US Government Shutdown Enters Third Week as Crypto ETF ‘Floodgates’ Wait to Open

The U.S. government shutdown has entered its third week, putting the approval of 16 pending crypto exchange-traded funds (ETFs) on hold. With deadlines passing and no decisions from the Securities and Exchange Commission (SEC), analysts say the crypto industry is anxiously awaiting what could be a historic wave of ETF launches once operations resume.

- The U.S. government shutdown began on Oct. 1, halting key agencies like the SEC.

- At least 16 crypto ETFs are awaiting final approval, with 21 new filings added in early October.

- ETFs cover major altcoins including Solana, XRP, Litecoin, and Dogecoin.

- The shutdown stalemate continues as Republicans and Democrats clash over spending priorities.

- Republicans demand budget cuts and border funding; Democrats seek healthcare and tax credit extensions.

- ETF analyst Nate Geraci predicts mass approvals once the government reopens.

- Analysts say ETF approvals could ignite the next altcoin season.

The U.S. government entered its third week of shutdown, bringing critical operations to a standstill — including those of the Securities and Exchange Commission (SEC), the regulatory body responsible for approving new crypto ETFs. As a result, 16 exchange-traded fund applications are now frozen in limbo, with their deadlines passing amid the political impasse.

The shutdown began on October 1, after lawmakers failed to agree on a funding bill. With Republicans and Democrats locked in a budget battle, most federal agencies are now running with only essential staff. This means ETF-related reviews, communications, and approvals have all stalled, delaying what many had dubbed the “ETF floodgate month.”

The SEC was expected to decide on at least 16 crypto ETFs in October, covering assets such as Bitcoin, Solana, XRP, Litecoin, and Dogecoin. An additional 21 applications were filed in just the first eight days of the month, signaling a surge in institutional interest. However, the ongoing shutdown has paused all progress.

There is no clear resolution in sight. Republicans have demanded spending rollbacks to reduce the $37.8 trillion national debt (roughly $111,000 per U.S. citizen) and additional funding for border enforcement. Democrats, meanwhile, oppose healthcare cuts and want extensions of expiring tax credits that make health insurance more affordable.

Both chambers of Congress — the House of Representatives and the Senate — must approve new funding legislation or a continuing resolution to reopen the government. Even though Republicans control both chambers, they currently lack enough Senate votes to pass spending bills without bipartisan support.

If passed, the bills would move to President Donald Trump, who would then need to sign them into law to end the shutdown.

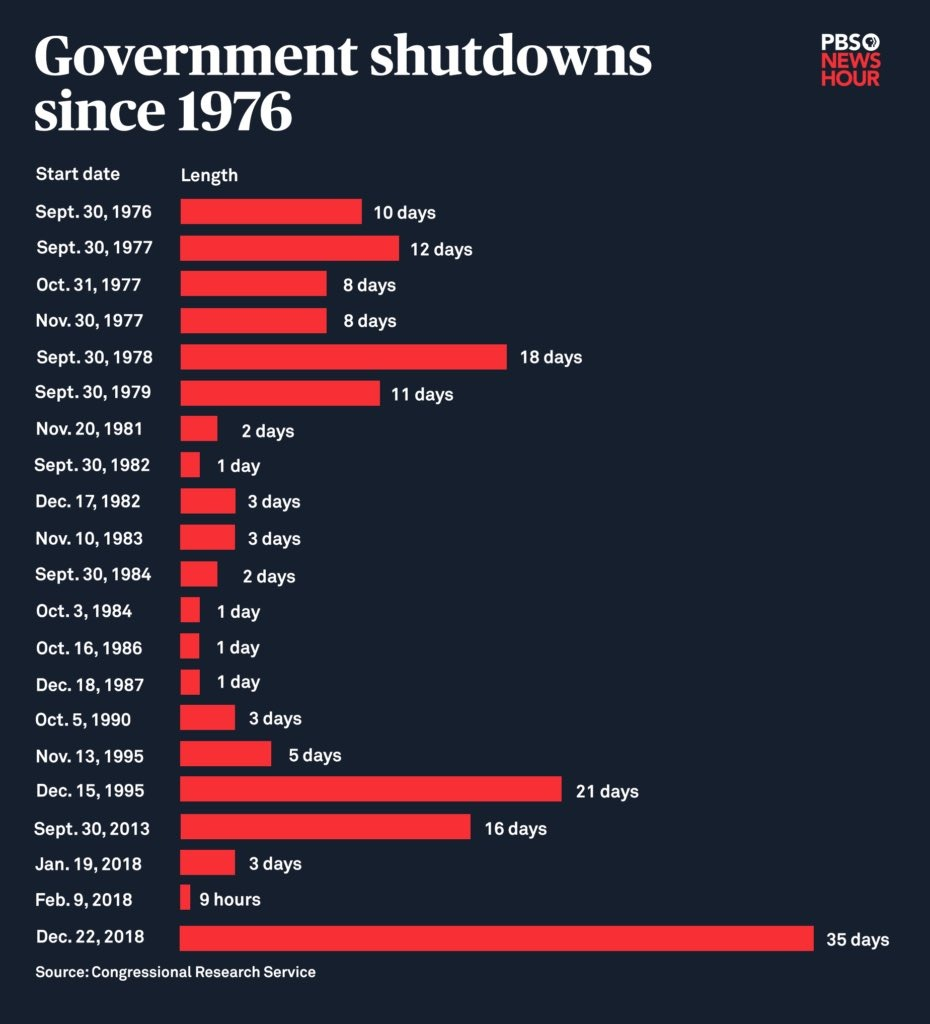

This marks the 11th shutdown in U.S. history and the first since 2018–2019, which lasted 35 days — the longest on record.

ETF and Market Outlook

ETF experts say that when the government finally reopens, a flood of approvals could immediately follow. Nate Geraci, president of NovaDius Wealth Management, predicted on X that “once the government shutdown ends, spot crypto ETF floodgates open,” with a wave of mass approvals likely to hit.

“Ironic that growing fiscal debt & usual political theater are holding these up — exactly what crypto is targeting,” Geraci added.

Bitfinex analysts had previously forecast that a series of ETF approvals could trigger a new altcoin season, as traditional investors gain safer exposure to digital assets through regulated instruments. Such ETFs, they argue, would reduce barriers to entry and attract new institutional capital.

Final Thought

As the political stalemate drags on, the crypto industry waits in suspense. The shutdown has effectively paused one of the most anticipated regulatory moments in crypto history — but when it ends, experts believe the “ETF floodgates” could open wide, potentially sparking the next big wave in altcoin growth and institutional adoption.