Arthur Hayes Says the 4-Year Bitcoin Cycle Is Dead

BitMEX co-founder Arthur Hayes believes the famous four-year Bitcoin cycle is over — but not because of halvings or market timing. Instead, he argues that global monetary policy, not crypto-specific events, now dictates Bitcoin’s price movements.

- Arthur Hayes claims Bitcoin cycles follow liquidity, not halving timelines.

- The current cycle differs due to US monetary easing and Chinese policy shifts.

- Rate cuts and liquidity injections could keep Bitcoin’s rally alive longer.

- China’s focus on ending deflation removes a major bearish factor.

- Hayes concludes: “The king is dead, long live the king.”

Arthur Hayes, co-founder of the crypto exchange BitMEX, has declared that Bitcoin’s traditional four-year cycle — once seen as the backbone of crypto market behavior — is “dead.” But according to Hayes, the change has nothing to do with halvings or institutional hype.

In a recent blog post, Hayes wrote that past Bitcoin cycles have always been tied to monetary conditions, particularly in the United States and China, rather than any built-in time pattern. “Traders are trying to fit old frameworks to a new reality,” he said, explaining that liquidity — the amount of money in circulation — has always been the key driver.

Historically, Bitcoin’s major bull runs have ended when central banks tightened monetary policy. For example:

- The first bull run in 2013 ended when both the Fed and China reduced money printing.

- The ICO boom of 2017 collapsed when Chinese credit growth slowed.

- The 2021 cycle ended when the Federal Reserve began raising rates after COVID-era stimulus.

According to Hayes, this time is different. The US Treasury has injected more than $2.5 trillion into markets, while President Donald Trump is pushing for easier money to stimulate growth. Meanwhile, the Federal Reserve is cutting rates even though inflation remains above target — with 94% odds of another cut in October and 80% odds in December, based on CME futures data.

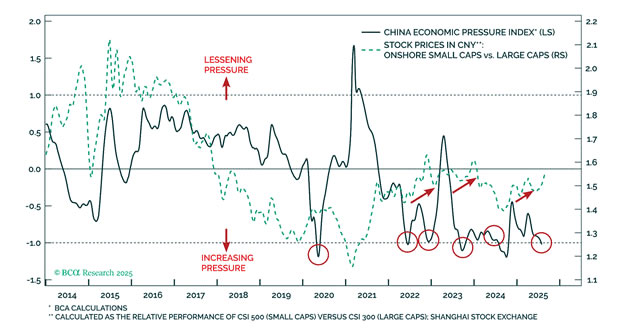

At the same time, China — which once drained global liquidity — is now trying to reverse deflation, creating a monetary environment that could prolong Bitcoin’s rally. “Our monetary masters in Washington and Beijing clearly state that money shall be cheaper and more plentiful,” Hayes said. “Therefore, Bitcoin continues to rise.”

In short, he believes macro liquidity, not halving cycles, determines Bitcoin’s trajectory. As long as central banks keep printing, Bitcoin will keep climbing.

However, not everyone agrees. Glassnode and Gemini’s Saad Ahmed argue that Bitcoin’s four-year rhythm still has merit, as investor psychology and supply shocks remain cyclical — even if macro forces play a stronger role than before.

Final Thought

Arthur Hayes’s bold claim reframes Bitcoin as a reflection of global monetary expansion rather than a predictable halving cycle. Whether this new paradigm holds will depend on the next round of Federal Reserve decisions — and whether global liquidity keeps flowing into crypto markets