Public Companies Hit 1 Million Bitcoin Holdings

Key Takeaways

• Public companies now hold over 1 million Bitcoin (1,000,698 BTC), worth approximately $111 billion

• MicroStrategy leads with 636,505 BTC, followed by MARA Holdings with 52,477 BTC

• Corporate Bitcoin adoption spans globally across 184 listed companies

• This represents 5.1% of Bitcoin’s total supply, contributing to supply-side pressure

• New entrants are rapidly scaling their Bitcoin treasury strategies

Historic Milestone Achieved

Corporate Bitcoin treasury adoption has reached a significant milestone, with public companies collectively holding over 1 million Bitcoin. According to BitcoinTreasuries.NET, the exact figure stands at 1,000,698 Bitcoin, representing a combined value exceeding $111 billion.

This achievement reflects the growing trend of corporations adopting Bitcoin as a treasury asset, a movement that began gaining momentum when MicroStrategy implemented its Bitcoin strategy in August 2020.

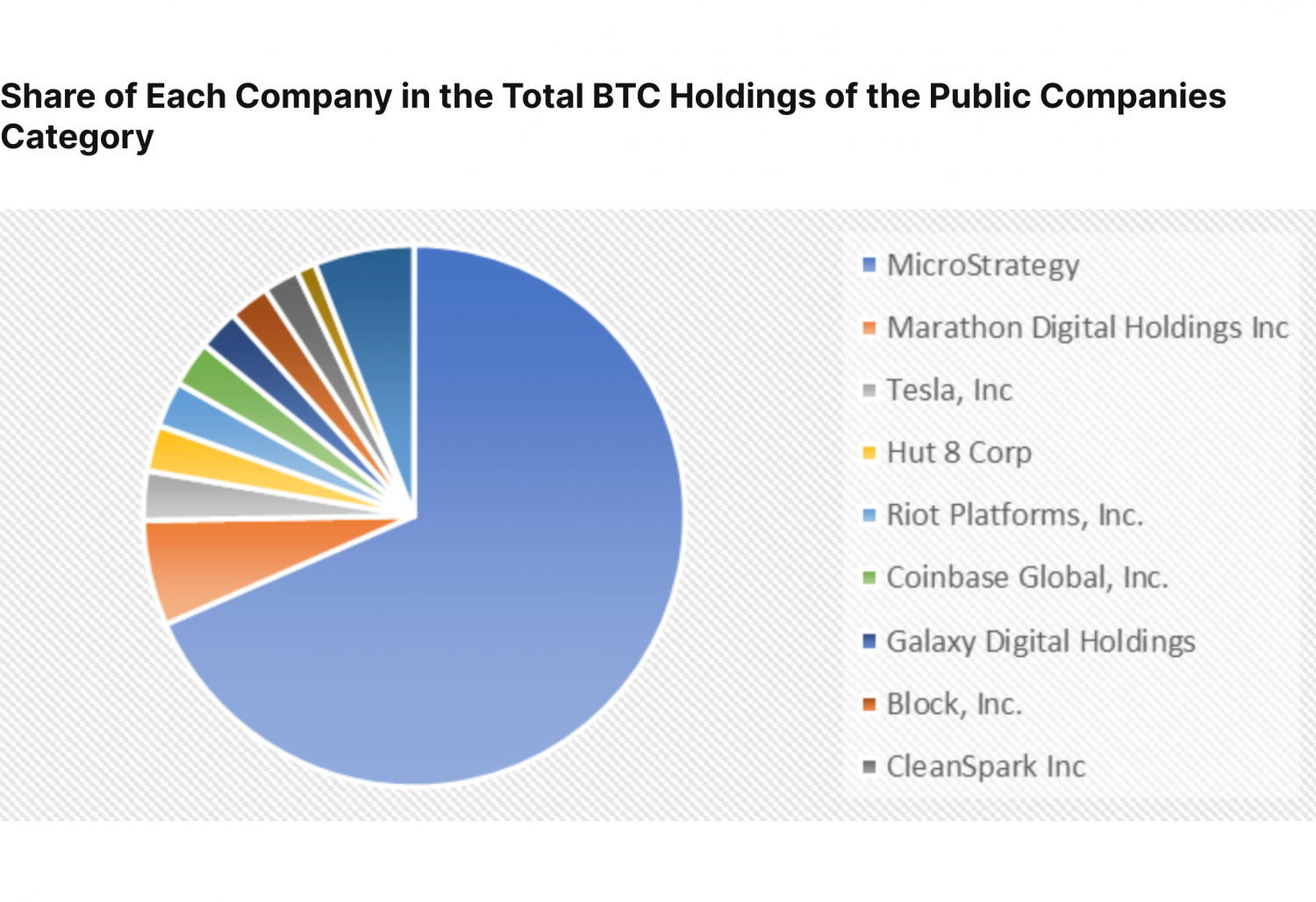

Market Leaders and Holdings

MicroStrategy maintains its position as the dominant corporate Bitcoin holder with 636,505 BTC. The company’s early adoption and aggressive accumulation strategy established it as the pioneer in corporate Bitcoin treasury management.

MARA Holdings holds the second position with 52,477 BTC, maintaining steady growth through its mining operations, including 705 BTC mined in August alone.

Emerging players are rapidly expanding their positions:

- Strike (XXI): 43,514 BTC

- Bitcoin Standard Treasury Company: 30,021 BTC

- Bullish (crypto exchange): 24,000 BTC

- Metaplanet: 20,000 BTC

Additional significant holders include Riot Platforms, Trump Media & Technology Group Corp, CleanSpark, and Coinbase, completing the top 10 corporate Bitcoin holders.

Market Impact and Price Dynamics

The accelerated Bitcoin purchasing by public companies and exchange-traded funds has created substantial demand pressure in the current market cycle. This institutional demand is widely recognized as a primary driver behind Bitcoin’s price rally to its all-time high of $124,450.

With only 5.2% of Bitcoin’s fixed supply remaining to enter circulation, continued corporate adoption could intensify supply-side constraints, potentially driving further price appreciation.

Future Accumulation Plans

Several companies have announced ambitious Bitcoin accumulation targets:

- Metaplanet aims to reach 210,000 BTC by end of 2027

- Semler Scientific targets 105,000 BTC by end of 2027

These targets represent significant expansions from their current holdings, with some companies planning to increase their Bitcoin positions by 10-20 times their current levels.

Resilience Through Market Cycles

Corporate Bitcoin strategies faced significant challenges during the 2022 bear market, when Bitcoin declined to $15,740 following the FTX collapse. While Bitcoin miners sold 58,770 BTC during this period, up from 3,500 the previous year, companies like MicroStrategy maintained their conviction.

MicroStrategy’s CEO demonstrated unwavering commitment, stating willingness to hold Bitcoin even to zero value, despite criticism from traditional financial media questioning the sustainability of the strategy.

The company’s successful navigation through the bear market has inspired a second wave of corporate adoption, with new entrants like Metaplanet and Semler Scientific citing Bitcoin’s transformative potential for their businesses.

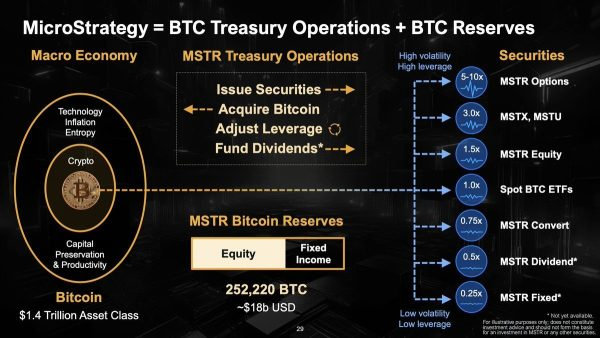

Financial Mechanisms and Strategy

Corporate Bitcoin accumulation strategies employ various sophisticated financial instruments:

- Equity offerings to fund Bitcoin purchases

- Debt financing through senior convertible notes

- Bitcoin-per-share value creation for shareholders

Special Purpose Acquisition Companies (SPACs) have emerged as an alternative route for Bitcoin treasury strategies, offering investors faster and more flexible Bitcoin exposure compared to traditional initial public offerings.

Global Distribution

Corporate Bitcoin adoption demonstrates significant international reach:

- 64 companies based in the United States

- 34 companies in Canada

- 11 companies in the UK and Hong Kong

- Additional presence in Mexico, South Africa, and Bahrain

This geographic distribution indicates the global nature of corporate Bitcoin adoption trends.

Comparative Holdings Analysis

While public companies represent a significant Bitcoin holder category, they are not the largest:

- Crypto exchanges and ETF issuers: 1.62 million BTC

- Public companies: 1.00 million BTC

- Governments: 526,363 BTC

- Private companies: 295,015 BTC

- Crypto protocols: 242,866 BTC

- Individual holders: 16.2 million BTC

This distribution shows that individual investors still control the majority of Bitcoin supply, while institutional adoption continues to grow across multiple sectors.