SEC Reforms and New Crypto Treasuries Fuel Institutional Surge

Key Takeaways

- Corporate crypto treasuries expand: Helius launches $500M Solana-focused treasury, one of the largest to date.

- Institutional capital inflows rise: Standard Chartered’s SC Ventures plans $250M fund backed by Middle East investors.

- Regulatory progress accelerates: SEC approves new ETF listing standards and Grayscale’s first multi-asset crypto ETP.

- Ethereum scaling upgrade set: Fusaka hard fork in December will double blob capacity, cutting costs and boosting L2s.

- DeFi innovation continues: Curve DAO considers $60M plan to make CRV yield-bearing; 40% of Americans open to DeFi under new laws.

Corporate Treasuries Push Deeper Into Crypto

Institutional adoption of digital assets took another leap forward this week. Nasdaq-listed Helius Medical Technologies announced a $500 million corporate treasury strategy centered on Solana (SOL). The firm priced an oversubscribed PIPE deal, including common stock and warrants, and will use the proceeds to build one of the largest Solana-focused treasury reserves in history.

Helius confirmed it will scale holdings aggressively over the next 12–24 months while exploring staking and lending strategies within the Solana ecosystem. The approach reflects a growing trend among corporations: not just holding digital assets but also monetizing treasury reserves through yield opportunities.

Meanwhile, Standard Chartered’s SC Ventures revealed plans to raise $250 million for a digital asset fund launching in 2026, backed by Middle East investors. The fund will focus on global opportunities, complementing SC’s existing ventures like Zodia Custody and Zodia Markets. Together, these announcements highlight rising corporate conviction that altcoins will play a central role in long-term financial strategies.

SEC Reforms Unlock New Path for ETFs

On the regulatory front, the US Securities and Exchange Commission approved generic listing standards for spot crypto ETFs, streamlining the process for issuers on Nasdaq, NYSE Arca, and Cboe BZX. This marks a significant breakthrough after years of piecemeal approvals.

In tandem, the SEC approved Grayscale’s Digital Large Cap Fund (GLDC), the first-ever multi-asset crypto exchange-traded product in the US. Unlike Bitcoin-only products, GLDC offers diversified exposure, signaling that institutions will soon have regulated access to a broader set of cryptocurrencies. The move is expected to accelerate inflows and strengthen the case for an upcoming altcoin supercycle.

Ethereum’s Fusaka Upgrade and DeFi Innovation

Ethereum’s developer community confirmed that the Fusaka hard fork will go live on December 3, followed by staged increases in blob capacity on December 17 and January 7, 2026. These upgrades will more than double blob storage, cutting transaction costs for layer-2 networks and expanding Ethereum’s scalability.

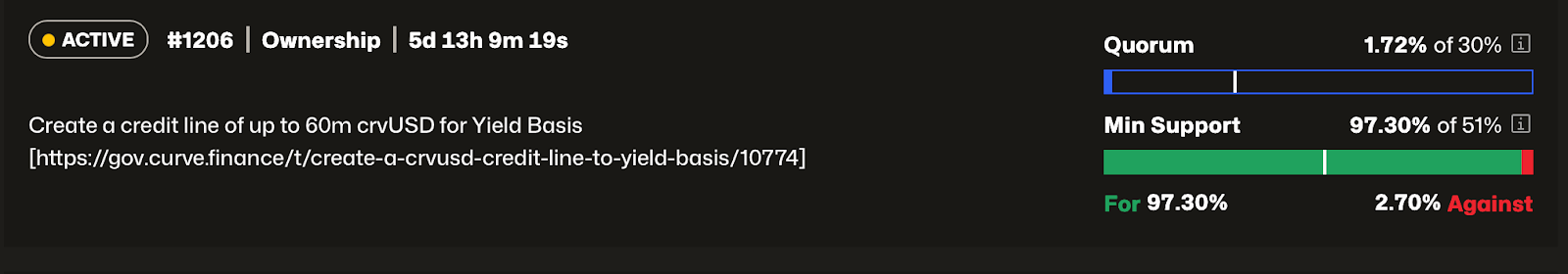

In DeFi, Curve Finance’s DAO is voting on a $60 million credit line proposal that would effectively make CRV a yield-bearing asset. Backed by founder Michael Egorov, the initiative would distribute revenue to veCRV holders while strengthening Curve’s ecosystem. Early voting shows overwhelming support, suggesting a new chapter for CRV’s utility.

At the same time, a new survey by the DeFi Education Fund revealed that 40% of Americans would use DeFi if legal clarity was provided, with most interested in online payments. This underscores a crucial point: regulatory certainty could unlock a massive wave of adoption.

DeFi Market Overview

The DeFi market ended the week in positive territory, with most top-100 tokens rallying. Aster (ASTER) surged over 600%, leading weekly gains, while Immutable (IMX) climbed more than 50%. Total value locked (TVL) also expanded, reinforcing the bullish sentiment.

With institutional capital flowing into treasuries, SEC reforms reshaping ETF access, Ethereum preparing for its next major scaling milestone, and DeFi protocols reinventing yield models, the narrative is converging: the foundation for another historic altcoin cycle is being laid.