USDT and USDC Lead $46 Billion Surge in Quarterly Stablecoin Inflows

The stablecoin market experienced a massive influx of capital in Q3 2025, with net inflows soaring to nearly $46 billion — a 324% jump from the previous quarter. The surge was led by Tether’s USDT, Circle’s USDC, and newcomer Ethena’s USDe, reflecting renewed investor demand for dollar-pegged assets.

- Tether (USDT) led the quarter with $19.6B in net inflows, followed by USDC ($12.3B).

- Ethena’s USDe saw rapid growth, adding $9B in Q3 alone.

- PayPal’s PYUSD and MakerDAO’s USDS posted over $1B each in inflows.

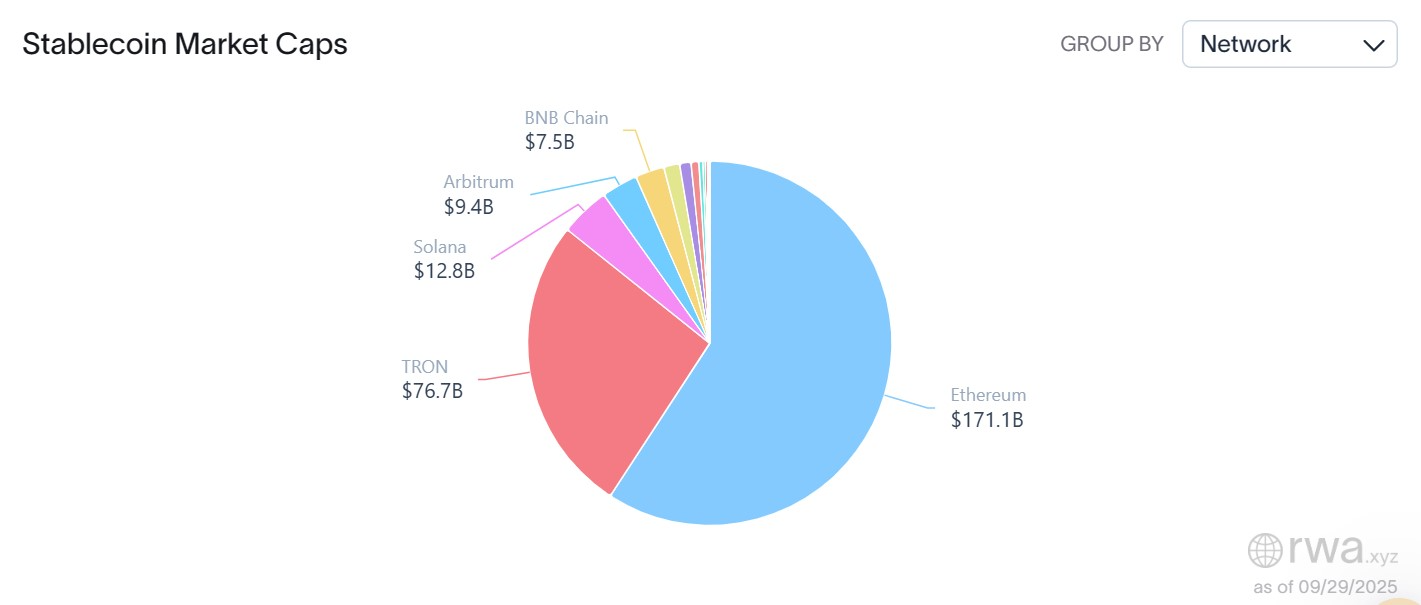

- Ethereum remains the leading blockchain for stablecoins, hosting $171B in supply.

- Total stablecoin market cap hit $290B, though active addresses and transfer volumes declined month-over-month.

Stablecoins saw explosive growth in Q3 2025, recording $45.6 billion in net inflows over the past 90 days — a sign that investor confidence in U.S. dollar-pegged crypto assets is strengthening again. According to data from RWA.xyz, this represents a 324% increase compared to the $10.8 billion recorded in Q2.

Tether’s USDT remained the dominant player, capturing $19.6 billion in new inflows during the quarter. Circle’s USDC followed closely with $12.3 billion, marking a sharp rebound from just $500 million in the previous quarter. Meanwhile, Ethena’s synthetic stablecoin USDe emerged as a fast-rising contender, securing $9 billion in net inflows — up dramatically from only $200 million last quarter.

Smaller but notable contributors included PayPal’s PYUSD, which attracted $1.4 billion, and MakerDAO’s USDS, which added $1.3 billion in net inflows. Newer entrants like Ripple’s RLUSD and Ethena’s USDtb also showed steady early growth, suggesting that the stablecoin ecosystem is diversifying beyond traditional issuers.

Net inflows reflect the difference between stablecoins minted and redeemed, meaning the Q3 spike indicates more tokens entering circulation than leaving. The data signals strong investor appetite for stable assets amid ongoing market uncertainty and macroeconomic shifts.

Over the last six months, total stablecoin inflows reached $56.5 billion, with the majority coming from Q3. Tether has consistently dominated the sector, accounting for over half of new issuance across both quarters, while USDC’s revival shows increasing institutional and DeFi usage.

On the network side, Ethereum remains the primary blockchain for stablecoins, hosting around $171 billion in circulating supply. Tron follows with $76 billion, and Solana, Arbitrum, and BNB Chain combined hold roughly $29.7 billion, according to RWA.xyz.

When viewed by token, USDT commands nearly 59% of the market share, followed by USDC at 25% and USDe at 5%, per DefiLlama data. The overall stablecoin market capitalization has grown to about $290 billion in the last 30 days, solidifying stablecoins as a core pillar of the crypto economy.

However, not all metrics were positive. RWA.xyz reported that monthly active addresses dropped by 22.6% to 26 million, while transfer volume declined 11%, totaling $3.17 trillion. Analysts suggest that while investor capital continues to flow in, on-chain user activity has temporarily slowed, likely due to market consolidation and fewer speculative trades.

Final Thought

The third quarter of 2025 underscores the growing importance of stablecoins as the bridge between traditional finance and crypto. With USDT and USDC maintaining dominance and new entrants like USDe gaining traction, the stablecoin sector is becoming more competitive, liquid, and essential to digital asset markets. Even as user activity dips, the surge in capital inflows confirms that demand for blockchain-based dollars remains stronger than ever.