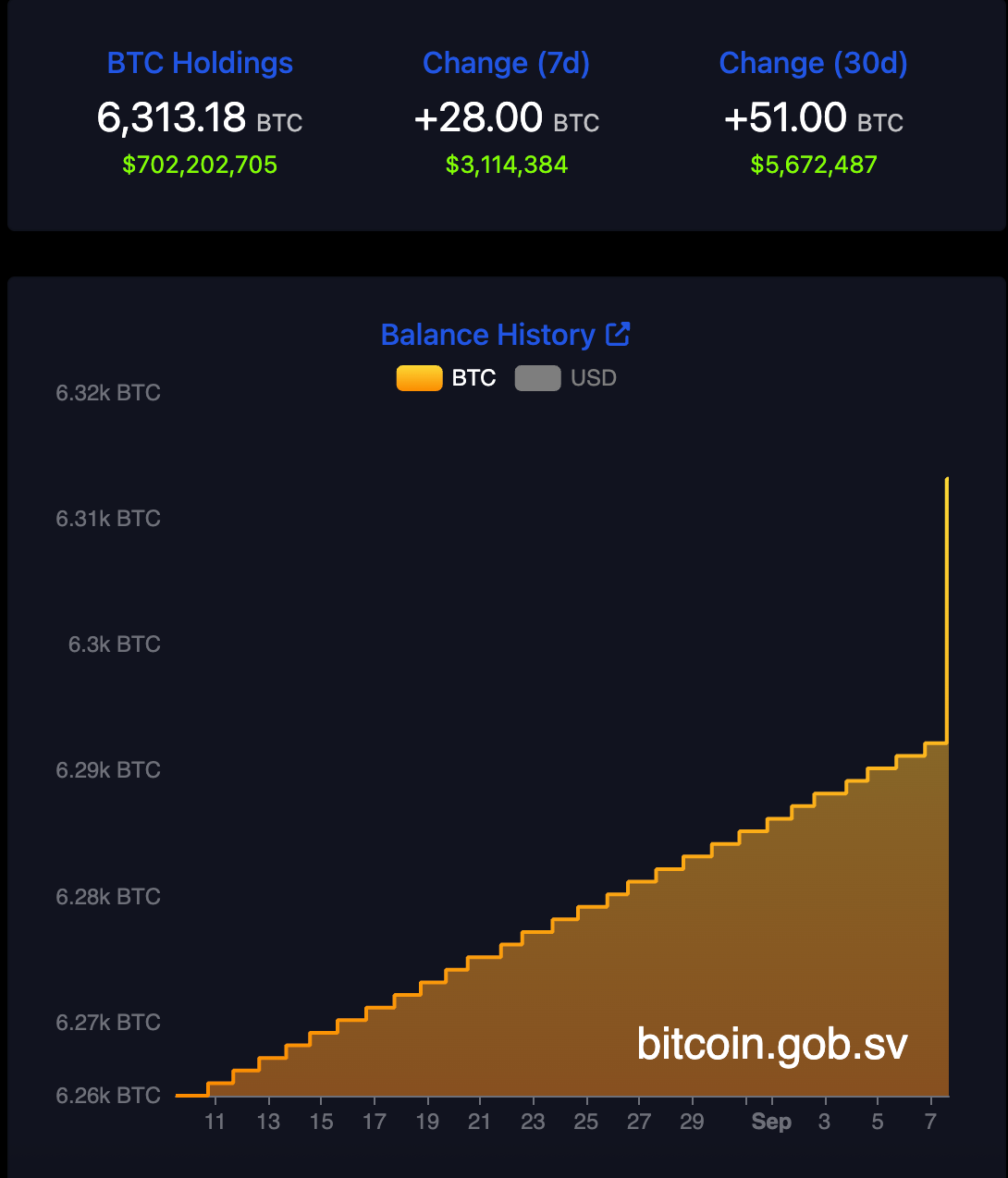

El Salvador Celebrates Bitcoin Day: 6,313 BTC Reserve

El Salvador marks four years since adopting Bitcoin as legal tender, celebrating a 6,313 BTC strategic reserve and education programs. Yet an IMF loan deal forced rollbacks—halting new BTC buys and scaling back public support—leaving mixed results on the ground.

- New banking law permits Bitcoin investment banks for sophisticated investors.

- Over 80,000 public servants certified in Bitcoin; public Bitcoin + AI education programs launched.

- January IMF loan deal led to repeal of legal-tender law and a pledge not to buy more BTC with public funds.

- Chivo wallet support was pared back after low resident adoption.

- IMF report (July) confirmed no new BTC purchases since Dec 2024; officials signed letter of intent confirming unchanged BTC balance.

- Critics say benefits favor state and investors, not average citizens; NGOs push for deeper grassroots education.

El Salvador’s Bitcoin Office marked the anniversary by highlighting milestones: a strategic reserve now holding 6,313 BTC, a banking law enabling BTC investment banks for sophisticated clients, and a series of government-backed Bitcoin and AI education programs that have certified tens of thousands of public servants. The government frames these steps as building national expertise and a strategic reserve to support financial innovation.

But the country’s experiment has also faced a retreat. As part of a $1.4 billion IMF loan agreement, lawmakers repealed the legal-tender status and agreed not to make further Bitcoin purchases with public funds. The IMF’s July report confirmed the government hasn’t added to its BTC balance since December 2024, and officials provided a signed letter of intent to that effect. The Chivo wallet—once central to adoption efforts—saw limited uptake and has received reduced support.

The result is a split verdict. Supporters point to the reserve, regulatory changes, and education initiatives as proof that the state can steward digital-asset infrastructure. Critics and many NGOs counter that real, everyday adoption remains limited: they argue the programs have benefited government visibility and corporate partners more than ordinary Salvadorans, and that broader, grassroots education and usability improvements are still needed to make Bitcoin genuinely useful for local people.

Final Thought

El Salvador’s four-year Bitcoin experiment is historic and instructive—its national reserve and education push are notable, but the IMF-driven pullback and uneven citizen adoption mean the long-term verdict is still up for debate.