Visa Direct Tests USDC and EURC Stablecoins for Instant Global Transfers

Visa has begun testing stablecoins as cash equivalents for real-time international payments. The new Visa Direct pilot, launched at SIBOS 2025, allows financial institutions to use USDC and EURC for pre-funding cross-border transfers, aiming to make global money movement faster and more efficient.

- The program helps banks and remittance firms pre-fund cross-border payments with stablecoins.

- Visa treats stablecoins as cash equivalents to simplify global transactions.

- The move could reduce capital lock-up, cut currency risk, and modernize treasury flows.

- Visa has settled $225 million in stablecoin volume so far, with a broader rollout planned for 2026.

- The pilot follows similar blockchain initiatives from SWIFT and growing VC interest in crypto payment startups.

Visa is expanding its blockchain ambitions with a new stablecoin pilot program designed to improve the speed and efficiency of cross-border payments. Announced during SIBOS 2025, the Visa Direct stablecoin pilot allows participating banks and financial institutions to use Circle’s USDC and EURC stablecoins as pre-funded assets to send and receive money instantly across borders.

According to Chris Newkirk, president of commercial and money movement solutions at Visa, the global payments system has long relied on outdated infrastructure. “Cross-border payments have been stuck in outdated systems for far too long,” Newkirk said. He explained that integrating stablecoins into Visa’s network could modernize treasury operations, reduce capital constraints, and enable faster, round-the-clock payouts.

The pilot targets banks, remittance companies, and financial institutions that want to improve liquidity management. Instead of locking up cash across multiple payment corridors, participants can fund their Visa Direct accounts with stablecoins, which Visa treats as cash equivalents for initiating transfers.

This setup reduces the need for large pre-funded accounts in various currencies and helps institutions avoid delays caused by traditional clearing systems — especially during weekends or off-hours. Visa says the model could also lessen exposure to currency volatility and improve working capital efficiency.

To date, Visa has processed over $225 million in stablecoin transactions, a small figure compared to its $16 trillion annual payment volume, but one that highlights growing institutional interest. The company plans to expand the pilot in 2026 after initial testing with select partners.

The initiative comes amid broader momentum in blockchain-based settlement systems. Just a day earlier, SWIFT announced it was partnering with Consensys and over 30 major financial institutions to build its own real-time blockchain payment platform.

Meanwhile, venture funding in stablecoin infrastructure is also heating up. RedotPay, a stablecoin payments startup, recently reached unicorn status after raising $47 million in a round led by Coinbase Ventures, while Bastion, another infrastructure startup, secured $14.6 million from investors including Sony, Samsung Next, and Andreessen Horowitz.

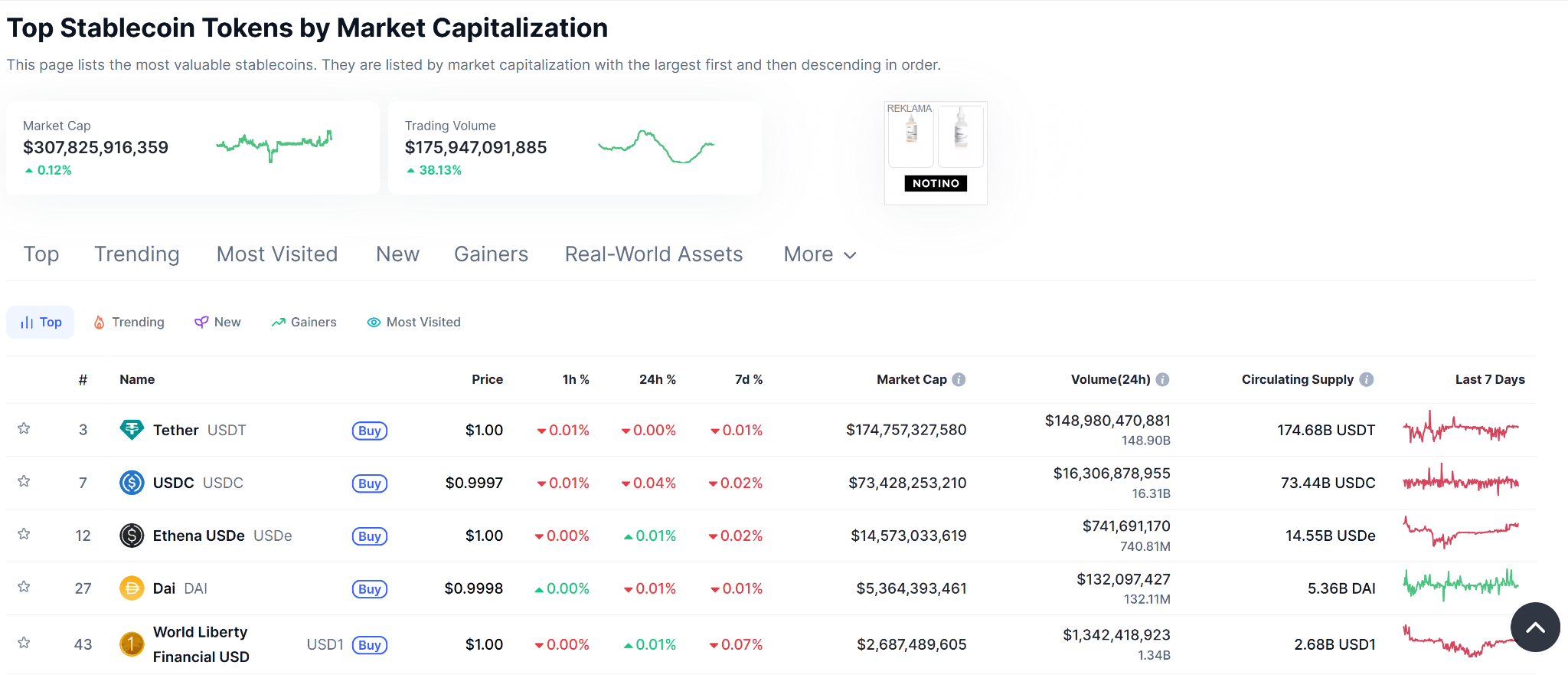

With the stablecoin market now exceeding $307 billion, Visa’s move underscores how traditional finance and blockchain technology are converging to reshape the future of money movement.

Final Thought

Visa’s pilot marks a major milestone for the global payments industry. By treating stablecoins like cash and integrating them into its Visa Direct network, the company is taking a clear step toward instant, borderless finance. If successful, this initiative could redefine how money moves between banks, businesses, and consumers around the world.