Aster Overtakes Hyperliquid With $1.25B Open-Interest Explosion

Decentralized perpetuals exchange Aster just rocketed past Hyperliquid in daily trading volume, with open interest soaring to $1.25 billion—a staggering 33,500% jump in less than a week, per CoinGlass and DefiLlama data.

- Logged $24.7B 24-hour perps volume, topping Hyperliquid’s $10B, with edgeX and Lighter trailing.

- Total value locked climbed 196% to $1.85B, showing strong liquidity inflow.

- Hyperliquid still dominates with $66B 7-day and $300B 30-day volumes.

- Boosted by BNB Chain support and CoinMarketCap’s CMC Launch program, plus ecosystem exposure from YZi Labs.

- CMC campaign delivered 400M homepage impressions, 3M tweet impressions, and 1.5M live-event views, driving visibility and trader adoption.

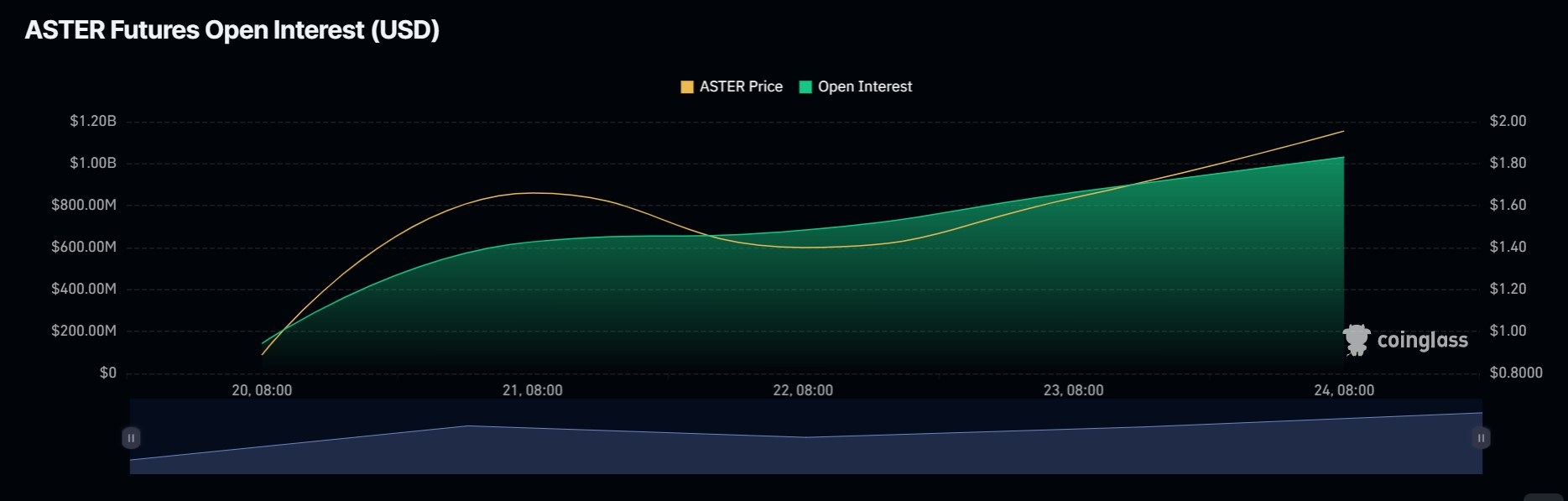

Aster, a decentralized perpetuals exchange built on BNB Chain, has staged a meteoric rise, with CoinGlass data showing open interest skyrocketing from $3.72 million on Friday to $1.25 billion by Wednesday. This 33,500% spike in outstanding contracts highlights a rush of traders deploying capital to the platform and signals rapidly growing market conviction.

Open interest, which tracks unsettled contracts, is a key indicator of liquidity and market participation. Alongside the surge in open interest, DefiLlama data revealed Aster’s total value locked (TVL) jumped 196% in the same timeframe, from $625 million to $1.85 billion, reinforcing the view that deep liquidity is flooding into the protocol.

Aster’s trading activity has also leapt ahead of established rival Hyperliquid in the short term. DefiLlama reported $24.7 billion in 24-hour perpetuals trading volume on Wednesday, more than double Hyperliquid’s $10 billion. Competitors edgeX and Lighter trailed with $8.25 billion and $6.18 billion, respectively.

Despite Aster’s eye-catching daily numbers, Hyperliquid retains the upper hand on longer horizons, logging $66 billion over the past week and nearly $300 billion across 30 days. Still, Aster’s sudden rise suggests it could challenge Hyperliquid’s dominance if momentum holds.

Several ecosystem supporters helped fuel the breakout. A BNB Chain spokesperson confirmed that Aster received guidance and resources from BNB Chain and YZi Labs (formerly Binance Labs), including technical assistance and marketing support. Meanwhile, CoinMarketCap’s CMC Launch program amplified Aster’s visibility through a high-impact campaign: 400 million homepage banner impressions, 3 million tweet impressions, over 5 million combined newsletter and notification reach, 1.5 million live-event views, 1.5 million landing page clicks, and 500,000 direct project-page visits, according to CMC Launch lead Jin Choo.

While Binance owns CoinMarketCap, CMC emphasized the project was chosen on its own merits—innovation, market potential, and community traction—and that Binance and CMC operate independently.

Aster’s explosive growth, aided by heavy marketing and ecosystem support, puts it squarely in the spotlight of decentralized perpetuals trading. Whether it can sustain this pace and overtake Hyperliquid’s long-term dominance remains the key question for traders and DeFi watchers.