Institutions to Double Digital Asset Allocations by 2028, Says State Street

Institutional investors are significantly increasing their exposure to digital assets, blockchain, and AI, according to a new report from State Street. The study forecasts that digital assets will make up 16% of institutional portfolios by 2028, more than double current levels.

- Digital assets account for 7% of portfolios today, expected to rise to 16% by 2028.

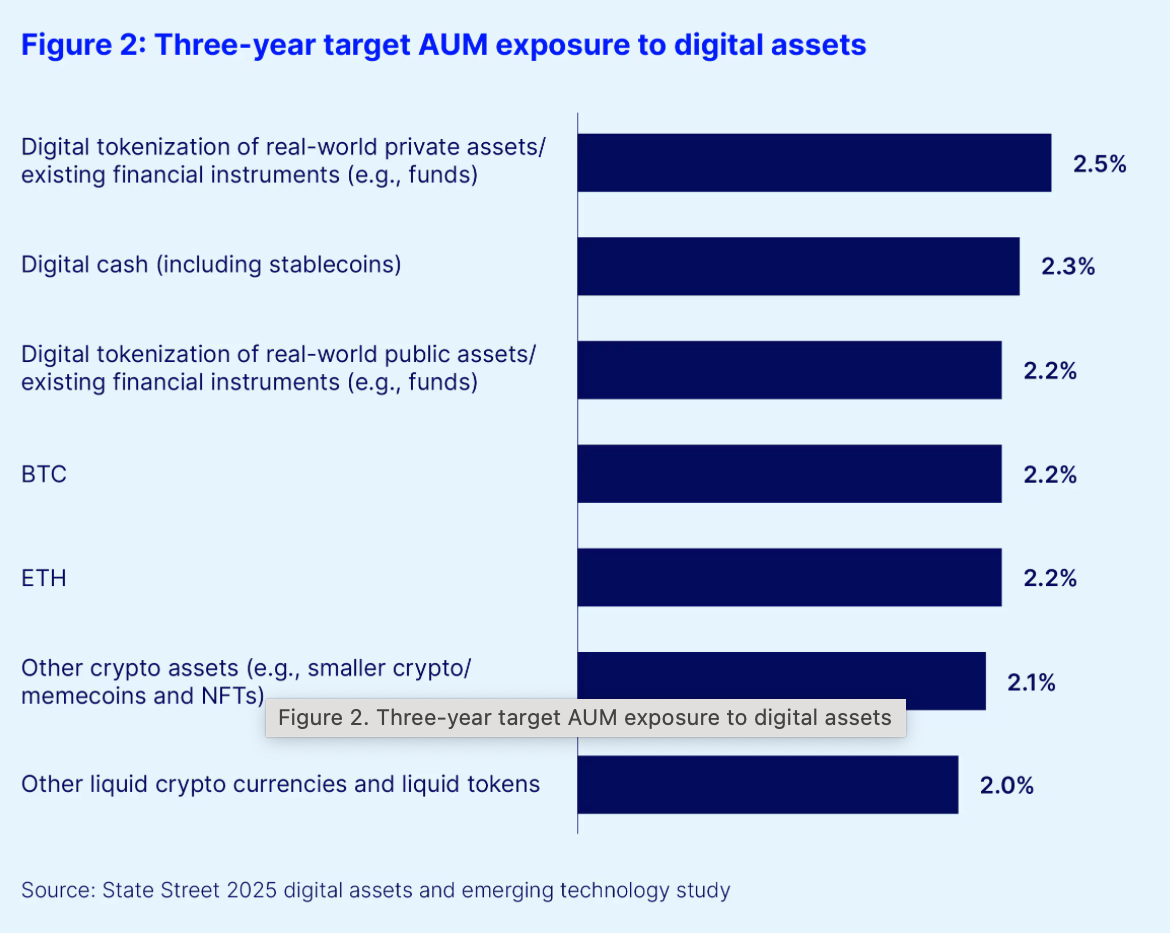

- Stablecoins and tokenized assets lead institutional exposure.

- Bitcoin and Ethereum cited as top-performing assets.

- 29% of firms view blockchain as integral to digital transformation.

- 45% believe AI will accelerate blockchain and digital asset growth.

- 43% expect hybrid DeFi-TradFi models to dominate within five years.

The new State Street survey shows a clear shift among global investors toward digital and tokenized assets. On average, institutions now hold around 7% of their portfolios in digital assets, but that figure is projected to more than double to 16% by 2028. The increase reflects a broader movement toward blockchain-based finance and tokenization, even as full onchain adoption remains limited.

Currently, institutional exposure is concentrated in stablecoins and tokenized securities, such as tokenized equities and fixed-income assets. Each makes up roughly 1% of total portfolios. While stablecoins are favored for liquidity and regulatory clarity, cryptocurrencies like Bitcoin and Ethereum continue to outperform, with 27% of investors naming Bitcoin as the top performer and 21% selecting Ethereum.

The report, created in partnership with Oxford Economics, surveyed over 300 institutional investors about their use of digital assets, AI, and blockchain. Participants also indicated that private markets — including tokenized real estate, credit, and funds — are likely to benefit first from blockchain adoption. Still, most investors foresee a slow and steady transition, with only 1% expecting most investments to move entirely onchain by 2030.

Beyond crypto exposure, institutions are adopting blockchain and artificial intelligence (AI) as core components of digital transformation strategies. Nearly all respondents said they are using these technologies to automate processes and improve interoperability. Around 29% identified blockchain as central to their strategy, while many are already applying it to cash flow management (61%), business data operations (60%), and legal or compliance functions (31%).

AI is also viewed as a critical catalyst for blockchain innovation. Nearly half (45%) of respondents believe that generative AI will accelerate the development of smart contracts, blockchains, and tokenized assets, enabling faster and safer digital transformation.

Still, not all investors expect blockchain to fully replace traditional systems. 43% predict that hybrid models combining decentralized and traditional finance will become the norm within the next five years, up sharply from just 11% last year. Conversely, 14% say blockchain-based investment systems will never fully replace traditional trading and custody infrastructure.

Final Thought

The findings highlight a maturing market where institutions are scaling up digital asset exposure while maintaining a balanced, hybrid approach. Blockchain and AI are becoming essential tools for efficiency and innovation, but traditional systems aren’t disappearing — they’re evolving to work alongside decentralized technology.