Judge Tosses Lawsuit Against Yuga Labs Over Howey Test

Key Takeaways

- Case Dismissed: A U.S. judge threw out the investor lawsuit against Yuga Labs, ruling its NFTs do not meet the Howey test.

- Collectibles, Not Securities: BAYC NFTs were marketed as membership-based digital collectibles, not investment products.

- No Common Enterprise: Buyers’ profits were not tied to Yuga’s ongoing operations, weakening the securities claim.

- No Profit Promises: Yuga did not explicitly assure buyers of profits, and references to value or volume were insufficient.

- Legal Precedent: The ruling strengthens the argument that NFTs, in most cases, should not be treated as securities under U.S. law.

The recent court ruling in the Yuga Labs Howey test case has drawn attention across the crypto and legal communities. A U.S. judge dismissed the investor lawsuit, concluding that Bored Ape Yacht Club NFTs and ApeCoin do not meet the legal definition of securities under the SEC’s framework. This decision not only resolves a high-profile dispute for Yuga Labs but also sets an important precedent for how NFTs are treated in U.S. law.

Court Rejects Claims That Yuga NFTs Are Securities

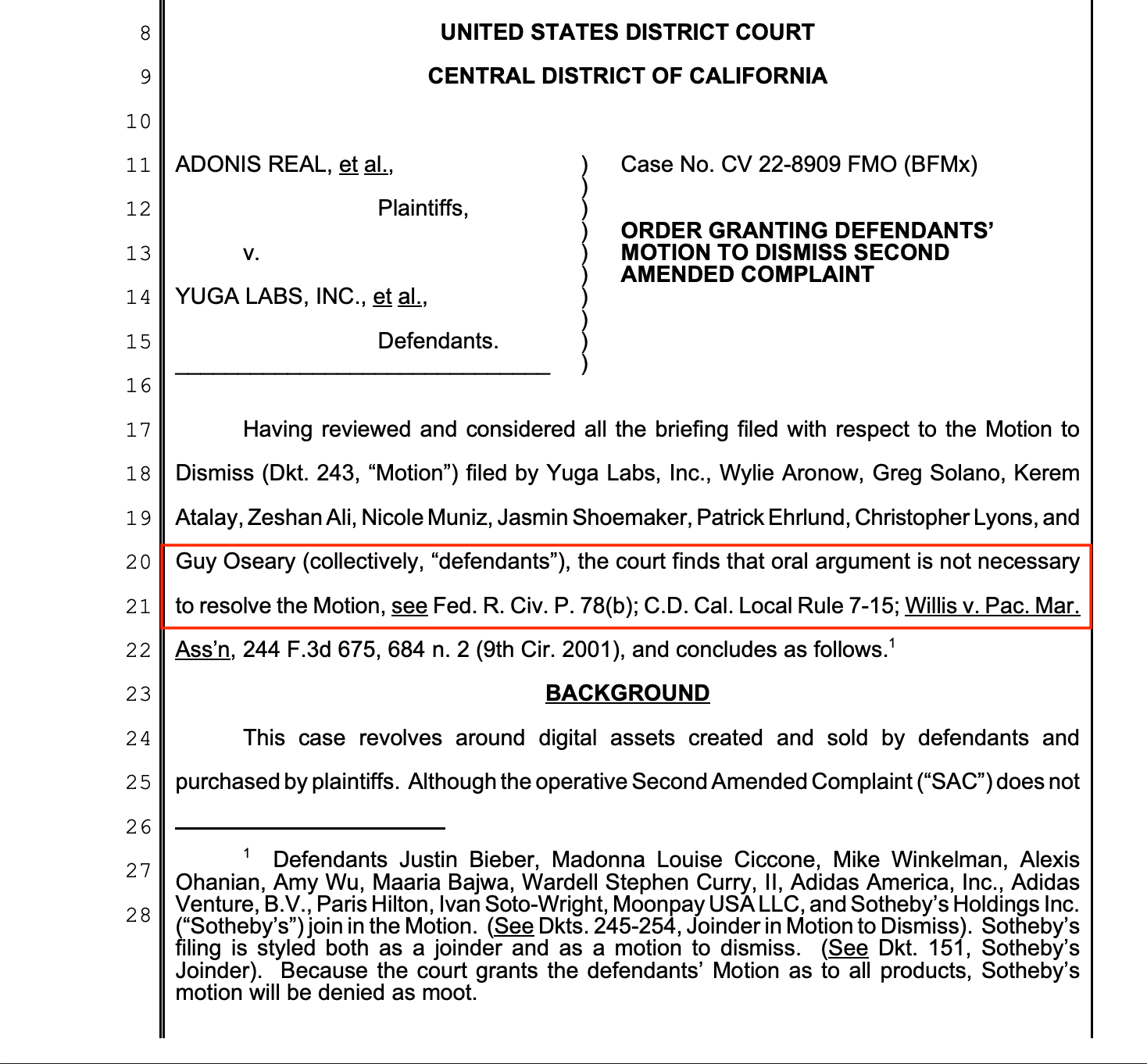

A long-running lawsuit targeting Yuga Labs, the Web3 company behind Bored Ape Yacht Club (BAYC), has been dismissed after a U.S. judge ruled that the plaintiffs failed to prove the company’s NFTs and ApeCoin qualified as securities.

Judge Fernando M. Olguin found that the case, first filed in 2022, did not demonstrate how the NFTs satisfied the conditions of the Howey test. The test, developed by the Securities and Exchange Commission (SEC), defines an investment contract as involving an investment of money in a common enterprise with the expectation of profit primarily from the efforts of others.

In his ruling, Olguin emphasized that Yuga marketed its NFTs as digital collectibles rather than investment products. The NFTs were presented with membership perks, such as exclusive access to events and communities, which aligned them more with consumables than financial assets.

“The fact that defendants promised that NFTs would confer future, as opposed to immediate, consumptive benefits does not alone transmute those benefits from consumptive to investment-like in nature,” Olguin wrote.

By framing NFTs as digital assets with social and entertainment value, the court concluded that Yuga Labs did not establish the necessary elements to transform them into securities under U.S. law.

No Common Enterprise, No Explicit Promise of Profit

The judge also addressed the question of whether the NFTs represented a “common enterprise,” one of the three prongs of the Howey test. According to Olguin, investors did not establish an ongoing financial relationship with Yuga Labs beyond their initial purchase. The NFTs traded on open blockchain networks, and their resale prices were determined by market activity rather than Yuga Labs direct control.

Legal experts noted the ruling reinforces the idea that most NFTs cannot be easily categorized as securities. Bill Hughes, an attorney at Consensys, commented that buyers paid a fee to Yuga at the point of sale, but NFT prices in the secondary market operated independently of the company. This undermined the claim that there was a financial enterprise linking investors’ profits to Yuga’s management.

Olguin further ruled that Yuga Labs did not make explicit promises of profit to potential buyers. Statements about NFT value, price trends, or trading volumes were not enough to establish the expectation of profit under securities law. “Statements about a product’s inherent or intrinsic value are not necessarily statements about profit,” the judge said.

He acknowledged that references to prices and trade volumes could appear closer to investment language, but concluded that such comments still failed to prove an expectation of profit. Without clear assurances from Yuga Labs that investors would financially benefit from their purchases, the lawsuit could not move forward.

The dismissal adds to the growing body of legal precedent suggesting that digital collectibles fall outside the SEC’s securities framework. While regulators continue to explore how to apply existing financial laws to crypto assets, this decision signals that courts may be reluctant to extend securities classifications to NFTs without stronger evidence of investor reliance on issuers’ promises.

For Yuga Labs, the ruling removes a significant legal challenge. The company remains one of the most recognized names in Web3, with its Bored Ape Yacht Club collection serving as a cultural touchstone in the NFT boom. The dismissal may also influence how future cases involving NFTs are argued, particularly as questions around regulation, consumer protection, and speculative trading persist.