Crypto Liquidations Top $1.8B in 24 Hours: Final Flush or More Pain Ahead?

A massive $1.8 billion crypto liquidation rocked markets on Monday, sparking debate on whether this was a final shakeout or just the start of a deeper correction.

- Over 370,000 traders liquidated, with losses hitting $1.8 billion in 24 hours, CoinGlass reports.

- Total crypto market cap dropped by $150B to $3.95 trillion, with Bitcoin dipping under $112K and Ether below $4,150.

- Long Bitcoin and Ether positions accounted for the largest share of liquidations.

- Analysts point to overleveraged longs and excessive altcoin leverage as key triggers.

- Possible Bitcoin dip to the $105K–$100K support zone, but long-term bull trend intact.

- September pullbacks are common; historically, October brings stronger performance (“Uptober”).

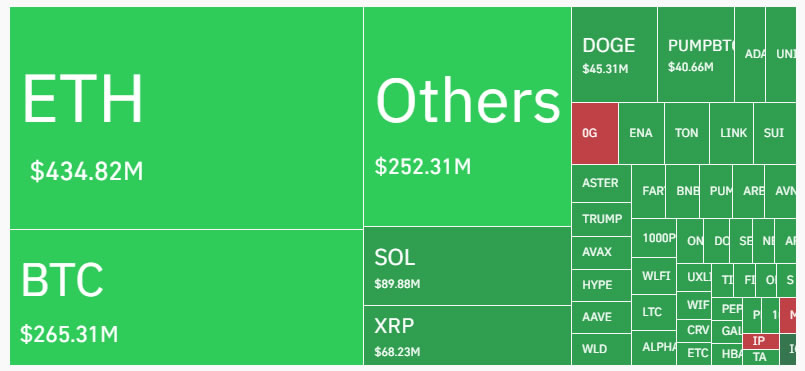

The crypto market endured one of its most violent shakeouts of 2025 as overleveraged traders were swept away by cascading liquidations totaling $1.8 billion in a single day. According to data from CoinGlass, more than 370,000 traders saw positions wiped out as the total crypto market cap shed over $150 billion, sliding to a two-week low of $3.95 trillion.

Bitcoin briefly fell below $112,000 on Coinbase while Ether dropped under $4,150, marking their sharpest pullbacks since mid-August. Altcoins were not spared, suffering double-digit losses across the board as the sell-off rippled through decentralized finance markets and leveraged derivatives.

Market veterans were quick to note that the move appeared to be more about leverage than fundamental weakness. Real Vision founder Raoul Pal described it as a classic crypto setup: “The market is focused on a big breakout, gets levered long ahead of it, it fails at first attempt, so everyone gets liquidated… only then does the actual breakout occur, leaving everyone sidelined.” CoinGlass confirmed it was the largest long liquidation event of the year, surpassing similar flushes in late February, early April, and early August.

Excessive leverage in altcoins also amplified the collapse. Researcher Bull Theory highlighted an “excessive imbalance” of altcoin leverage compared to Bitcoin, noting that Ether liquidations topped $500 million, more than double those of Bitcoin. “One sharp move down triggers cascading liquidations. That’s how you flush out weak hands and reset the board,” the analyst explained.

Despite the carnage, some experts see this as a healthy reset. Nassar Achkar, chief strategy officer at CoinW, argued the wipeout “may present a near-term adjustment rather than a shift in the long-term structural bull run,” pointing to supportive macro factors for risk assets like Bitcoin.

Technical indicators also suggest room for a deeper but controlled pullback. IG market analyst Tony Sycamore said Bitcoin could revisit the $105K–$100K support zone, which includes the 200-day moving average around $103,700. “It would flush out weaker hands and set up a nice buying opportunity for a run up into year-end,” Sycamore noted, adding that Bitcoin remains decoupled from tech stocks and gold as it consolidates its gains from the August peak near $125K.

Even with this week’s rout, Bitcoin’s correction from its mid-August all-time high remains relatively mild — only about 9.5%. Historically, September has brought weakness, with BTC falling in 8 of the past 13 years, yet the crypto giant still holds a roughly 4% gain for the month. Investors are now eyeing “Uptober,” a period that has historically delivered strong upside following late-summer pullbacks.

Final Thought

While $1.8 billion in liquidations may feel like a crushing blow, seasoned analysts view it as a textbook crypto reset. If history repeats, this shakeout could pave the way for a stronger rally into year-end.