Tether Refutes Bitcoin Sell-Off Claims, Confirms Ongoing BTC, Gold, and Land Investments

Tether CEO Paolo Ardoino has pushed back against speculation that the stablecoin issuer has been liquidating its Bitcoin holdings to buy gold.

In a Sunday post on X, Ardoino stressed that Tether “didn’t sell any Bitcoin” and reiterated the firm’s long-term strategy of reinvesting profits into assets such as Bitcoin, gold, and land.

Rumors Sparked by Attestation Data

The rumors began after YouTuber Clive Thompson cited Tether’s Q1 and Q2 2025 attestations from BDO, suggesting the company’s BTC stash dropped from 92,650 BTC in Q1 to 83,274 BTC in Q2.

However, Jan3 CEO Samson Mow clarified that the reduction wasn’t a sell-off. Instead, Tether had shifted 19,800 BTC to Twenty One Capital (XXI), a new Bitcoin-focused financial venture led by Strike’s Jack Mallers. Transfers included 14,000 BTC in June and 5,800 BTC in July.

$3.9 Billion in BTC Moved to XXI

In total, Tether transferred more than 37,000 BTC — roughly $3.9 billion worth — to back XXI earlier this year. Mow explained that, if these transfers are taken into account, Tether’s overall holdings actually increased by 4,624 BTC compared to the end of Q1.

Ardoino confirmed the reasoning, stating the Bitcoin was simply moved, not sold: “While the world continues to get darker, Tether will continue to invest part of its profits into safe assets.”

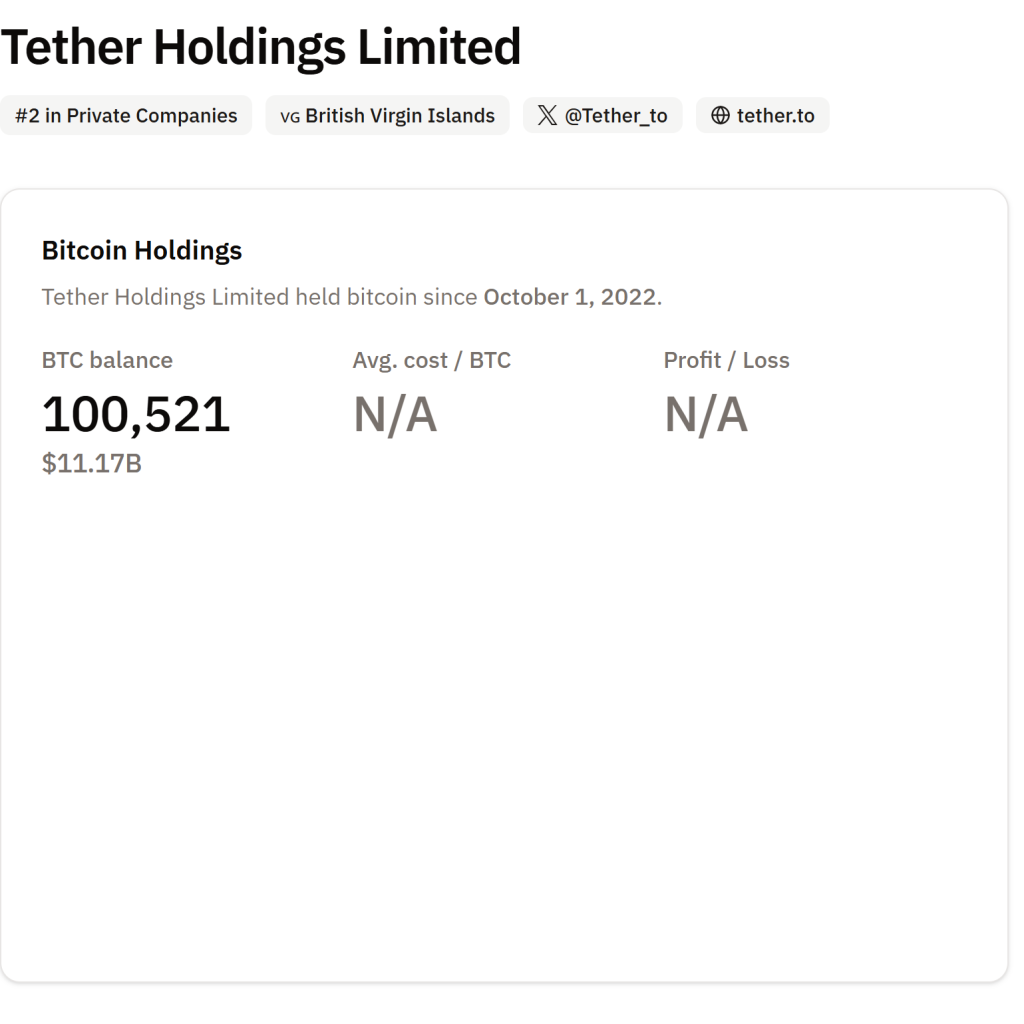

As of now, Tether, issuer of the USDt stablecoin, holds more than 100,521 BTC valued at around $11.17 billion, according to BitcoinTreasuries.NET.

El Salvador Diversifies with Gold

Meanwhile, El Salvador revealed its first gold purchase in over three decades, adding 13,999 troy ounces worth $50 million to its reserves. The country’s central bank said the move was part of a broader diversification strategy to reduce reliance on the U.S. dollar.

Before acquiring gold, El Salvador had already built a $700 million Bitcoin reserve consisting of 6,292 BTC. However, the IMF reported in July that the nation hasn’t made additional Bitcoin purchases since February.