiving daily rental payments and participating in key ownership decisions. Yields in the range of eight to twelve percent combine steady cash flow with appreciation potential, while global access transforms what was once a local and illiquid asset into a borderless investment. A Vietnamese investor can own a share of a Detroit rental home; a Kenyan farmer can hold part of an office tower in Manhattan.

The luxury segment is also being reshaped. Elevated Returns tokenized the $18 million St. Regis Aspen Resort, lowering the entry point to $130,000 and distributing income proportionally to token holders. While still aimed at wealthier investors, the model demonstrates how tokenization is dismantling traditional barriers to exclusive markets. Commercial property is following suit, with office buildings divided into hundreds of thousands of tokens, offering rent distributions, daily valuations, and instant liquidity that traditional REITs cannot match.

Beyond real estate, tokenization is reaching art and commodities. Masterworks manages more than $800 million in art investments, reporting net annual returns of around nine percent, while platforms like Async Art and NBA Top Shot have shown that digital scarcity itself can create enduring value. In commodities, Paxos Gold (PAXG) represents one troy ounce of LBMA-approved gold, redeemable for physical bars yet tradeable globally around the clock. Coffee, cocoa, and other agricultural products are now being tokenized with supply chain traceability, giving farmers the ability to borrow against their tokenized inventory.

The trend also extends to carbon credits and private markets. Toucan Protocol is addressing the shortcomings of traditional voluntary carbon markets by bringing them on-chain, eliminating double counting and automating ESG compliance. Platforms such as INX are making private equity more accessible, offering SEC-registered security tokens with minimum investments as low as $1,000 and secondary market liquidity in place of decade-long lockups. For small businesses, protocols like Centrifuge tokenize invoices, providing working capital while giving DeFi lenders exposure to real-world revenues.

Insurance is being reimagined through parametric models, where payouts are triggered automatically by objective data. A delayed flight or a failed crop verified by APIs or satellite feeds can be settled instantly, replacing months of claims processing.

Supporting this shift requires robust infrastructure. Regulations are catching up, with frameworks such as SEC Regulation D and S in the U.S. and MiCA in the EU offering clarity and guardrails. Legal hubs like Delaware, Wyoming, Singapore, and Switzerland are competing to attract tokenization businesses. At the same time, custody solutions from Fidelity, State Street, and BNY Mellon provide the security institutions demand, while oracle networks such as Chainlink ensure that smart contracts can rely on accurate and timely real-world data.

Challenges remain. Most RWA tokens fall under securities law, creating compliance hurdles across jurisdictions. Liquidity in secondary markets is still limited, and price discovery mechanisms are only beginning to mature. Technical bottlenecks in scalability and interoperability add further complexity. Yet the trajectory is unmistakable. What began as an experiment is evolving into a structural change in global finance.

Tokenization represents a shift from “crypto for speculation” to “crypto solving real problems.” As infrastructure improves and regulation becomes clearer, growth will accelerate. These are no longer abstract ideas but real assets generating real returns, delivered in programmable form.

Chapter 7: The Future is Happening

Looking back from 2024, the journey from Andre Cronje’s garage experiments to BlackRock’s ETF desks makes one point undeniable: this is not simply a technological shift but a redefinition of money, assets, and financial power.

The change is already visible. The Bitcoin Lightning Network now processes millions of daily transactions with sub-second settlement at negligible cost. Street vendors in San Salvador accept Bitcoin as casually as cash, while freelancers in Manila receive pay from U.S. clients without a bank in sight. This is no longer a test environment; it is adoption unfolding in real time.

The Ethereum Layer 2 ecosystem has also matured. Networks such as Arbitrum, Optimism, and Polygon have reduced transaction costs from nearly fifty dollars to cents, opening the door for smaller investors. A ten-dollar contribution can now enter DeFi pools or NFT markets where once only large players could participate. Access to yield farming, micro-lending, and digital collectibles is no longer the preserve of crypto elites but part of a broader, global market.

Cross-border payments illustrate the scale of the shift. Systems that once took three to five days and cost up to ten percent in fees are being replaced by rails that settle instantly, operate continuously, and charge less than one percent. According to the Bangko Sentral ng Pilipinas, Filipino overseas workers are saving about two billion dollars a year in remittance costs by using crypto instead of Western Union.

At the same time, stablecoin competition is intensifying. China’s digital yuan is positioned as an alternative to U.S. dollar dominance in trade settlements, while the European Central Bank is preparing its digital euro to reduce reliance on American financial infrastructure. The outcome will likely be multipolar, with regional blocs connected by interoperability bridges.

Looking ahead, financial services are shifting toward designs that are global by default and adaptive to users rather than the other way around. Programmable money will allow automation in savings, payments, and compliance. Portfolios will be able to incorporate new asset classes, rebalance around the clock, and open previously exclusive opportunities to a wider base of investors. This evolution, however, demands education, careful adoption, and effective risk management.

The direction is clear. Just as the internet reshaped communication, blockchain is reshaping finance. The question is not whether change will come, but how quickly and in what form. As the technology becomes invisible in the background, outcomes become obvious: cheaper, faster, and more accessible financial services.

We are standing at the edge of a transformation on par with the invention of central banking or the creation of joint-stock companies. This is not an incremental adjustment but a structural shift in how societies organize economic life. Those who recognize and adapt to it will define the next chapter.

History shows that finance always evolves to meet human needs. Blockchain is the latest expression of that cycle, an opening chapter rather than a closing one. What began in a developer’s garage has grown into a trillion-dollar ecosystem and is evolving into a parallel system that may one day rival the structures of traditional banking.

The story is still being written. Technologies change, new players emerge, but the constant remains: the demand for financial systems that are fast, fair, reliable, and global. Integrated finance promises to meet that demand better than ever before. The revolution is not on the horizon; it is already here.

From the merchant fleets of the Dutch East India Company to Ethereum smart contracts, from the British pound to Bitcoin, the story of finance has always been one of reinvention. Each era turns the page to another, and today we are invited to take part in writing the future of money.

A Multi-Dimensional Financial Future

This analysis affirms that a new financial era is emerging from the convergence of DeFi, CeFi, and TradFi. What began with the chaotic experiments of DeFi Summer has evolved into a system shaped by innovation, failures, and the growing involvement of the world’s largest institutions.

Each sector plays a distinct role. DeFi drives innovation with resilient protocols, CeFi provides the bridge for mass adoption despite its flaws, and TradFi contributes scale, regulatory trust, and stability.

The future will not belong to one model alone but to a hybrid system. Navigating it will require balancing decentralization with efficiency, innovation with regulation, and sovereignty with convenience. The path is still unfolding, but the direction is clear: finance is becoming multi-dimensional.