Circle Brings Native USDC and Cross-Chain Protocol to Hyperliquid’s HyperEVM

Circle is expanding its stablecoin footprint by launching a native version of USDC and its upgraded Cross-Chain Transfer Protocol (CCTP v2) on Hyperliquid, the leading decentralized derivatives trading platform.

- Upgraded CCTP v2 will streamline USDC transfers across more than a dozen networks.

- Circle becomes a direct Hyperliquid stakeholder through its first HYPE token investment.

- Move follows Hyperliquid’s selection of USDH as a native, compliant USD stablecoin.

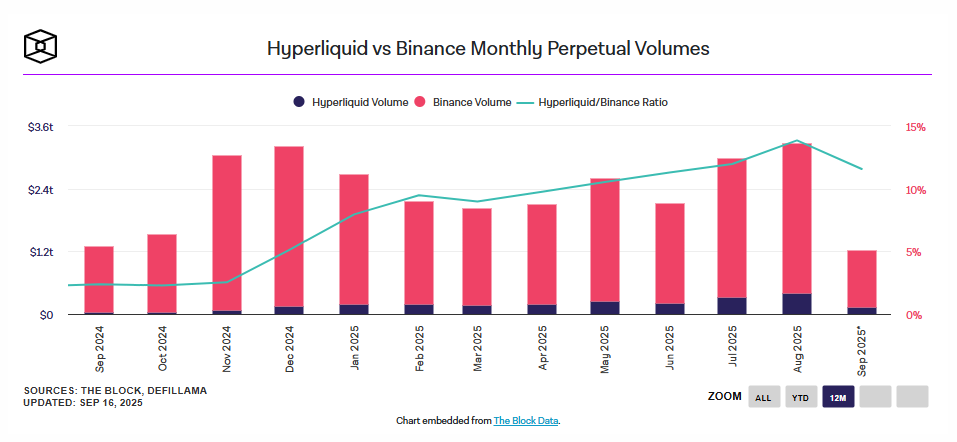

- Hyperliquid holds nearly $6B in USDC reserves and processes around $150B in monthly onchain derivatives volume.

Circle, the issuer of the dollar-pegged USDC stablecoin, is taking a major step into decentralized derivatives by natively integrating USDC with Hyperliquid. The rollout begins with Hyperliquid’s Ethereum-compatible HyperEVM network and will expand to the HyperCore protocol in the coming weeks. Alongside this launch, Circle is deploying its upgraded Cross-Chain Transfer Protocol (CCTP v2), which will simplify USDC transfers across more than a dozen supported networks, enhancing cross-chain liquidity for users and fintech partners.

This initiative comes shortly after Hyperliquid concluded a high-profile contest to introduce its own native stablecoin, USDH, described as “Hyperliquid-first, Hyperliquid-aligned, and compliant.” Startup Native Markets, co-founded by an early Hyperliquid contributor, won the bid to manage USD reserves and issue USDH, which will roll out gradually on HyperEVM with a USDH/USDC spot pair planned. While USDH will serve as a native option, Hyperliquid will continue supporting other stablecoins that meet strict requirements such as a 200,000 HYPE stake, a strong $1 peg, and deep liquidity.

Circle’s integration also signals a closer relationship with the Hyperliquid ecosystem. The company has become a direct stakeholder through its first investment in HYPE, Hyperliquid’s native token, and is exploring additional roles such as becoming a Hyperliquid Validator. Circle has outlined incentive programs to encourage USDC adoption and intends to work closely with HyperEVM developers and HIP-3 proposals to expand use cases for its stablecoin.

Jeremy Allaire, Circle’s CEO, emphasized that this move aligns with Circle’s broader goal of supporting an internet economy capable of handling hundreds of trillions of dollars in activity. The launch underscores Circle’s ambition to remain competitive as stablecoin issuers face rising distribution costs and regulatory scrutiny following the GENIUS Act. Circle’s USDC already operates on roughly two dozen networks, with over $73 billion in circulation, and Hyperliquid’s growing market—processing nearly $150 billion in on-chain derivatives trades this month—offers a significant opportunity for further expansion.

Final Thought

By bringing USDC and CCTP v2 directly to Hyperliquid, Circle is deepening its role in decentralized finance and strengthening its position against rising competition in the stablecoin sector. This strategic integration enhances cross-chain liquidity and cements USDC’s presence on one of the most active on-chain derivatives platforms.