The $46M Hyperliquid Manipulation Attack Explained

Decentralized finance has always carried the reputation of being both full of promise and full of risk. The $46M Hyperliquid Manipulation Attack has become one of the most shocking events in DeFi derivatives. Hyperliquid, once promoted as one of the most ambitious on-chain exchanges, was built to represent the next step in financial evolution. Yet in August 2025 it turned into the stage for a carefully engineered strike. What happened was not the theft of private keys or a smart contract failure, but something more alarming: the platform’s own design flaws allowed attackers to twist the system to their advantage. For traders, funds, and regulators, the incident served as a stark reminder of how fragile even the most prominent DeFi infrastructures remain.

The Defining Moment: 5:35 AM, August 27th, 2025

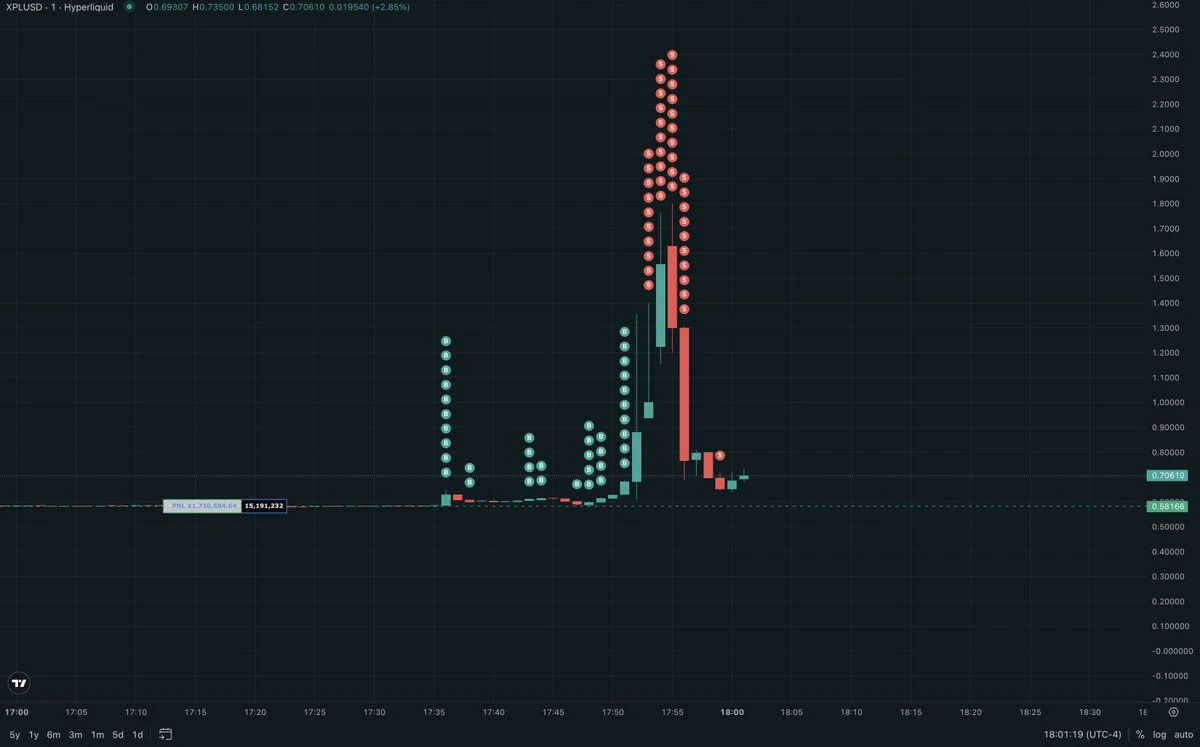

The decisive strike came at 5:35 in the morning Indochina time. In New York, it was just past midnight, the slowest trading hour of the day. In Europe, markets were still asleep. In Asia, activity had yet to peak. Across global time zones, liquidity thinned to its weakest point. Hyperliquid’s order book was exposed, and the attackers knew it. With a single massive order, wallet 0xb9c…6801e pushed the price of XPL from sixty cents to one dollar eighty in less than two minutes.

What appeared, on the surface, to be a sudden surge of demand was in fact a carefully orchestrated maneuver. The trade was not about belief in XPL’s long-term value but about engineering a flash spike that would destabilize the exchange’s liquidation engine. By timing the move to coincide with a global liquidity vacuum, the attackers guaranteed that no arbitrage bots or rival traders could step in quickly enough to counteract the swing. Within moments, the dominoes began to fall: leveraged short positions were liquidated, automated systems amplified the surge, and Hyperliquid’s infrastructure buckled under the weight of its own mechanics.

This was more than a price anomaly. It was a demonstration of how systemic vulnerabilities, when combined with perfect timing, can turn an exchange into an arena for financial destruction. And it raised the question that lingers over DeFi: if trustless code can be twisted so easily, who is left to bear responsibility when millions disappear overnight?

The Main Characters: Four “Silent Operators” And A Perfect Plan

Every heist has its players, and the Hyperliquid attack was no different. Behind the sudden $46 million windfall stood four wallets that worked in silence, moving capital and executing trades with almost mechanical precision. They were not reckless gamblers chasing quick profits, but operators who had studied the system, understood its pressure points, and waited for the perfect moment to strike. Each address carried its own story, and together they formed a network designed to exploit Hyperliquid’s weakest link.

The Mastermind: A Ghost From the Past

At the center of the operation stood wallet 0xb9c…6801e, a figure whose digital trail reached back years. 5 years earlier, this address had transferred ETH to Justin Sun, sparking speculation that the mastermind might be tied to the Tron ecosystem. Whether coincidence or signal, the connection immediately fueled community intrigue. But the wallet’s real significance was not historical, it was strategic. The operator displayed patience and precision, qualities that allowed them to map Hyperliquid’s weaknesses long before striking.

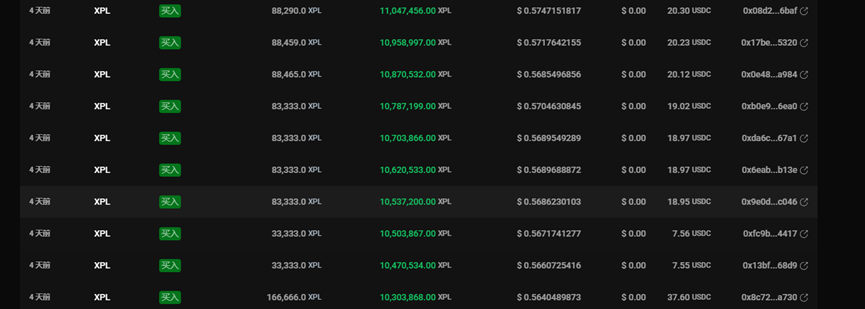

Beginning on August 24th, the address quietly built up XPL long positions through a method known as iceberg orders, where large trades are split into smaller visible portions to avoid disrupting market prices. This was not idle accumulation. It was careful positioning, laying the foundation for a larger attack that would later unfold with surgical timing.

Three Accomplices: The Network Behind the Strike

The mastermind did not act alone. Three additional wallets formed a supporting cast, each with a distinct role in the unfolding scheme.

- 0xe41…858c7 (“silentraven”): A proven trader with a history inside Hyperliquid’s ecosystem. Just months earlier, he had earned more than $10 million on a HYPE long, showing not only experience but also deep familiarity with the platform’s liquidity quirks. Unlike anonymous exploiters, silentraven maintained a visible profile on Debank, reinforcing the sense that this was a serious operator, not a shadowy scammer.

- 0x006…2a78f: Financially intertwined with silentraven, this address shared the same funding source and funneled deposits through Debridge. The repeated overlap suggested more than chance. It pointed to a coordinated partnership, with one address perhaps acting as the financial backbone while the other executed trades.

- 0x894…00779: The most enigmatic of the group, funded directly from Binance. Whether this wallet was simply an opportunist who capitalized on the sudden XPL surge or an undisclosed insider who knew the plan in advance remains unclear. Its participation, however, widened the circle of suspicion, hinting that the operation may have been bigger than just a small clique of traders.

Together, these four addresses formed a silent network. Their coordination was subtle enough to escape immediate notice, yet deliberate enough to deliver one of the most devastating manipulations DeFi has seen.

The Perfect Plan: Exploiting System Vulnerabilities

The attack on Hyperliquid was not the product of chance. It unfolded as a sequence of deliberate steps, each building on the last. The operators moved with the discipline of professionals: first observing, then striking, and finally letting the platform’s own mechanics magnify their impact. What followed exposed how fragile Hyperliquid truly was when tested under pressure.

Phase 1: Studying the Enemy (August 22–26)

In the days before the event, three wallets quietly accumulated XPL positions. But the real purpose was observation. They tracked how orders flowed during quiet trading windows and identified where the platform was most exposed. What they found was alarming:

- The pre-market relied on a single price feed.

- Trading activity dropped to near silence in the early morning.

- No safeguards existed to slow sharp price swings.

- The liquidation system triggered automatically with no buffer.

By the time their surveillance was complete, the attackers knew exactly when to move and how the system would respond.

Phase 2: The Decisive Moment (5:35 AM, August 27th)

The strike came at the weakest point of the global cycle. It was midnight in the U.S., dawn in Asia, and Europe still asleep. Order books were shallow, and almost no arbitrage traders were active.

At 5:35 AM, wallet 0xb9c…6801e placed a massive buy order. The goal was never investment, it was a shock. Within a single minute, XPL leapt from $0.60 to $1.80. The mechanics were simple: with so few sell orders on the book, the trade consumed everything in sight, dragging the market higher in one violent move. Hyperliquid had no circuit breaker, no external reference price, and no way to resist the surge.

Phase 3: The Domino Disaster and “Perfect Storm”

Once the spike hit, Hyperliquid’s own design did the rest.

- Liquidation Cascade: Short positions collapsed one after another. Each liquidation forced new market buys, compounding the upward drive until prices spiraled out of control.

- Trader Shock: By the time many users woke up, their balances had already been erased. Few could process what had happened, and none had time to intervene.

- System Strain: Thousands of automated liquidations flooded the platform at once, overwhelming its capacity and causing severe slippage.

What began as a single engineered move had snowballed into a chain reaction. The attackers didn’t just exploit Hyperliquid; they let the platform destroy itself.

Analyzing Hyperliquid’s Responsibility: When “Decentralization” Becomes A Shield

The August 27th attack not only exposed the sophistication of the perpetrators, it also cast a harsh light on Hyperliquid itself. For a platform that marketed speed, fairness, and decentralization, the incident revealed just how fragile its foundations were. The central question is whether decentralization was truly a guiding principle, or simply a shield to avoid answering for design flaws.

Fundamental Design Flaw: A Single Point of Failure

Unlike Binance or OKEx, which aggregate prices from more than ten external venues, or dYdX, which uses circuit breakers to pause extreme volatility, Hyperliquid relied entirely on its own mark price. GMX, meanwhile, anchored its system to Chainlink’s multi-source oracles. Hyperliquid stood alone in leaving its pricing mechanism so exposed.

This weakness was visible from the beginning. Sources close to the project suggest Jeff, the founder, was aware of the risk but chose not to prioritize a fix, leaving the platform vulnerable when liquidity was thin.

A Pattern of Deflection

Previous episodes such as the JELLY collapse and the HLP incident followed a familiar script. Instead of addressing structural problems, the team attributed losses to “market volatility” or “whale activity.” In his essay Explaining the Decentralized Nature of Hyperliquid’s Margin Mechanism, Jeff described these risks as natural features of open markets. In reality, what traders faced was not a law of decentralization but the product of design decisions that offered no margin for protection.

Conflicts of Interest: Gains From Volatility

The structure of Hyperliquid also raises questions about incentives.

- Fee Revenue surged as the liquidation cascade unfolded, generating income at the exact moment users were losing millions.

- The HLP Pool could profit when traders were forced out of positions, undermining perceptions of neutrality.

- Publicity from dramatic events often attracts new users chasing quick profits, even as others leave scarred.

Rather than suffering from turbulence, Hyperliquid seemed positioned to benefit from it. By presenting flaws as the unavoidable cost of decentralization, the platform sidestepped liability while continuing to profit from the chaos.

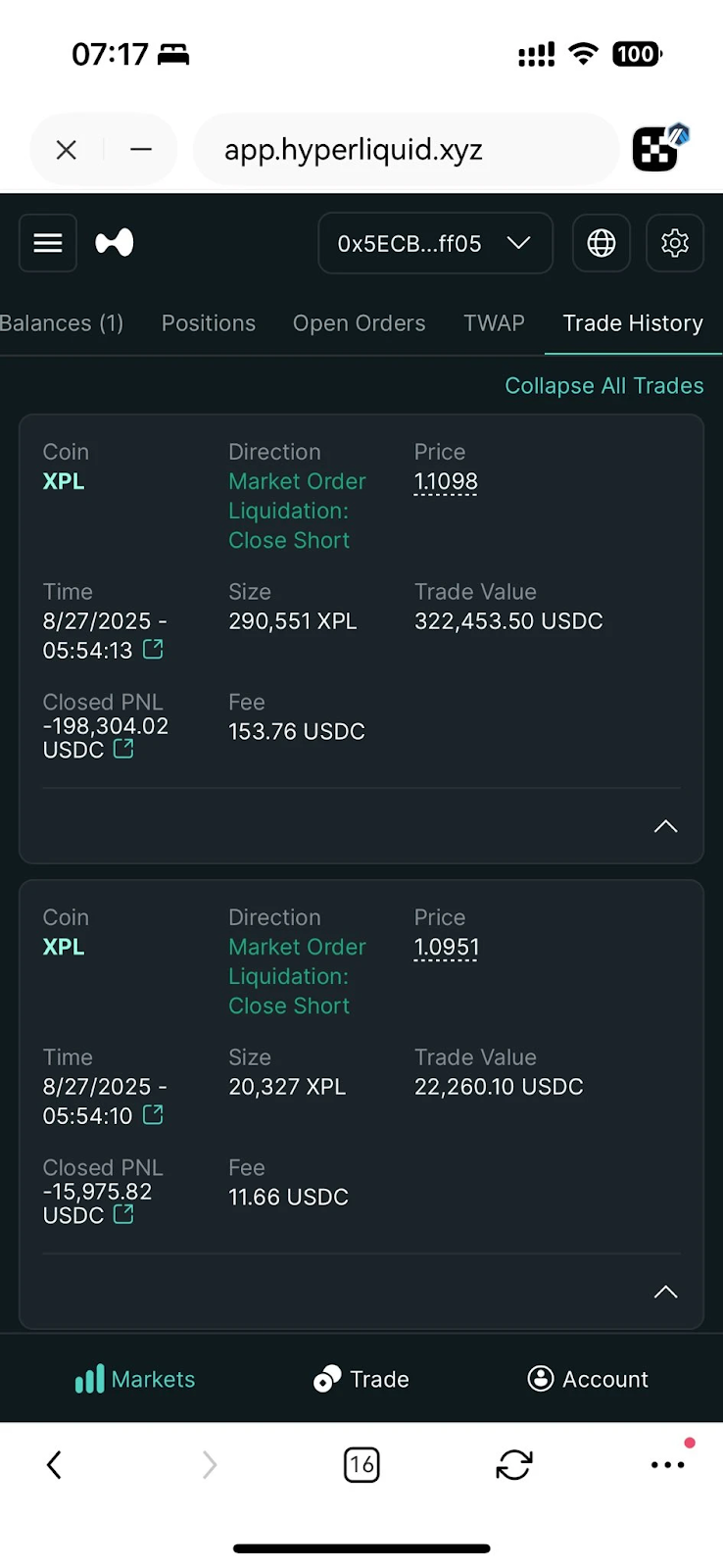

The Victims: The Human Stories Behind The Numbers

Every financial collapse has a human side, and the Hyperliquid attack was no exception. Behind the charts and liquidation data were traders and funds who believed they had prepared for the worst, only to discover that no amount of discipline could withstand the platform’s flaws. The damage was not only measured in millions of dollars lost, but also in broken trust and shaken confidence among both individuals and institutions.

CBB’s Heartbreaking Story: When Experience Isn’t Enough

CBB was far from a novice. He once launched the “Open Whale Hunting Campaign,” proving his awareness of manipulation tactics. When hedging his XPL position, he did everything that should have kept him safe: 1x leverage, a wide margin buffer, and only 10% exposure of his portfolio. Yet none of those safeguards mattered once Hyperliquid’s mechanics collapsed. “I thought I was being smart,” he admitted, “but ended up losing $2.5 million.”

The Tragedy of Aoke Quant Captain Oak

Even professional firms were not spared. A quant fund connected to Captain Oak lost $2 million despite having a team dedicated to risk controls. The fact that seasoned quants were blindsided showed the core issue was not poor trading judgment but the design of the exchange itself.

0xC2Cb: When Wealth Management Becomes a Nightmare

Wallet 0xC2Cb reported losses of $4.59 million. Analysts believe it may have been a family office or large fund, which means the loss was not just one entity’s misfortune, it could have represented the pooled savings of dozens or even hundreds of clients. For those investors, trust in both their managers and in DeFi as a whole may be difficult to rebuild.

The stories of CBB, Oak, and 0xC2Cb revealed a sobering reality: careful hedging, professional oversight, and diversified risk meant little when the very system hosting their trades was unstable.

Technical Analysis: Exploitable Vulnerabilities

What happened to CBB, Captain Oak’s fund, and 0xC2Cb was the consequence of flaws that any determined operator could study and exploit. Three vulnerabilities in particular made the platform uniquely fragile.

Vulnerability 1: Oracle Manipulation

Hyperliquid’s pre-market pricing relied solely on its internal mark price, derived from either the last trade or the midpoint between bids and asks. In periods of thin liquidity, this left prices dangerously exposed. The attackers slowly accumulated long positions, then executed a large buy order to sweep the wall. That single move shifted the mark price dramatically and triggered a chain of liquidations. Analysts later estimated:

- With only $10–20 million, an operator could manipulate assets worth $100–200 million under similar market conditions.

Vulnerability 2: Liquidation Engine

The liquidation mechanism amplified the damage. Positions were closed the moment margin requirements fell short, with no grace period for traders to add collateral. Because liquidation levels were tied to the manipulated mark price, attackers could predict exactly when and where shorts would collapse. Once triggered, the system itself did the heavy lifting by liquidating positions en masse and creating new buying pressure.

Vulnerability 3: Pre-Market Isolation

Hyperliquid’s pre-market existed in isolation, cut off from external exchanges. Without arbitrage to restore balance, prices could remain distorted for minutes—an eternity in crypto markets. MEV bots were deterred by high gas costs and latency, while retail traders had no chance to respond. This meant:

- Tokens listed only on Hyperliquid were prime targets.

- Time zone gaps, especially U.S. midnights and Asian mornings, offered the best windows for attack.

Comparison With Other Exchanges: Why Hyperliquid Is Vulnerable

To understand how Hyperliquid was exposed, it helps to compare its design with other leading derivatives platforms.

| Exchange | Oracle System | Risk Controls | Liquidation Protection | Track Record |

| Binance Futures | Multi-source pricing from 15+ exchanges | Circuit breakers halt trading >20% volatility | Liquidation + insurance funds worth billions | No successful manipulation since 2018 |

| dYdX V4 | Decentralized oracle from multiple feeds | Community governance sets risk parameters | Progressive liquidation, cross-margin | Learned from early failures, system upgraded |

| GMX | Chainlink with 7+ external price feeds | Liquidity pool model (no order book exposure) | Oracle-based liquidation, stable design | No major manipulation events |

| Hyperliquid | Internal mark price only, from its own order book | No circuit breakers, fully automated liquidations | No insurance fund, no buffer | Multiple incidents (JELLY, HLP, XPL attack) |

Long-term Impact: When Trust Is Damaged

Regulatory Implications

The scale of the attack makes regulatory scrutiny inevitable:

- United States (SEC/CFTC): Hyperliquid may be treated as an unregistered derivatives exchange.

- European Union (MiCA): Rules could block EU citizens from trading on the platform.

- Asia (Singapore, Hong Kong): Authorities may demand licensing or impose outright restrictions.

Competitive Landscape

The incident reshapes user trust across the derivatives sector.

- Winners: Platforms like dYdX and GMX stand to gain users seeking stronger protections, while centralized players such as Binance and Bybit will be favored for reliability.

- Losers: Hyperliquid’s ecosystem tokens and protocols that depend on its infrastructure are likely to suffer. The broader DeFi derivatives market may also lose credibility in the short term.

Technical Evolution

For Hyperliquid to recover, major changes would be unavoidable:

- A redesigned oracle system that incorporates multiple price feeds.

- Circuit breakers or volatility controls to prevent runaway liquidations.

- Progressive liquidation mechanisms and a dedicated insurance fund.

- Greater transparency about risk parameters through community governance.

The challenge will be balancing decentralization with user safety. If Hyperliquid fails to adapt, the incident may become a turning point where the market decides that innovation without safeguards is no longer acceptable.

Arthur Hayes: From Critic to Fanboy

Arthur Hayes, former CEO of BitMEX and a long-time authority on derivatives trading, was once one of Hyperliquid’s loudest critics. He described the exchange as “pretending to be decentralized” and suggested its token HYPE would collapse back to its starting price. Only months later, he struck a very different tone, presenting himself as a supporter and even predicting that HYPE could rise by 126 times.

A Psychological Reading

The reversal may reflect strategy rather than inconsistency. Hayes could be positioning himself ahead of a market narrative he expects to gain traction: that Hyperliquid, despite its flaws, might still emerge as a winner. Endorsing the token early allows him to benefit if confidence builds. At the same time, his earlier criticisms serve to distance him from regulatory scrutiny, creating a form of reputational hedge.

In this sense, his conflicting statements are less contradiction than calculation. They reveal how experienced traders manage both perception and profit in a volatile space. More broadly, Hayes’s pivot underscores a truth that runs through crypto markets: once sentiment shifts, narratives often outweigh fundamentals.

The Outcome: Winners, Losers, and Telling Numbers

By the end of the attack, four wallets had secured a combined profit of $46 million. It was an extraordinary windfall, the kind of gain that in traditional finance might take years of careful investment. To put it in perspective, the haul was enough to purchase over a hundred luxury apartments in Ho Chi Minh City, fifteen Lamborghini supercars, or fund a mid-sized tech company for two years.

Profit Distribution

| Wallet | Estimated Profit | Notes |

| 0xb9c…6801e | ~$20 million | The central operator |

| 0xe41…858c7 | ~$15 million | Known as “silentraven” |

| 0x006…2a78f | ~$8 million | Financial partner |

| 0x894…00779 | ~$3 million | Independent participant |

| Total | $46 million |

Ripple Effects Across the Market

The profits alone would have been enough to make headlines, but the aftershocks reached much further. WLFI, a related token, suddenly climbed to $0.42 in what looked like pure FOMO. Even more striking, Hyperliquid’s own token, HYPE, touched $50 and briefly pushed its capitalization above $15 billion.

The contradiction was hard to ignore. A platform exposed as deeply flawed was, at the same time, rewarded by markets with record valuations. It was a reminder that in crypto, sentiment and narrative can often outweigh fundamentals, at least in the short run.

Lessons and the Future: The Big Questions

What happened on Hyperliquid is more than a story of lost capital. It forces the industry to confront unresolved questions about responsibility, regulation, and design. In traditional markets, exchanges are expected to maintain insurance funds, apply risk controls, and protect investors from sudden shocks. DeFi, by contrast, often leaves users to carry the full burden of risk. Whether this is a mark of freedom or a sign of negligence has now become a central debate.

Accountability also lingers in the background. A platform that profits from liquidations cannot easily claim neutrality, and if decentralization is invoked only when things go wrong, it risks sounding more like a defense mechanism than a guiding principle. Regulators will inevitably take notice, but they face a dilemma: too much intervention could stifle innovation, too little could leave traders vulnerable to structural fragility.

The technical remedies are already well known. Multi-source oracles, circuit breakers, progressive liquidation systems, and insurance pools have all been tested elsewhere. The challenge lies not in invention but in willingness to adopt them, knowing they bring extra costs, operational complexity, and sometimes a less seamless trading experience. Beneath the technical debate lies a deeper philosophical one: does “code is law” absolve developers of responsibility, or must they carry an ethical duty to protect users from foreseeable harm? Are crashes like this a kind of natural selection that makes markets stronger, or do they simply undermine trust and keep DeFi on the margins?

Epilogue: $46 Million and Hard Lessons

The Hyperliquid attack was never just about $46 million changing hands. It was about what happens when innovation runs ahead of safeguards. Trust was shaken when a supposedly advanced exchange collapsed under pressure. Innovation turned into recklessness when basic protections were ignored. Responsibility remained absent as users bore heavy losses while the platform collected fees.

For victims like CBB, who swore never to enter an isolated pre-market again, the incident has left scars that go beyond money. For the broader industry, the lesson is sharper still. DeFi cannot expect mainstream acceptance while episodes like this continue to resemble a lawless frontier rather than a financial system. Hyperliquid may recover if it embraces reform, but if denial and deflection persist as Arthur Hayes’s early warning that HYPE would eventually sink back to its starting point, could yet prove accurate.

What is certain is that the memory of those losses will not fade. In DeFi, code may define the rules, but the burden of responsibility will always remain human.