Ethereum’s ‘Spooky’ Stock Correlation Signals a Major Breakout Ahead

Ethereum’s price is moving almost identically to small-cap U.S. stocks, and analysts believe this correlation could set the stage for a big rally. With multiple Federal Reserve rate cuts expected, both assets could surge together in the coming weeks.

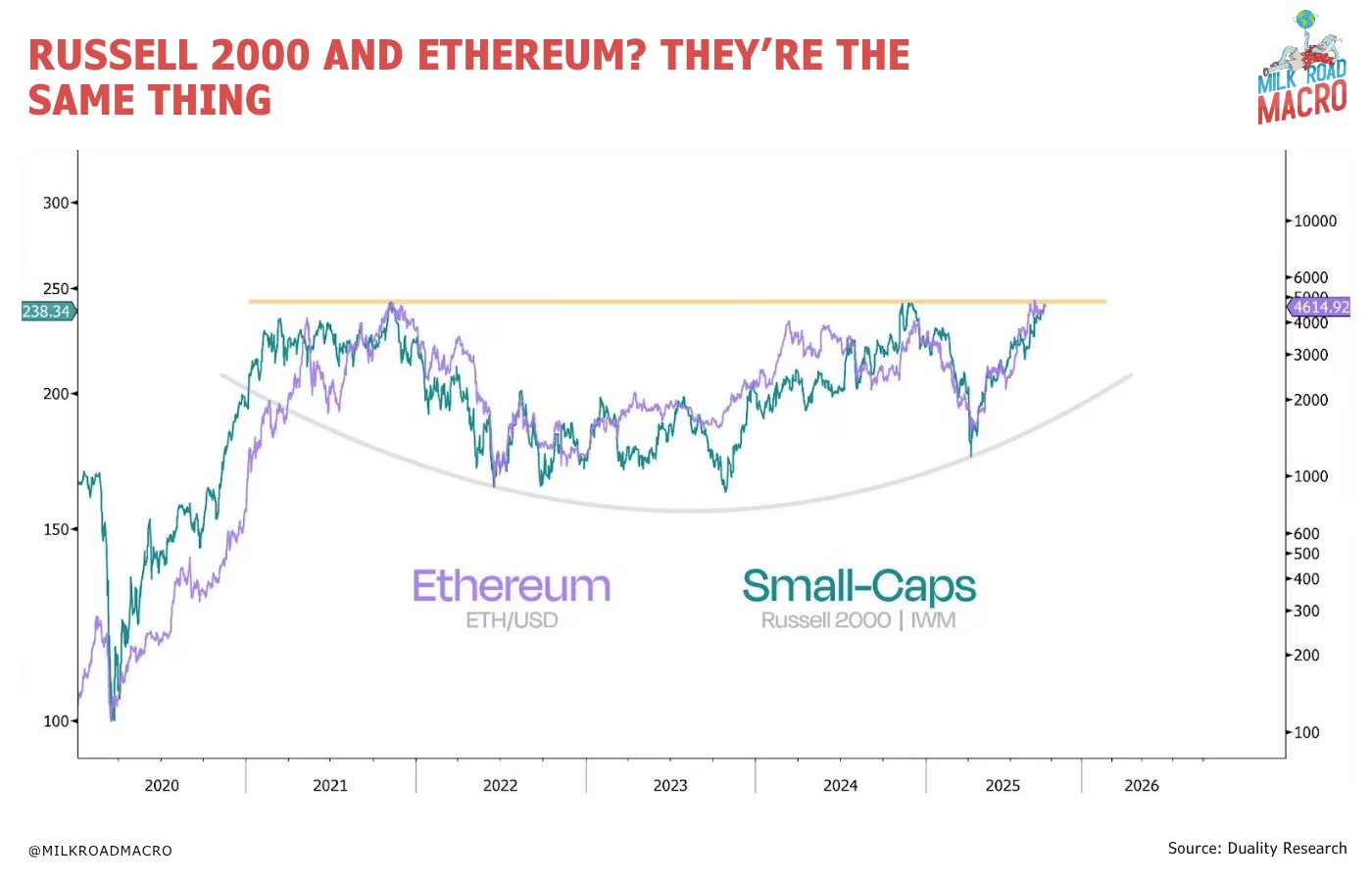

- Ethereum’s price is closely mirroring the Russell 2000 Index, a small-cap stock benchmark.

- Analysts predict up to four Fed rate cuts, boosting risk assets like ETH.

- Ethereum’s chart shows a bullish cup-and-handle pattern signaling a potential breakout.

- Experts say easing monetary policy could drive rotation into crypto and risk assets.

- ETH could soon reach $5,200 to $8,500, according to traders.

Ethereum’s price movements are showing what analysts are calling a “spooky” correlation with small-cap U.S. equities, especially the Russell 2000 Index, which tracks 2,000 smaller U.S. companies. Both Ethereum and small-cap stocks tend to react strongly to interest rate changes, and with several Federal Reserve rate cuts possibly on the horizon, experts believe they could rise together.

According to macro analysts at Milk Road, this near-identical price behavior between ETH and the Russell 2000 highlights how both assets thrive in lower-rate environments. “Expect both of them to move up in tandem,” they said, noting the potential for as many as four consecutive rate cuts through the end of the year. Futures markets currently give a 95.7% chance of a 0.25% rate cut in late October and an 82.2% chance of another in December.

“Unlike Bitcoin, Ether generates yield, and that matters a lot in a world where rate cuts are practically guaranteed,” said Justin d’Anethan from Arctic Digital. Analysts also observed that ETH and the Russell 2000 are forming a cup-and-handle pattern, a bullish setup that often leads to a major breakout.

Crypto trader Michaël van de Poppe said ETH is poised for a new rally for two key reasons. The ETH/BTC pair appears to have bottomed after a healthy correction, and gold’s parabolic rise above $4,000 per ounce may reverse soon, pushing investors toward riskier assets like crypto. “If central banks globally move into easing mode, there’s a strong case for capital rotating into risk assets with upside, and ETH fits that profile,” added d’Anethan.

Market analysts such as Matt Hughes predict that Ethereum is preparing for its next all-time high, as long as it maintains support above $4,350. Hughes targets $5,200 for the next major move, while others, like analyst “Poseidon,” see a potential cycle top near $8,500.

Despite a brief 6% dip to $4,430, Ethereum remains in a strong technical position, showing stability above critical support levels and renewed investor optimism ahead of potential Fed action.

Final Thought

Ethereum’s strong link to interest-sensitive stocks and its bullish technical patterns suggest that a major move could be imminent. If rate cuts materialize as expected, Ethereum may be among the top-performing assets of the next market cycle.