US Government Shutdown Halts Crypto Progress as SEC Freezes Operations

The ongoing US federal government shutdown has put crypto policy and innovation on hold, with the Securities and Exchange Commission (SEC) halting key initiatives, including exemptive relief for tokenized assets, according to TD Cowen.

- US government shutdown halts SEC operations and crypto-related progress.

- SEC’s exemptive relief for tokenized equities and new crypto products paused indefinitely.

- TD Cowen warns that recovery from the shutdown could cause further delays even after reopening.

- SEC’s limited staffing means no progress on ETF approvals or regulatory clarity for crypto.

- Focus temporarily shifts to other regulators like the Fed, OCC, and FDIC, which remain operational.

- Analysts will monitor how banks handle stablecoins, custody, and tokenized payment systems during the freeze.

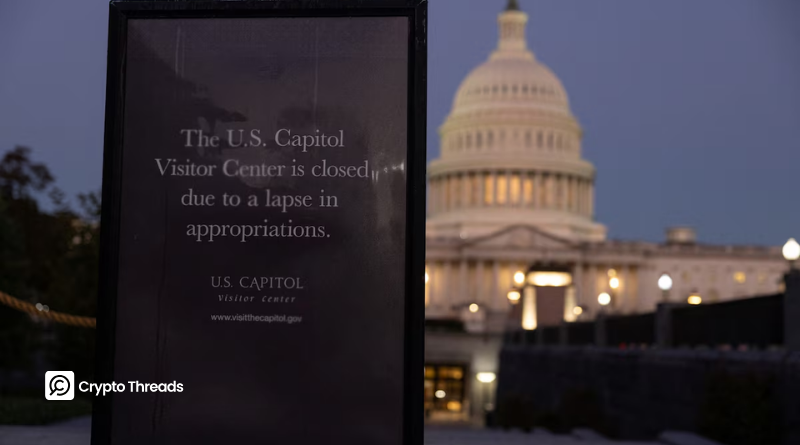

The latest US federal government shutdown has effectively stalled progress for the cryptocurrency industry, as federal agencies like the Securities and Exchange Commission (SEC) halt operations. According to TD Cowen’s Washington Research Group, led by Jaret Seiberg, the SEC will not be able to resume work on any crypto policy changes until Congress reaches a funding deal.

The shutdown, which began after lawmakers failed to agree on a budget, has furloughed thousands of federal employees and left agencies operating with only a skeleton crew. As a result, all ongoing discussions around exemptive relief for new crypto products and tokenized equity initiatives have been frozen. TD Cowen noted that the SEC’s crypto policy agenda — particularly around tokenization and market structure reforms — has been put “on ice.”

Seiberg emphasized that this disruption will have long-term consequences. “It’s not just a delay equal to the number of days the government is shut down,” he explained. “Once staff returns, they’ll face a backlog of unresolved issues and must restart work on crypto policies from scratch.”

The SEC currently operates under a contingency plan, maintaining only a minimal number of staff for emergency purposes. This has also halted movement on pending crypto exchange-traded fund (ETF) approvals, several of which were expected to receive clearance soon. Without active regulators, market innovation and compliance clarity for the crypto sector will likely stagnate.

With the SEC “effectively closed,” the regulatory spotlight temporarily shifts to other federal bodies — the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) — which remain functional during the shutdown. Analysts at TD Cowen said attention will now turn to banking institutions, particularly regarding stablecoin issuance, crypto custody, and tokenized payment systems.

Still, the halt comes at a sensitive time for the crypto industry, which has been awaiting regulatory breakthroughs on tokenized assets and stablecoin frameworks. The pause threatens to delay momentum further just as institutional interest in digital assets continues to rise.

Final Thought

The federal shutdown underscores how dependent the crypto sector remains on regulatory clarity and government coordination. With the SEC frozen, crypto policy in the US faces another setback, prolonging uncertainty for investors and innovators. Unless Congress acts quickly, America’s leadership in digital asset innovation may fall further behind.