OKX Built a Perps DEX but Delayed Launch Over Regulatory Concerns

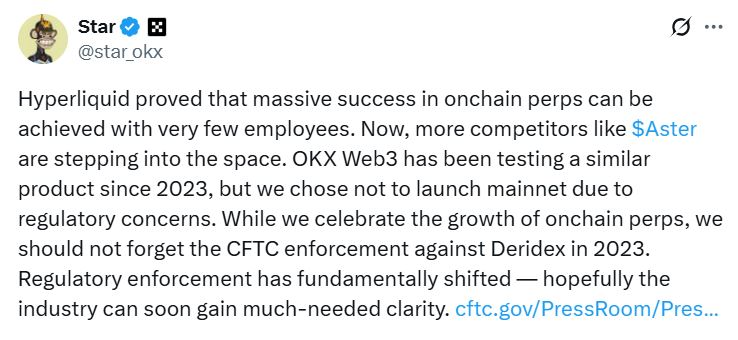

Crypto exchange OKX developed a decentralized perpetuals trading platform but chose not to launch it, citing uncertainty around U.S. regulatory enforcement.

- Founder Star Xu said mainnet deployment was paused due to regulatory concerns.

- Xu referenced the 2023 CFTC action against Deridex for unregistered derivatives trading.

- Hyperliquid and Aster are thriving, with billions in monthly trading volume.

- Recent U.S. policy changes and Trump-era appointments could reshape crypto oversight.

OKX’s foray into decentralized derivatives trading has hit a regulatory roadblock. Founder and CEO Star Xu revealed that the exchange’s Web3 division built a decentralized perpetuals (perps) platform similar to Hyperliquid and Aster but chose not to launch it over compliance concerns. Xu shared on X that the team had been testing the product since 2023 but decided against deploying it to mainnet.

Xu pointed to the Commodity Futures Trading Commission’s September 2023 enforcement action against Deridex as a cautionary example. The CFTC accused Deridex of illegally offering digital asset derivatives without proper registration as a swap execution facility or futures commission merchant, focusing on its perpetual swaps. The same action also named Opyn and ZeroEx for offering leveraged retail commodity transactions without authorization.

Meanwhile, decentralized perpetuals exchanges have continued to grow rapidly. Hyperliquid, which debuted in 2024, has become one of DeFi’s most active venues, processing around $319 billion in trading volume in its strongest month. Aster, launched as Aster Chain in July and backed by CZ-affiliated YZi Labs, has recorded more than $22 billion in trading over the past 30 days, according to DefiLlama.

Regulatory winds may be shifting in the United States. Since the election of crypto-friendly President Donald Trump, the CFTC has appointed more crypto industry leaders to its Global Markets Advisory Committee. A July White House report proposed sharing digital asset oversight between the CFTC and the Securities and Exchange Commission, granting the CFTC authority over spot crypto markets.

Final Thought

OKX’s decision to delay its perps DEX underscores the uncertainty surrounding crypto derivatives regulation. As U.S. policy evolves, clearer guidance could determine whether OKX and others bring their decentralized trading platforms to market.