Singapore and UAE Named the World’s Most Crypto-Obsessed Countries

Singapore and the United Arab Emirates have officially topped the global rankings as the most crypto-obsessed nations, according to a new report by ApeX Protocol. The two countries lead the world in crypto ownership, online search activity, and adoption growth.

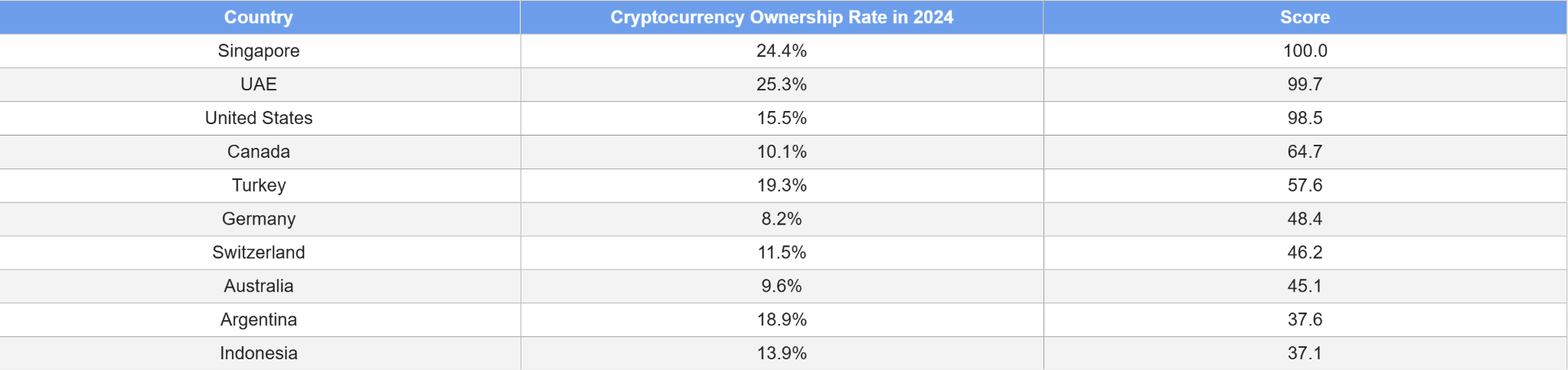

- Singapore ranks #1 globally for crypto obsession, with 24.4% of its population owning crypto.

- UAE follows closely at #2, leading worldwide in ownership (25.3%) and 210% adoption growth since 2019.

- The United States ranks #3, with strong infrastructure and over 30,000 crypto ATMs.

- Canada shows the fastest adoption growth at 225%, while Turkey rounds out the top five.

- Other top 10 countries include Germany, Switzerland, Australia, Argentina, and Indonesia.

- ApeX Protocol says crypto is now a core part of national identity and financial innovation.

- Chainalysis ranks the U.S. second globally in adoption, with India retaining the top spot.

ApeX Protocol’s latest report has crowned Singapore as the world’s most crypto-obsessed nation. The study gave Singapore a perfect composite score of 100, fueled by its high ownership rate and unparalleled search activity. Around 24.4% of Singaporeans now hold cryptocurrencies, a massive jump from 11% in 2021, and the country records roughly 2,000 crypto-related searches per 100,000 people — the highest globally.

Trailing just behind, the United Arab Emirates (UAE) secured a near-perfect score of 99.7. The Gulf nation ranked first worldwide in crypto ownership, with 25.3% of its population holding digital assets. Since 2019, the UAE has witnessed an impressive 210% surge in adoption, with a notable spike in 2022 when more than a third of its residents reported owning crypto.

The ApeX report measured global crypto engagement across four key indicators: ownership rate, adoption growth, online search activity, and ATM availability. The data paints a clear picture — crypto is no longer a niche interest but a fundamental part of modern economies.

The United States ranked third with a score of 98.5, backed by unmatched infrastructure. It leads the world in crypto ATM availability, boasting more than 30,000 machines, which is ten times more than any other country. The U.S. also saw a 220% increase in crypto usage since 2019, reinforcing its position as a key player in the global digital asset landscape.

Canada came in fourth, with the highest recorded adoption growth of 225%. Roughly 10.1% of Canadians own crypto, and the country has over 3,500 crypto ATMs. Meanwhile, Turkey placed fifth, scoring 57.6, with 19.3% of its population holding crypto and high monthly search volumes nearing 1,000 per 100,000 people.

The rest of the top ten includes Germany (48.4), Switzerland (46.2), Australia (45.1), Argentina (37.6), and Indonesia (37.1) — each showing steady growth in user interest and adoption.

An ApeX Protocol spokesperson commented that crypto is now shaping how nations define their financial futures — not just as a speculative asset but as a core part of how people interact with money, technology, and trust.

Separately, Chainalysis’ 2025 Global Crypto Adoption Index shows the U.S. climbing to second place worldwide, bolstered by Bitcoin ETF inflows and clearer regulations. India remains in the top spot for the third year running, with the Asia-Pacific region leading overall in transaction growth. Other top performers include Pakistan, Vietnam, and Brazil, while Nigeria slipped to sixth despite improving regulatory conditions.

Final Thought

The surge of crypto adoption in Singapore and the UAE highlights a global shift toward digital assets as part of mainstream finance. With growing public engagement, supportive regulation, and technological innovation, crypto is no longer on the sidelines — it’s becoming an integral part of how nations build their digital economies.