Aging Boomers and Global Wealth Could Drive Bitcoin and Crypto Growth Until 2100

Aging populations and rising global wealth could sustain cryptocurrency demand well into the next century, as investors seek alternatives like Bitcoin amid declining real interest rates and expanding asset markets, according to new Federal Reserve projections.

- Aging populations and rising wealth will drive asset demand — including crypto — through 2100, per the Federal Reserve Bank of Kansas City.

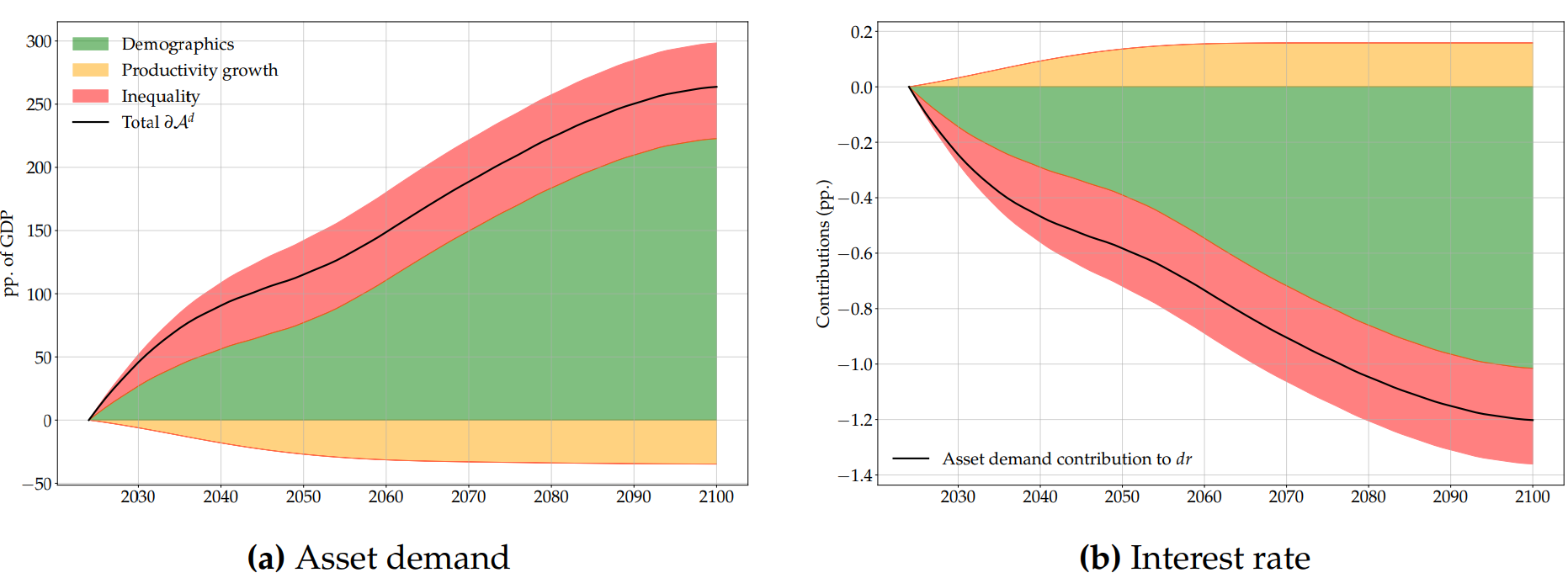

- The Fed projects global asset demand to rise by 200% of GDP between 2024 and 2100.

- Lower real interest rates could increase appetite for alternative assets like Bitcoin.

- Older generations may begin valuing Bitcoin like gold as regulatory clarity and ETFs mature.

- Rising global wealth is expected to fuel diversification into emerging asset classes, including crypto.

- Younger investors remain more open to altcoins and new crypto projects, given their tech literacy and risk appetite.

A recent Federal Reserve Bank of Kansas City report suggests that global aging and rising wealth will keep driving investment demand — including for cryptocurrencies — until the year 2100. The study projects that as populations grow older and accumulate more wealth, there will be a sustained need for investment assets, both traditional and digital.

According to the report, the demographic shift means that “the upward trend in asset demand from recent decades will continue,” with projections showing an increase of 200% of global GDP in asset demand between 2024 and 2100. This growing appetite, the report adds, could lead to a continued decline in real interest rates, which historically pushes investors toward alternative stores of value such as Bitcoin and other cryptocurrencies.

While crypto remains volatile, the broader economic environment could make it more appealing to long-term investors. Bitget CEO Gracy Chen told Cointelegraph that as the market matures and regulations become clearer, older investors could start treating Bitcoin like gold within the next 75 years. “The maturity of crypto regulations being worked on at the moment can play a good role in fueling future demand for the asset class,” Chen said.

She added that crypto’s increasing government acceptance and role as a store of value make it a natural hedge for an aging world looking for capital preservation. According to Triple-A’s December 2024 data, about 34% of global crypto holders are aged between 24 and 35, suggesting significant room for demographic expansion as the older generations enter the market.

Data from Bybit Research also shows that Bitcoin now represents nearly one-third (30.95%) of total investor portfolios, up from 25.4% just months earlier — highlighting its strengthening position among global investors.

Meanwhile, analysts from Bitfinex predict that growing personal wealth will directly translate into higher risk tolerance and diversification toward newer asset classes. “Increasing personal wealth increases diversification into newer assets, as risk appetite develops,” the analysts said. They emphasized that wealthier investors with longer horizons are more likely to hold Bitcoin, while younger, tech-savvy investors will continue to explore altcoins and experimental crypto projects.

This generational blend — older investors seeking safe digital stores of value and younger investors embracing innovation — could ensure long-term demand for crypto assets, supporting market growth for decades to come.

Final Thought

As the world ages and wealth accumulates, the financial landscape may tilt toward alternative, decentralized assets like Bitcoin. With growing institutional adoption and regulatory maturity, crypto could evolve from a speculative asset into a core component of global investment portfolios through 2100.