US National Debt Soars by $6 Billion Daily, Pushing Investors Toward Bitcoin

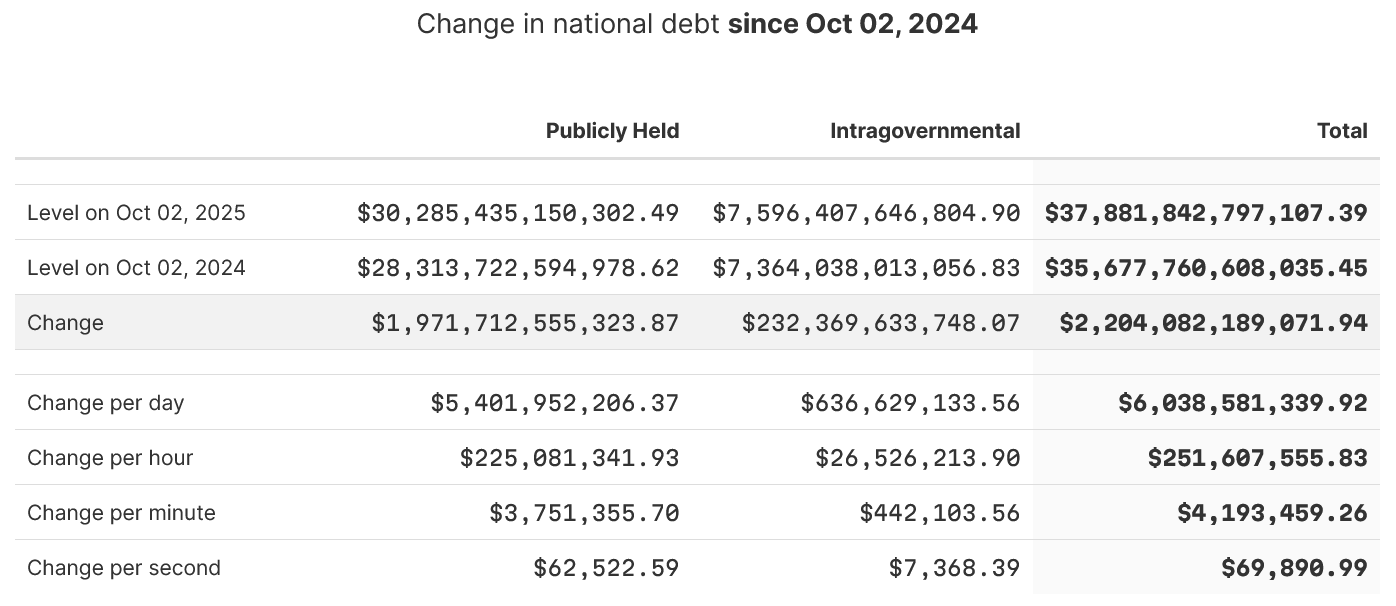

The United States national debt is climbing at a record pace — nearly $6 billion per day — and is on track to surpass $38 trillion within weeks. The mounting debt crisis is pushing investors to hedge with assets like Bitcoin and gold.

- US national debt grows by about $6 billion every day.

- Total debt stands at $37.9 trillion and could hit $50 trillion in a decade.

- Investors are moving toward Bitcoin and gold as safe havens.

- Analysts warn of global “debt doom loops” as worldwide debt nears $338 trillion.

America’s national debt has reached a staggering $37.9 trillion, growing by nearly $70,000 every second, according to the US Congress Joint Economic Committee. This pace equals roughly $4.2 million per minute or $6 billion every day — a figure larger than the GDP of more than 30 countries. Lawmakers warn the country could surpass $38 trillion in just weeks, with projections suggesting it may reach $50 trillion within a decade if spending continues unchecked.

Representative Keith Self urged immediate fiscal reforms, warning that without action, the gradual climb could become a sudden financial collapse. His comments come as investors increasingly seek protection from economic uncertainty through alternative assets such as Bitcoin and gold.

Both assets recently hit new highs — Bitcoin reached $125,506 while gold touched $3,920. JPMorgan analysts described the pair as part of a “debasement trade,” as the weakening US dollar and rising inflation drive demand for store-of-value assets. Bitcoin’s limited supply and independence from central banks make it particularly attractive to institutional investors.

Major figures like BlackRock CEO Larry Fink and Bridgewater founder Ray Dalio have also voiced support for Bitcoin as a hedge against currency debasement. Fink predicted the cryptocurrency could reach $700,000 in the long term, while Dalio recommended that investors allocate up to 15% of their portfolios to hard assets like Bitcoin and gold.

The debt crisis isn’t limited to the US. Global debt has surged to a record $337.7 trillion, fueled by loose monetary policies and a softening dollar. Experts warn that many Western nations, including the UK, face similar risks of a “debt doom loop” — where rising interest expenses and government borrowing reinforce each other.

While the Trump administration has sought to curb spending, progress remains limited. Efforts to trim federal budgets through the Department of Government Efficiency reportedly saved $214 billion, but new legislation, including the “Big Beautiful Bill Act,” added to overall spending and debt obligations.

Final Thought

As the US debt nears unprecedented levels, investors are increasingly looking beyond traditional markets. With faith in fiat currencies fading, assets like Bitcoin and gold are emerging as preferred shelters against inflation, government spending, and long-term debt instability.