Japan Doubles Crypto Adoption After Policy Reforms and New Yen Stablecoin, Chainalysis Says

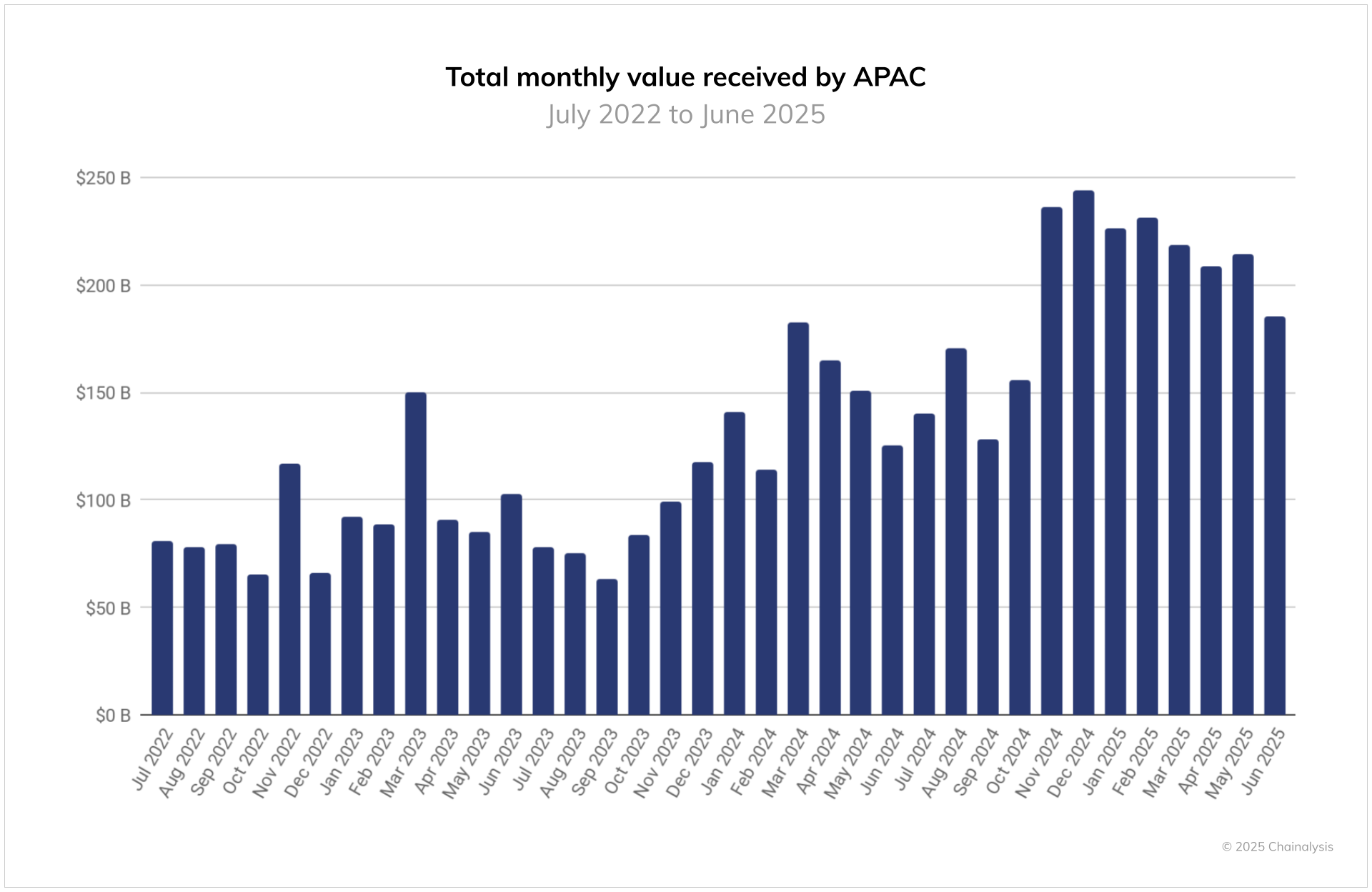

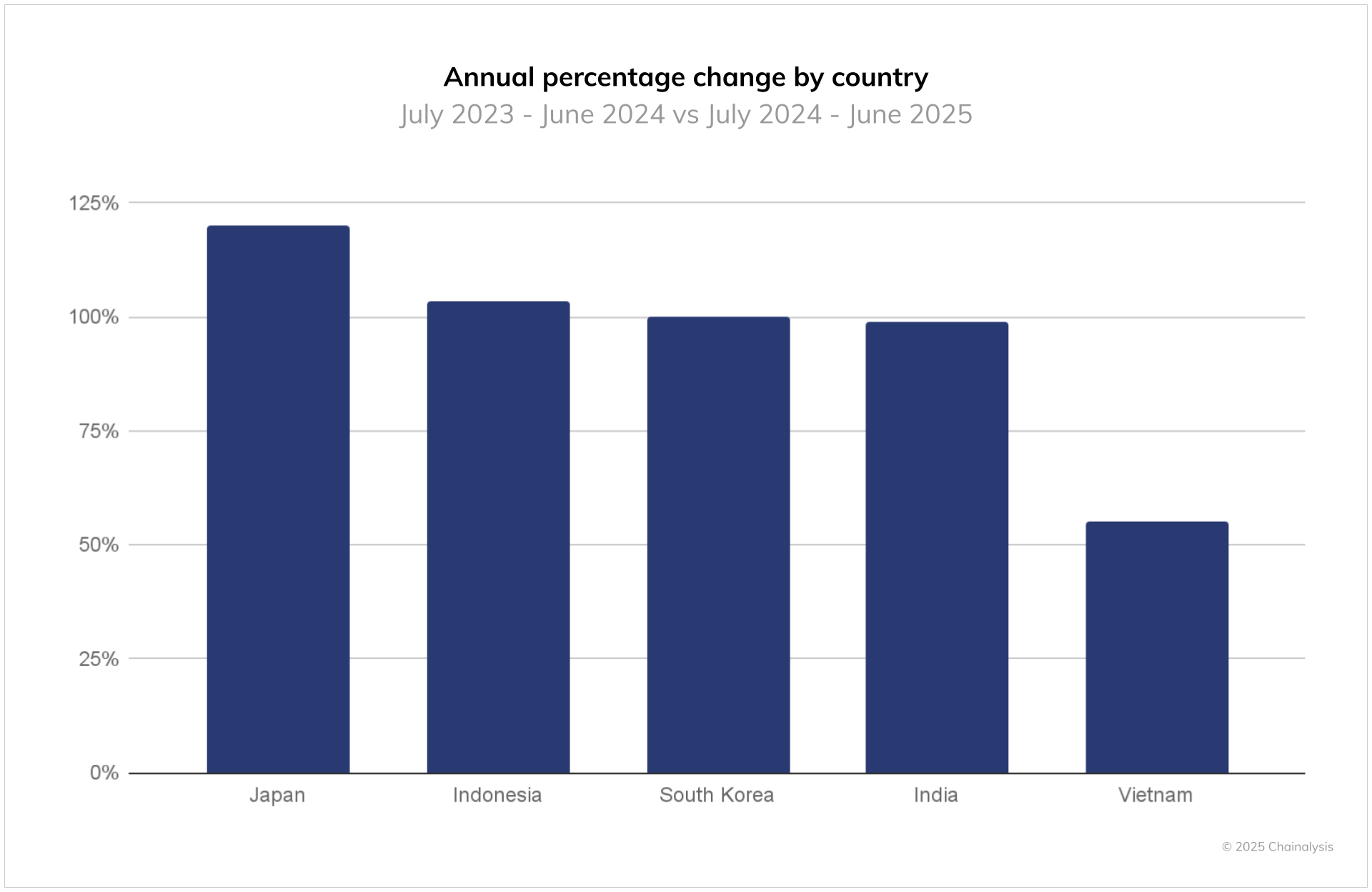

Chainalysis reports that Japan’s on-chain crypto activity surged 120% year-on-year as policy and tax changes and the approval of a yen-pegged stablecoin helped fuel adoption. The wider Asia-Pacific region remains the fastest-growing market for crypto, with stablecoins playing a central role.

- Policy changes aligned crypto rules with securities law and eased tax burdens.

- Regulators approved JPYC, the first yen-pegged stablecoin for domestic markets.

- APAC led global growth: India tops the Global Adoption Index; Indonesia, South Korea and India doubled value received.

- Stablecoins surged across APAC, with South Korea seeing 50%+ growth early in 2025 and $59B in purchases.

- Countries show varied crypto use cases: remittances (Vietnam), trading/income (India), inflation-hedging/payments (Pakistan), equities-style trading (South Korea).

Chainalysis’ 2025 Geography of Cryptocurrency report shows Japan’s crypto ecosystem has accelerated sharply over the past year. The country’s on-chain value received climbed 120% year-on-year to June, a jump Chainalysis attributes to regulatory shifts, tax reforms and the recent greenlight for JPYC — the first yen-pegged stablecoin approved for domestic use. Chengyi Ong, Chainalysis’ APAC policy lead, told Cointelegraph the uptick reflects global trading momentum late in 2024 and growing expectations of a friendlier policy and tax environment in Japan that would encourage both retail and institutional participation.

Japanese exchanges report steady user growth: Bitbank’s Atsushi Kuwabara noted rising activity from both new and returning users through August. The regulatory changes aim to align crypto markets more closely with existing securities rules while reducing tax friction, which should help listings, liquidity and on-ramp options for yen-linked digital assets. The approval of JPYC removes a long-standing barrier to domestic stablecoin listings and is expected to boost liquidity and use in payments and settlements.

Across APAC, Chainalysis found broad expansion: Indonesia, South Korea and India doubled their on-chain value received, while Vietnam grew 55%, reflecting mature use cases such as remittances, gaming and savings. Stablecoins have become a key infrastructure layer: South Korea saw stablecoin trading volumes jump more than 50% early this year, with total stablecoin purchases reaching around $59 billion in the year to June. USD-pegged stablecoins currently dominate, but local currency stablecoins (like JPYC and potential won-backed tokens) are gaining strategic interest from banks and regulators.

The region’s markets follow different adoption paths. India’s growth is driven by young traders using crypto for income and cross-border remittances. Vietnam uses crypto as everyday financial rails for payments and gaming. Pakistan’s mobile-first population leans on stablecoins as an inflation hedge and payment tool. South Korea is evolving toward equity-style crypto trading with regulatory changes reshaping activity on domestic venues. Smaller APAC hubs such as Australia, Singapore and Hong Kong are working to align rules and provide clearer oversight, including selective licensing and regulatory relief for stablecoin distributors.

Final Thought

Japan’s policy and tax reforms, combined with the emergence of a yen-pegged stablecoin, have catalyzed rapid adoption — a reminder that pragmatic, targeted regulation and native stablecoin infrastructure can unlock mainstream crypto use.