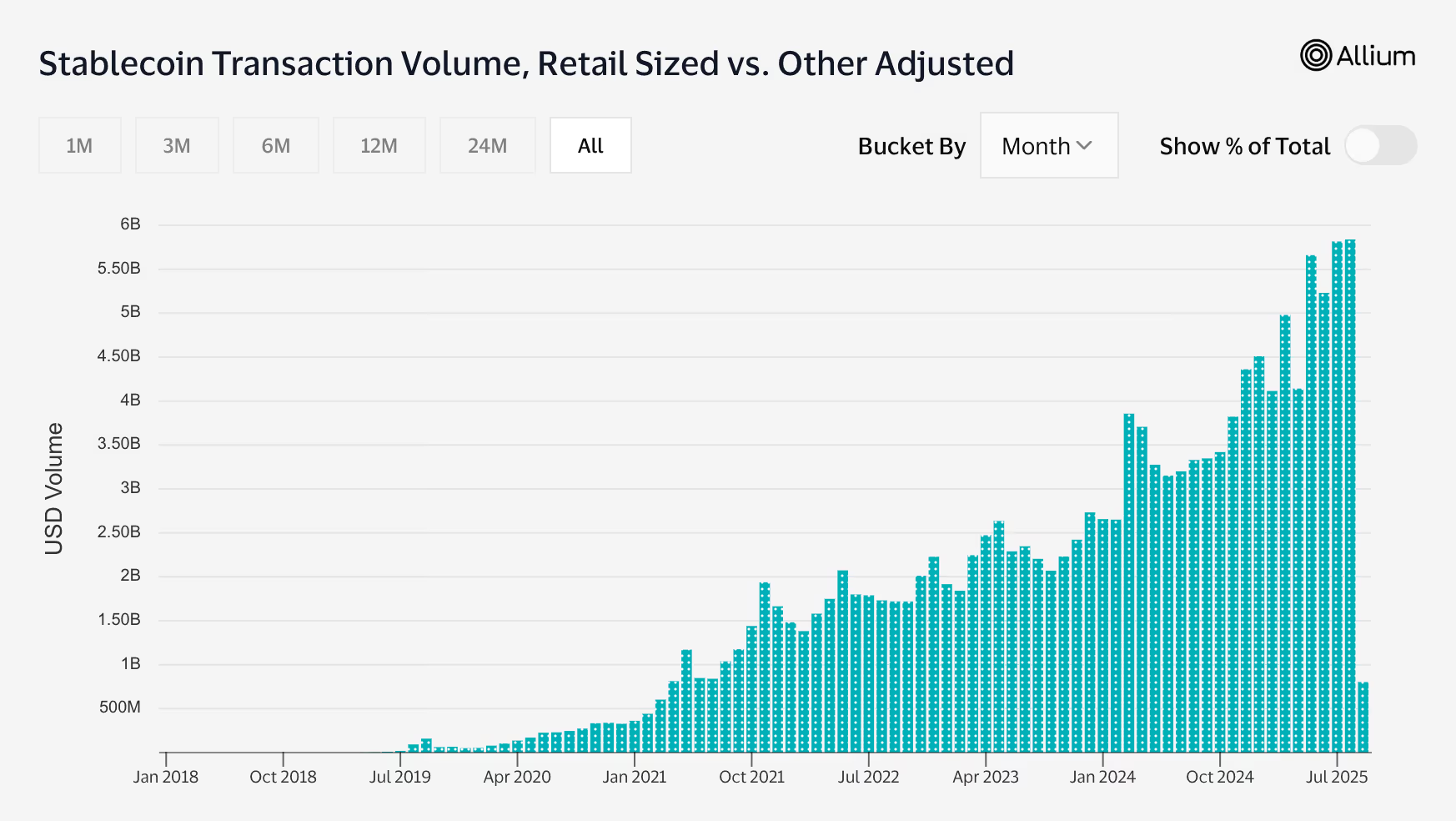

Retail Stablecoin Transfers Reach Record $5.84B in August – Outpace 2024 Totals

Stablecoin adoption at the retail level is surging, with transfers under $250 hitting an all-time high of $5.84 billion in August 2025. A fresh report by CEX.io highlights a major shift in network preferences, as Binance Smart Chain and Ethereum gain share while Tron slips.

- Stablecoins are increasingly used in emerging markets (Nigeria, India, Bangladesh, Pakistan, Indonesia) to avoid high banking fees and delays

- 70% of surveyed users report using stablecoins more frequently than last year; 75% expect usage to grow further

- Tron lost ground, with transactions down 6% (−1.3M monthly) and slower volume growth

- Binance Smart Chain captured ~40% of retail activity, with transactions up 75% and volumes up 67% in 2025

- Ethereum (mainnet + L2s) accounted for 20% of volume, 31% of transaction counts; mainnet transfers under $250 surged 81% in volume and 184% in count

- Ethereum’s competitiveness improved as fees dropped >70% in the past year

Stablecoin transactions at the retail level have smashed records in 2025, according to a CEX.io report citing Visa and Allium data. By August, retail-sized transfers — defined as transactions under $250 — reached $5.84 billion for the month, marking the highest tally yet. With four months left, this year has already outpaced all of 2024 in total consumer stablecoin activity.

The findings highlight how stablecoins, typically pegged to fiat currencies such as the U.S. dollar, are becoming embedded in everyday transactions from remittances to micro-payments. Survey data reinforced the trend: out of 2,600 respondents across Nigeria, India, Bangladesh, Pakistan, and Indonesia, most said they use stablecoins to avoid excessive banking fees and sluggish transfers. Nearly 70% reported increased usage compared to 2024, while more than three-quarters expect adoption to keep growing.

On the infrastructure side, market share is shifting. Tron — historically the leader for small-value stablecoin transfers thanks to USDT support and low fees — has lost ground, with monthly transactions slipping by 1.3 million (−6%) and slower growth in volume. Binance Smart Chain has stepped up to capture nearly 40% of all retail stablecoin activity this year, riding a 75% surge in transaction counts and a 67% rise in transfer volumes, boosted by PancakeSwap trading activity and Binance’s delisting of USDT in Europe.

Ethereum and its L2 ecosystem also made major inroads. Together, they accounted for more than 20% of retail volume and 31% of transaction counts. While L2s handled most of the micro-transactions, Ethereum mainnet recorded a surprising jump in sub-$250 activity, with volumes up 81% and transaction counts soaring 184%. A key driver has been a sharp 70%+ decline in gas fees, making mainnet stablecoin transfers more competitive even at smaller sizes.

Final Thought

Stablecoins have cemented their role as retail payment rails in 2025, with shifting network dynamics showing how cost, liquidity, and local market conditions are reshaping global usage.