Trump-Linked WLFI Accused of Freezing Investor Funds

Key Takeaways:

- WLFI accused of freezing tokens from early investors and high-profile figures

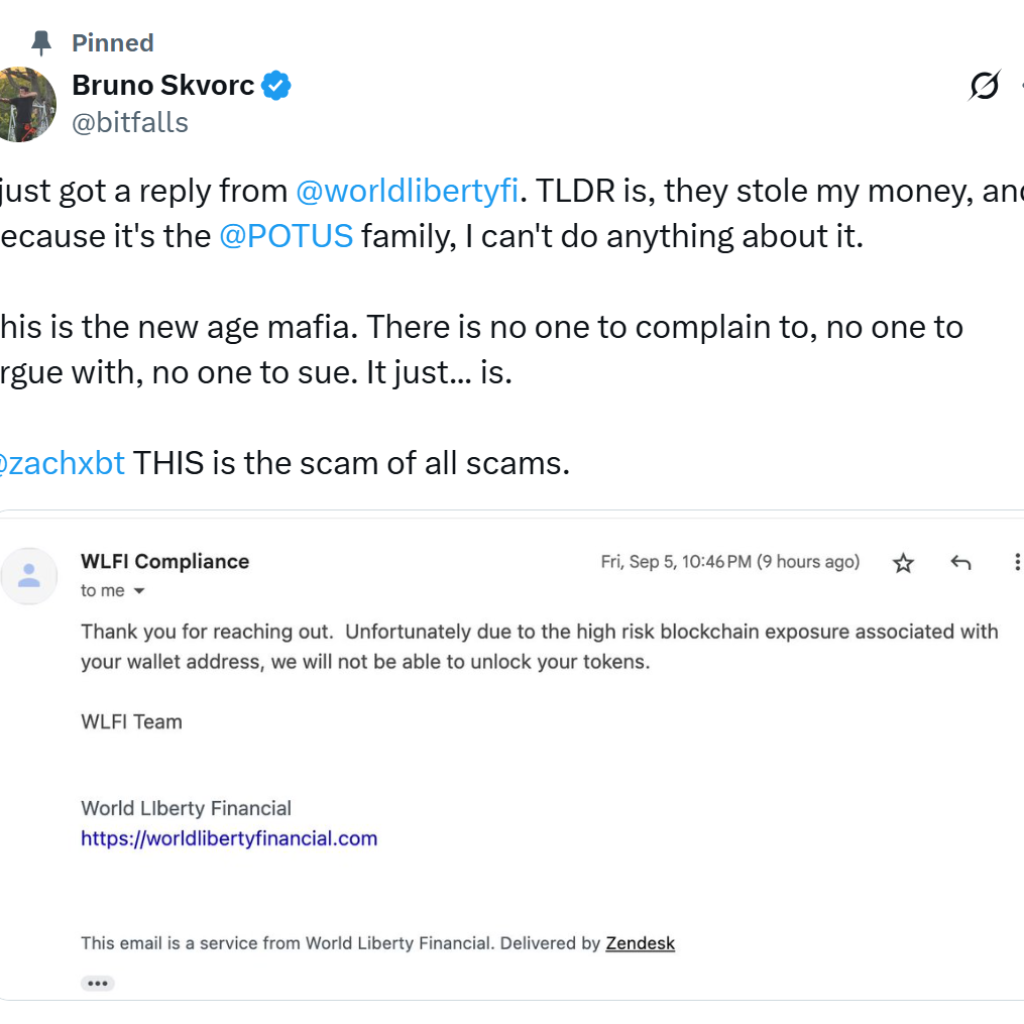

- Polygon DevRel Bruno Skvorc brands the project “the new age mafia”

- ZachXBT criticizes reliance on flawed compliance flagging tools

- Tron founder Justin Sun also sees $9M in WLFI tokens frozen

Developer Cries Foul: “The New Age Mafia”

The crypto community is reeling after explosive claims that World Liberty Financial (WLFI), the Trump-linked token project, is locking investors out of their own money.

Bruno Skvorc, a well-known blockchain developer from Croatia who previously contributed to Ethereum 2.0 and now leads RMRK, went public with a damning accusation: WLFI stole his money. His revelation came after receiving an email from WLFI’s compliance team informing him that his wallet had been flagged as “high risk” and that his tokens would not be released.

Skvorc took to X to vent his outrage, writing: “TLDR is, they stole my money. And because it’s the @POTUS family, I can’t do anything about it. This is the new age mafia.” He emphasized the hypocrisy of the situation, noting that WLFI had no problem accepting money into his wallet, but when the time came to unlock his tokens, they cited compliance risks as justification for refusal.

He further revealed that he is not alone. According to Skvorc, six investors in total faced 100% lockups from the beginning. His case underscores how compliance rules can be weaponized against users in projects that operate without transparent legal recourse.

The controversy quickly drew the attention of crypto watchdogs and influencers. Onchain sleuth ZachXBT explained that compliance tools often cast a net so wide that they generate false positives. Wallets can be flagged for distant or trivial exposure to sanctioned addresses. Skvorc’s address, for example, was tied to old Tornado Cash interactions and indirect links with sanctioned exchanges Garantex and Netex24.

This sparked renewed debate over the reliability of compliance technology in crypto, especially when its outputs can determine whether investors can access millions in tokens.

Justin Sun’s $9M WLFI Tokens Frozen

The uproar intensified when Justin Sun, founder of Tron and a high-profile crypto entrepreneur, disclosed that his WLFI allocation had also been frozen. His wallet was blacklisted after blockchain trackers flagged a $9 million transfer.

Sun called the freeze “unreasonable” and warned that WLFI’s decision went against blockchain’s fundamental values. He stressed that tokens should be “sacred and inviolable,” arguing that selective blacklisting undermines investor trust and the entire ethos of decentralization.

For WLFI, the stakes could not be higher. Already facing skepticism over its Trump ties, the project now stands accused of exploiting compliance tools to consolidate power and silence investors. What was supposed to be a bold experiment in tokenization has instead ignited accusations of fraud and censorship.

The fallout has spread quickly across the crypto space, fueling speculation about whether WLFI can survive mounting backlash. Investors and analysts alike are watching to see whether regulators will intervene, or whether WLFI will continue to operate beyond the reach of traditional accountability.

At the center of the storm, both Skvorc and Sun have become rallying figures for critics who argue that WLFI represents the dangers of centralized control in a supposedly decentralized ecosystem. The project may claim to be future-facing, but its heavy-handed tactics have drawn comparisons not to innovation, but to an authoritarian clampdown.