Explanations of USDe ‘Depeg’ on Binance Point to Coordinated Attack and Oracle Glitch

The sudden USDe stablecoin depeg on Binance, which saw its price plummet to $0.65, was caused by an internal oracle malfunction — not a fundamental flaw, according to Ethena Labs founder Guy Young. The event, however, has sparked speculation that the crash may have been part of a coordinated attack.

- USDe dropped to $0.65 on Binance but remained stable on other exchanges.

- Ethena’s founder blamed the issue on Binance’s internal oracle, not USDe’s collateral.

- Over $2 billion USDe was redeemed within 24 hours with minimal slippage.

- Traders suspect a coordinated exploit using Binance’s “Unified Account” feature.

- The crash contributed to a $20 billion crypto liquidation, the largest ever.

- Binance will switch to external oracles by October 14 to prevent future issues.

A sharp depegging of the USDe synthetic dollar on Binance has triggered widespread debate across the crypto community. The token, issued by Ethena Labs, dropped to $0.65 on Friday in what many initially feared was a system-wide failure. However, Ethena’s founder Guy Young clarified that the issue was isolated to Binance’s internal oracle system and had no connection to the underlying protocol or collateral.

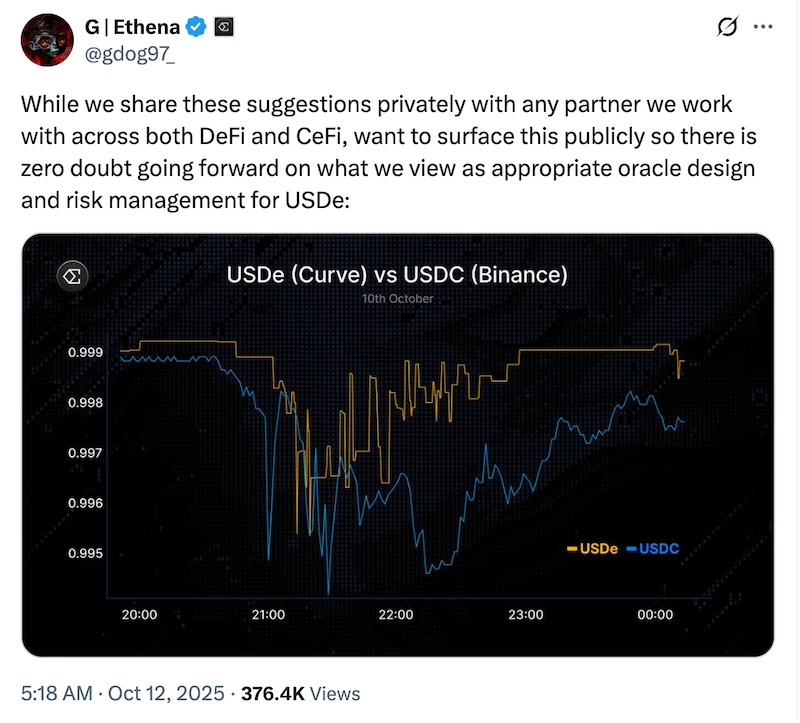

Young explained that USDe minting and redemptions continued to function smoothly throughout the incident. In the 24 hours following the event, users redeemed $2 billion in USDe across exchanges such as Curve, Fluid, and Uniswap, with price variations contained within 30 basis points.

“The severe price discrepancy was isolated to a single venue,” Young said, noting that Binance’s oracle referenced its own thin orderbook instead of external data sources. This, combined with temporary deposit and withdrawal issues, prevented market makers from stabilizing the price quickly.

While the glitch was localized, it occurred amid one of the largest liquidation events in crypto history, wiping out more than $20 billion in leveraged positions. Some traders suggested that this could have been more than coincidence.

According to crypto analyst ElonTrades, the incident might have been a coordinated attack exploiting Binance’s Unified Account feature, which allows users to post USDe as collateral based on the exchange’s own orderbook prices. By dumping around $90 million worth of USDe, attackers allegedly pushed the token’s price down and triggered a chain of forced liquidations.

At the same time, the attackers reportedly shorted Bitcoin and Ether on Hyperliquid, a decentralized futures platform. When President Trump announced 100% tariffs on China minutes later, market panic amplified the losses, helping the attackers profit an estimated $192 million from their short positions.

Binance has since confirmed that it will transition its collateral system to rely on external oracle feeds by October 14, addressing the vulnerability that enabled the attack. The episode has reignited calls from industry leaders, including Crypto.com CEO Kris Marszalek, for a formal investigation into exchanges that suffered major losses during the crash.

Final Thought

The USDe incident highlights how fragile on-chain and exchange infrastructure can become when oracle design flaws meet extreme volatility. While Ethena’s fundamentals appear unaffected, the event serves as a stark reminder that even stablecoins can be destabilized by external mechanisms — and that better oracle transparency is essential to protect traders in an increasingly interconnected market.