Vitalik Buterin Praises Base’s L2 Design, Dismisses ‘Exchange’ Concerns

Ethereum co-founder Vitalik Buterin defended Coinbase’s Base network and other layer-2s, arguing they are extensions of Ethereum—not centralized exchanges—despite U.S. regulatory chatter about L2 sequencers.

- Base is “doing things the right way,” combining centralized UX benefits with Ethereum’s decentralized security.

- True L2s like Base are non-custodial—they can’t steal or block user funds.

- SEC Commissioner Hester Peirce questioned whether single-entity “matching engines” in L2 sequencers resemble exchanges.

- Coinbase CLO Paul Grewal compared L2s to Amazon Web Services, saying infrastructure providers are not exchanges.

- Base co-founder Jesse Pollak stressed that sequencers order transactions; they don’t match trades like an exchange engine.

Ethereum co-founder Vitalik Buterin publicly endorsed the design of Base, Coinbase’s layer-2 scaling solution, amid rising regulatory speculation over whether L2 sequencers should be classified as securities exchanges.

“Base is doing things the right way: an L2 on top of Ethereum that uses its centralized features to provide stronger UX features, while still being tied into Ethereum’s decentralized base layer for security,” Buterin said on Tuesday. He emphasized that Base does not custody funds, meaning “they cannot steal funds or stop you from withdrawing funds.”

The debate over L2 regulation heated up after SEC Commissioner Hester Peirce raised concerns during a Sept. 7 podcast, noting that if a single entity controls a matching engine that “brings together buyers and sellers,” it could resemble an exchange subject to securities law. However, Peirce also clarified that if the assets aren’t securities, the SEC’s reach may be limited.

Coinbase CLO Paul Grewal countered that reasoning, likening layer-2 sequencers to AWS cloud infrastructure: “If an exchange runs on AWS, is AWS an exchange? Obviously not.” Grewal argued that L2s simply batch and relay code or smart-contract calls, not trades, and therefore don’t meet the SEC’s exchange definition.

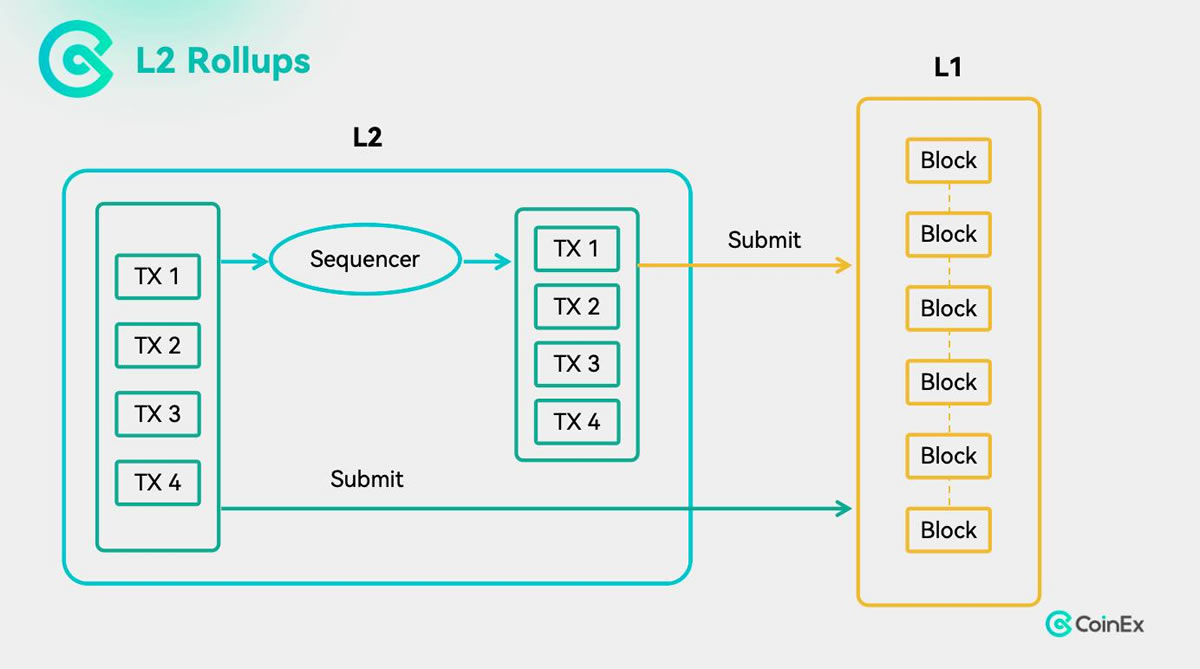

Base co-founder Jesse Pollak elaborated on sequencer operations, explaining that users can submit transactions either through the sequencer or directly on Ethereum, preserving full decentralization. “It’s like a traffic controller ensuring smooth flow,” Pollak said. He added that sequencers only set transaction order—unlike matching engines that pair buy and sell orders at specific prices.

If U.S. regulators were to classify L2s as exchanges, they would have to register with the SEC and comply with strict trading-platform rules, a move industry leaders warn would stifle innovation.Buterin’s endorsement reinforces the view that layer-2 networks are infrastructure extensions of Ethereum, not financial intermediaries. His comments may help ease the current “sequencer FUD,” underscoring that Ethereum’s scaling strategy remains on a decentralized path.