Tether Reportedly Targeting $500B Valuation With Up to $20B Raise

Stablecoin giant Tether is reportedly in talks to raise $15–20 billion at a valuation near $500 billion, a move that would rank it among the world’s most valuable private companies, Bloomberg reports.

- Around $500B, placing Tether alongside OpenAI and SpaceX in global private valuations.

- Cantor Fitzgerald, a Tether shareholder, is reportedly leading the talks.

- Tether controls a $172B USDT supply and posted $4.9B Q2 profit in 2025.

- Rival Circle recently IPO’d at a $30B valuation, highlighting Tether’s dominant lead.

- Bloomberg sources caution the raise size and valuation are top-end targets, not guaranteed.

Stablecoin issuer Tether is reportedly seeking to raise between $15 billion and $20 billion in new equity funding at an eye-popping $500 billion valuation, according to Bloomberg, citing people familiar with the discussions. If successful, Tether would become one of the most valuable privately held companies in the world, on par with high-profile firms like Elon Musk’s SpaceX and Sam Altman’s OpenAI.

Bloomberg’s report notes that Cantor Fitzgerald, a long-time Tether partner and shareholder, is advising on the deal. Cantor Fitzgerald reportedly holds about a 5% stake in Tether, which would be worth $25 billion if the company reaches the targeted valuation. The Wall Street Journal previously valued that stake at roughly $600 million.

Sources indicated that Tether is targeting an equity sale of about 3% of the company, but cautioned that both the raise amount and valuation could ultimately come in significantly lower than the top-end figures. The planned transaction would involve the issuance of new equity, with no current investors selling shares.

Tether did not respond to Bloomberg’s request for comment. Notably, Bo Hines, CEO of Tether’s recently created U.S. unit, said at a conference in Seoul that the company “has no plans to raise money,” potentially signaling internal caution around the report.

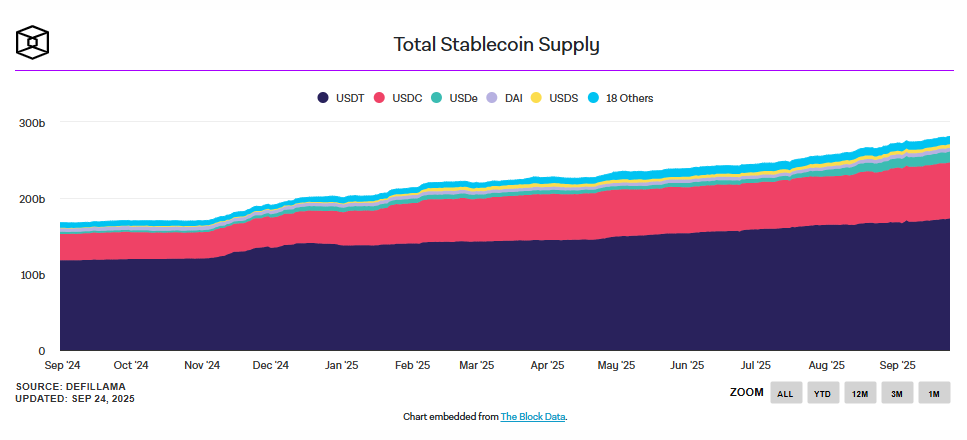

Founded in El Salvador, Tether dominates the stablecoin market with a circulating supply of $172 billion USDT. For comparison, its closest competitor Circle, issuer of the USDC stablecoin, manages $74 billion in USD-pegged tokens and recently went public at a valuation of about $30 billion.

Tether’s extraordinary profitability further underscores its market power. The company announced a $4.9 billion net profit for Q2 2025, reinforcing its reputation as perhaps the most profitable business in crypto. Tether also recently revealed plans for a USD-pegged stablecoin targeting the U.S. market, signaling continued expansion despite heightened regulatory scrutiny.A $500 billion valuation would cement Tether not just as the largest stablecoin issuer, but as a global corporate heavyweight, rivaling tech and AI titans in private-market value. Whether investor appetite and regulatory conditions will support such an ambitious raise remains to be seen.