Federal Reserve Poised to Cut Rates – What It Means for Crypto Prices

The U.S. Federal Reserve is widely expected to cut interest rates by 25 basis points today, a move that could spark short-term volatility but strengthen crypto markets over the long run

- Lower rates typically boost risk assets like crypto over time.

- Analysts warn of a possible short-term “sell the news” pullback.

- Traders and banks expect 2–3 total cuts in 2025, though some see that as optimistic.

- A surprise 50 bps cut could raise economic concerns and unsettle markets.

Market participants are watching closely as the U.S. Federal Reserve prepares to cut interest rates, with most analysts expecting a 25 basis point reduction. The move follows signs of a weakening U.S. labor market, including a downward revision of more than 900,000 jobs for 2025 and rising unemployment.

Crypto markets, which often move in tandem with broader liquidity cycles, could see mixed effects. Coin Bureau founder Nic Puckrin explained that while lower rates generally lift asset prices over the long term, traders should be wary of a near-term correction. “Hope is high and there’s a big chance of a ‘sell the news’ pullback,” Puckrin said, adding that speculative assets such as memecoins may be especially vulnerable.

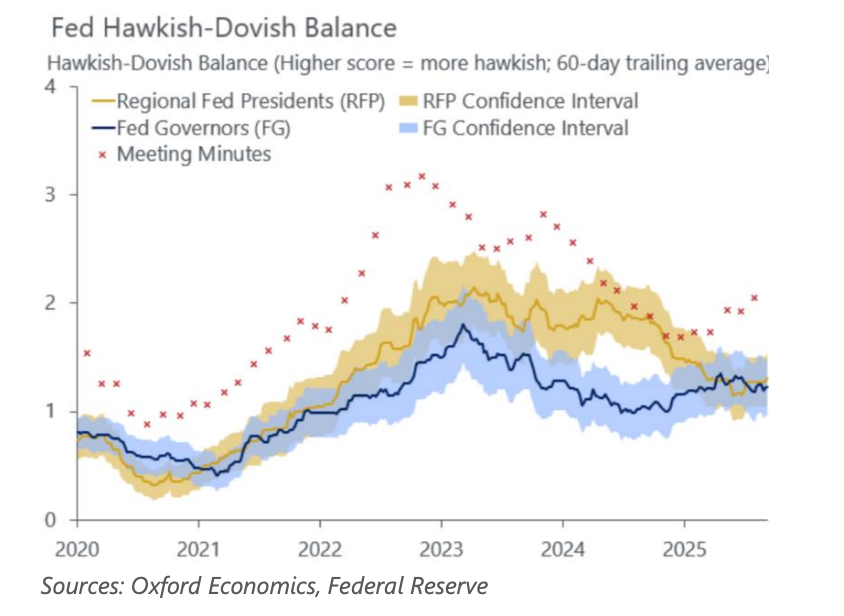

Major financial institutions like Goldman Sachs and Citigroup anticipate at least two rate cuts in 2025, with some projections going as high as three. However, Oxford Economics forecasts a maximum of two cuts, calling three “overly optimistic” even with today’s expected reduction.

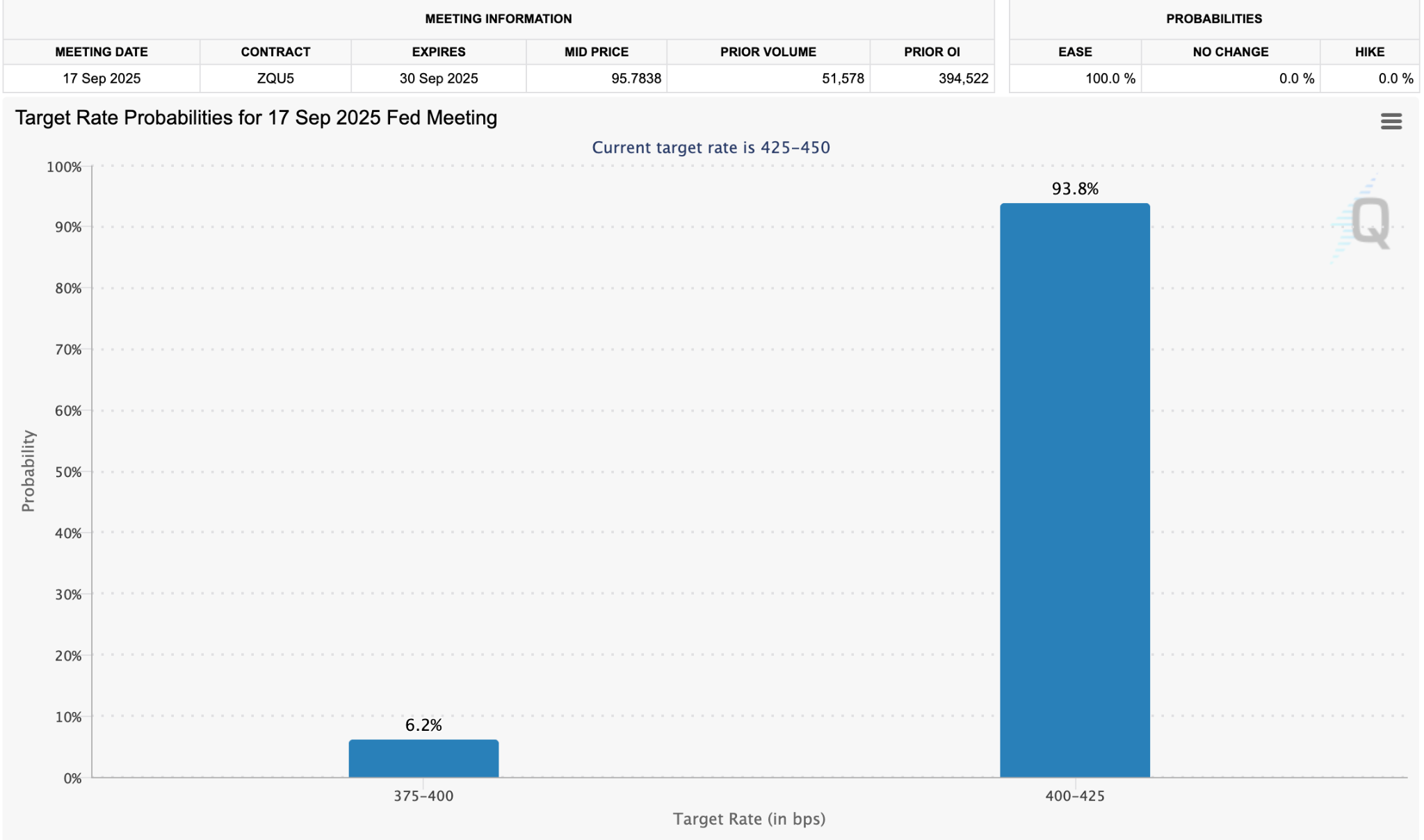

Data from the Chicago Mercantile Exchange shows only 6.2% of traders expect a surprise 50 basis point cut. Javier Rodriguez-Alarcon, CIO of digital asset firm XBTO, noted that a standard 25 bps cut would likely “spark a brief rally” in risk-on assets, whereas a larger 50 bps move might signal economic stress and weigh on markets in the short term. Still, Rodriguez-Alarcon said that rate cuts ultimately support asset prices as investors shift from cash into higher-yielding investments like crypto.

Final Thought

While a Fed rate cut should provide long-term support for Bitcoin and other digital assets, traders should brace for potential short-term volatility, especially if the market has already priced in today’s move.