Web3 White Hat Hackers Earn Millions, Outpacing $300K Traditional Cybersecurity Salaries

Key Takeaways:

- Top Web3 white hat hackers earn millions annually, significantly more than traditional cybersecurity professionals

- Bug bounty platform Immunefi has created 30 millionaires and paid out over $120 million in rewards

- The largest single payout was $10 million for discovering a critical Wormhole bridge vulnerability

- Critical vulnerabilities in DeFi protocols can yield rewards between $1-14 million depending on severity

- Cross-chain bridges remain the most lucrative targets due to their complexity and high total value locked

Elite white hat hackers in the Web3 space are generating substantial income by discovering vulnerabilities in decentralized protocols, earning far more than their traditional cybersecurity counterparts who typically max out at $300,000 annually.

The bug bounty platform Immunefi has demonstrated this earning potential through its leaderboard, which shows researchers generating millions per year compared to conventional cybersecurity salaries ranging from $150,000 to $300,000. This stark difference highlights the premium placed on security expertise in the rapidly evolving DeFi ecosystem.

In the cryptocurrency world, “white hats” represent ethical hackers who receive compensation for responsibly disclosing vulnerabilities in decentralized finance protocols. Unlike traditional salaried corporate positions, these security researchers enjoy the freedom to select their targets, establish their own schedules, and earn based on the significance of their discoveries.

Impressive Financial Returns

Immunefi has facilitated over $120 million in total payouts across thousands of vulnerability reports, creating 30 millionaires in the process. The platform currently protects more than $180 billion in total value locked across various programs, offering bounties up to 10% for critical security flaws.

These substantial million-dollar payouts reflect the high-stakes nature of DeFi protocols, where many platforms have tens or hundreds of millions of dollars at risk from single vulnerabilities. The financial incentive structure acknowledges that preventing one major exploit can save exponentially more than the bounty cost.

Record-Breaking Discoveries

The most significant single payout in Web3 white hat history reached $10 million, awarded to a researcher who identified a catastrophic flaw in Wormhole’s cross-chain bridge infrastructure. This vulnerability had the potential to destroy billions in locked assets, justifying the unprecedented reward amount.

Despite this proactive discovery, Wormhole still experienced a $321 million exploit on its Solana bridge in 2022, marking it as the year’s largest cryptocurrency hack. Subsequently, Web3 infrastructure company Jump Crypto and Oasis.app executed a “counter exploit” in February 2023, successfully recovering $225 million from the original attacker.

Critical vulnerabilities consistently command the highest rewards, with top researchers earning between $1 million and $14 million depending on the severity and scope of their findings. These exceptional performers represent the elite tier of security researchers capable of identifying vulnerabilities that others overlook.

Evolving Threat Landscape

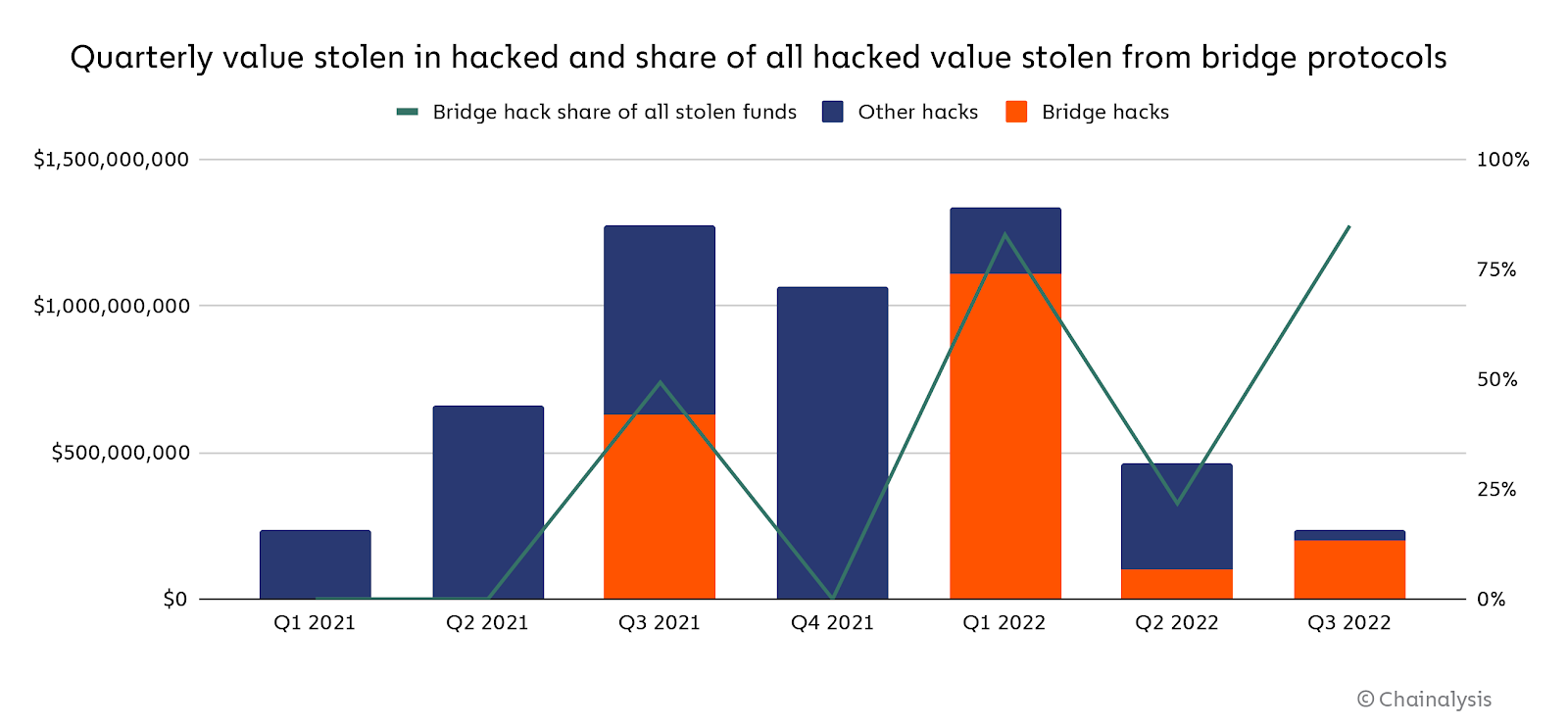

Cross-chain bridges face increasing security risks. Source: Chainalysis

While DeFi’s early years were characterized by smart contract vulnerabilities, 2025 has witnessed a shift toward “no-code” exploits including social engineering attacks, compromised private keys, and operational security failures. Despite this evolution, cross-chain bridges continue to represent the most profitable targets due to their inherent complexity and the massive value they secure.

Certain patterns have emerged regarding which projects face the highest breach risk. DeFi protocols managing significant total value locked without robust bounty programs remain most vulnerable. Early-stage teams rushing products to market without adequate security measures, alongside established players who have become complacent, carry elevated risk profiles.

Current Market Conditions

Recent data indicates that cryptocurrency-related hacks and scams resulted in $163 million in losses during August, representing a 15% increase from July’s $142 million figure. However, the overall number of incidents showed a downward trend, with only 16 recorded attacks compared to 20 in June, suggesting that while individual attacks may be more severe, the frequency is decreasing.

The substantial earning potential for Web3 white hat hackers reflects the critical importance of security in the decentralized finance ecosystem, where the stakes continue to rise alongside the total value locked in various protocols.