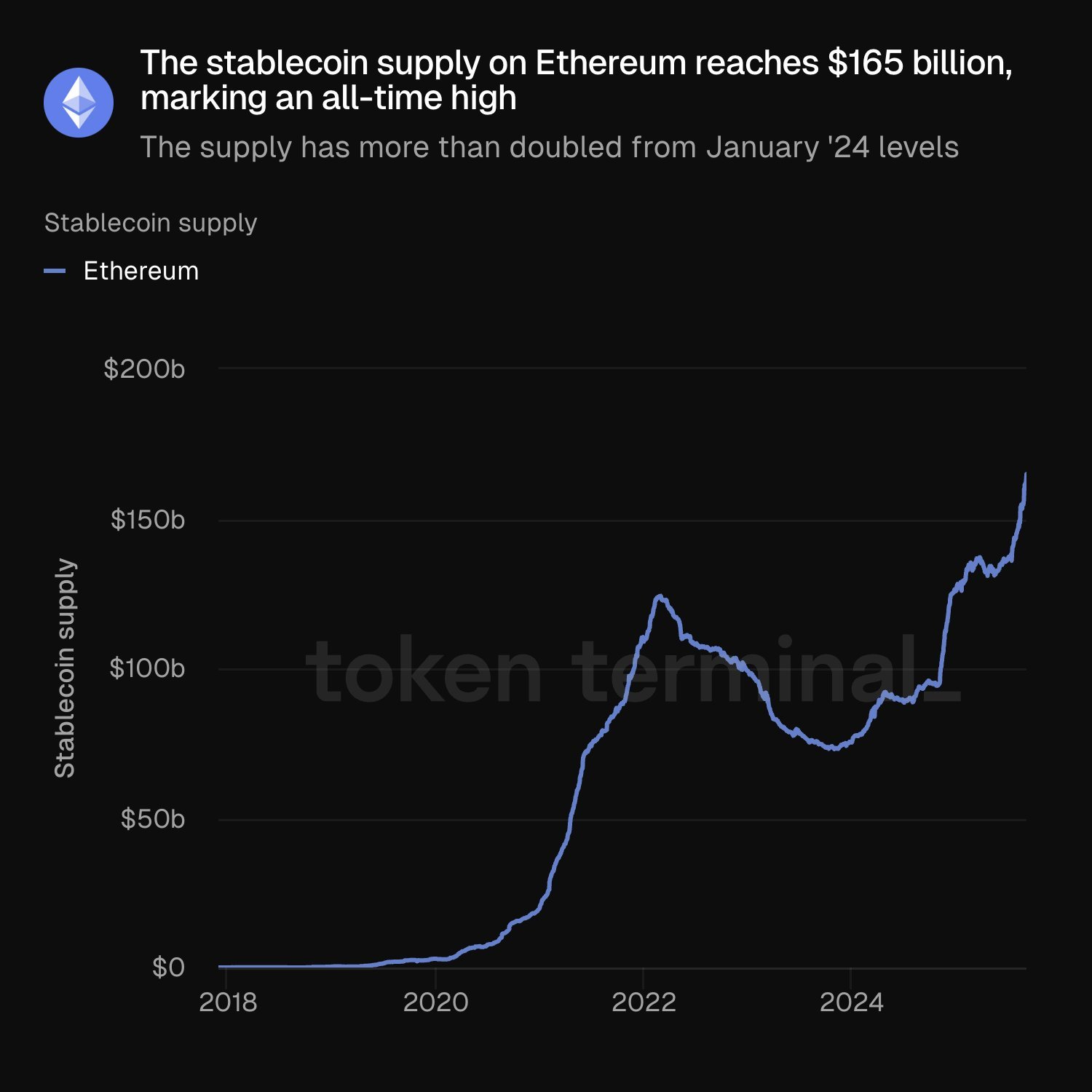

Ethereum Stablecoin Supply Hits $165B After $5B Weekly Inflows

Ethereum added nearly $1 billion worth of stablecoins per day last week, pushing its total supply to a record high and cementing its dominance in real-world asset (RWA) tokenization.

- Ethereum gained $5B in new stablecoins last week, bringing total supply to a record $165B.

- The network now holds 57% market share, far ahead of Tron (27%) and Solana (<4%).

- Tokenized gold on Ethereum has doubled YTD, reaching $2.4B with 77% market dominance.

- Ethereum also leads in tokenized Treasurys, holding over 70% of the market.

- Global institutions like Fidelity are choosing Ethereum to tokenize funds and products.

Ethereum’s dominance in stablecoin adoption continues to grow at a rapid pace. According to Token Terminal, the network added about $5 billion in stablecoins over the past week, averaging nearly $1 billion a day. This surge pushed Ethereum’s stablecoin supply to an all-time high of $165 billion, more than double what it was in January 2024. Other sources, like RWA.xyz, report a slightly lower figure of $158.5 billion, but both confirm new record highs. With 57% market share, Ethereum remains far ahead of its closest competitor Tron at 27%, while Solana lags behind with under 4%.

Beyond stablecoins, Ethereum is also the clear leader in tokenized commodities. The network hosts around $2.4 billion worth of tokenized gold — another all-time high — representing 77% market dominance. If layer-2 Polygon is included, Ethereum’s share jumps to 97%. The same leadership extends to tokenized U.S. Treasurys, where Ethereum accounts for more than 70% of the market, making it the top blockchain for RWAs after private credit.

This growth has fueled strong demand for Ether itself. ETH prices have surged more than 200% since April, peaking near $5,000 in late August. Large treasury corporations have also accumulated nearly 4% of the total ETH supply in just five months, reinforcing confidence in Ethereum’s role as the backbone of RWA tokenization. Educator Anthony Sassano highlighted Ethereum’s “credible neutrality” as a key driver, stressing that true mass adoption depends on open, permissionless systems not controlled by any single entity.

The institutional race to tokenize financial products further strengthens Ethereum’s position. Fidelity, the world’s third-largest asset manager, recently launched a tokenized U.S. Treasurys fund on Ethereum. Dubbed the Fidelity Digital Interest Token (FDIT), the product went live on-chain on September 1 and already manages over $203 million in assets, according to RWA.xyz.

Final Thought

Ethereum’s explosive growth in stablecoins, tokenized gold, and Treasurys proves its unmatched dominance in the RWA space. With institutions like Fidelity entering the arena, Ethereum is not just leading blockchain adoption — it’s setting the foundation for the future of global finance.