$19B Crypto Crash Was ‘Controlled Deleveraging,’ Not a Market Meltdown

The record $19 billion crypto market liquidation on Friday has left traders divided. While some accused market makers of triggering a coordinated sell-off, blockchain data analysts insist it was mainly an organic deleveraging event — a necessary reset after months of leveraged trading buildup.

- Friday’s flash crash erased $19 billion in leveraged positions, a record single-day wipeout.

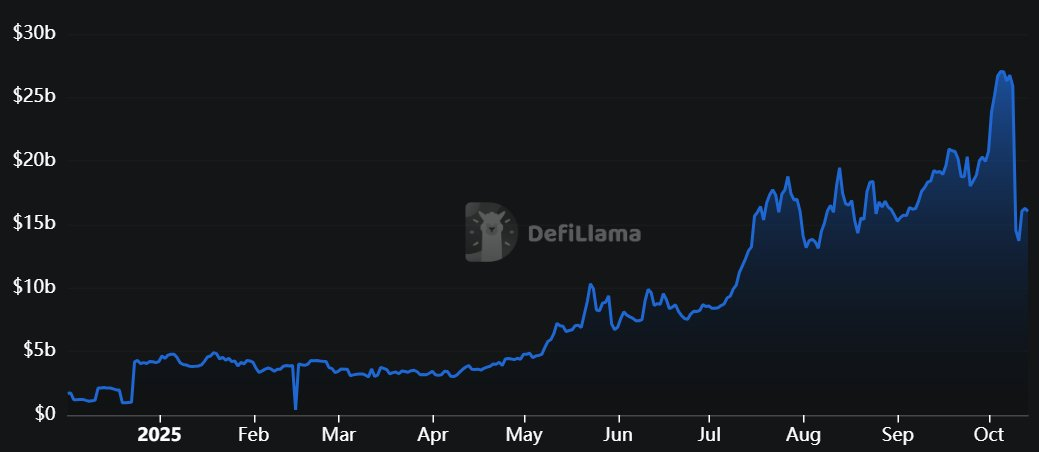

- Open interest dropped from $26B to $14B across decentralized exchanges.

- Analysts say 93% of the drop was a “controlled deleveraging,” not panic selling.

- Lending protocol fees hit a record $20 million in one day.

- Some traders accused market makers of pulling liquidity during the crash.

- Binance and other exchanges saw 98% collapses in market depth, worsening volatility.

Friday’s dramatic crypto crash, which saw over $19 billion in liquidations, has divided the trading community. Some argue it was the result of orchestrated market manipulation, while others — including onchain analysts — say the event was a natural correction after an overheated market.

According to data from DefiLlama, open interest on perpetual futures across decentralized exchanges plunged from $26 billion to under $14 billion within hours. Simultaneously, crypto lending protocol fees surged to more than $20 million, marking an all-time high, and weekly decentralized exchange (DEX) volumes surpassed $177 billion. The total borrowed across lending platforms fell below $60 billion for the first time since August.

Despite the chaos, CryptoQuant analyst Axel Adler Jr said the correction showed market maturity rather than collapse. He explained that of the $14 billion open interest wiped out, 93% represented controlled deleveraging, not cascading liquidations.

“Only about $1 billion in Bitcoin long positions were liquidated,” Adler noted, calling it a “very mature moment for Bitcoin.” This suggests most traders were voluntarily closing positions to manage risk rather than being forcibly liquidated.

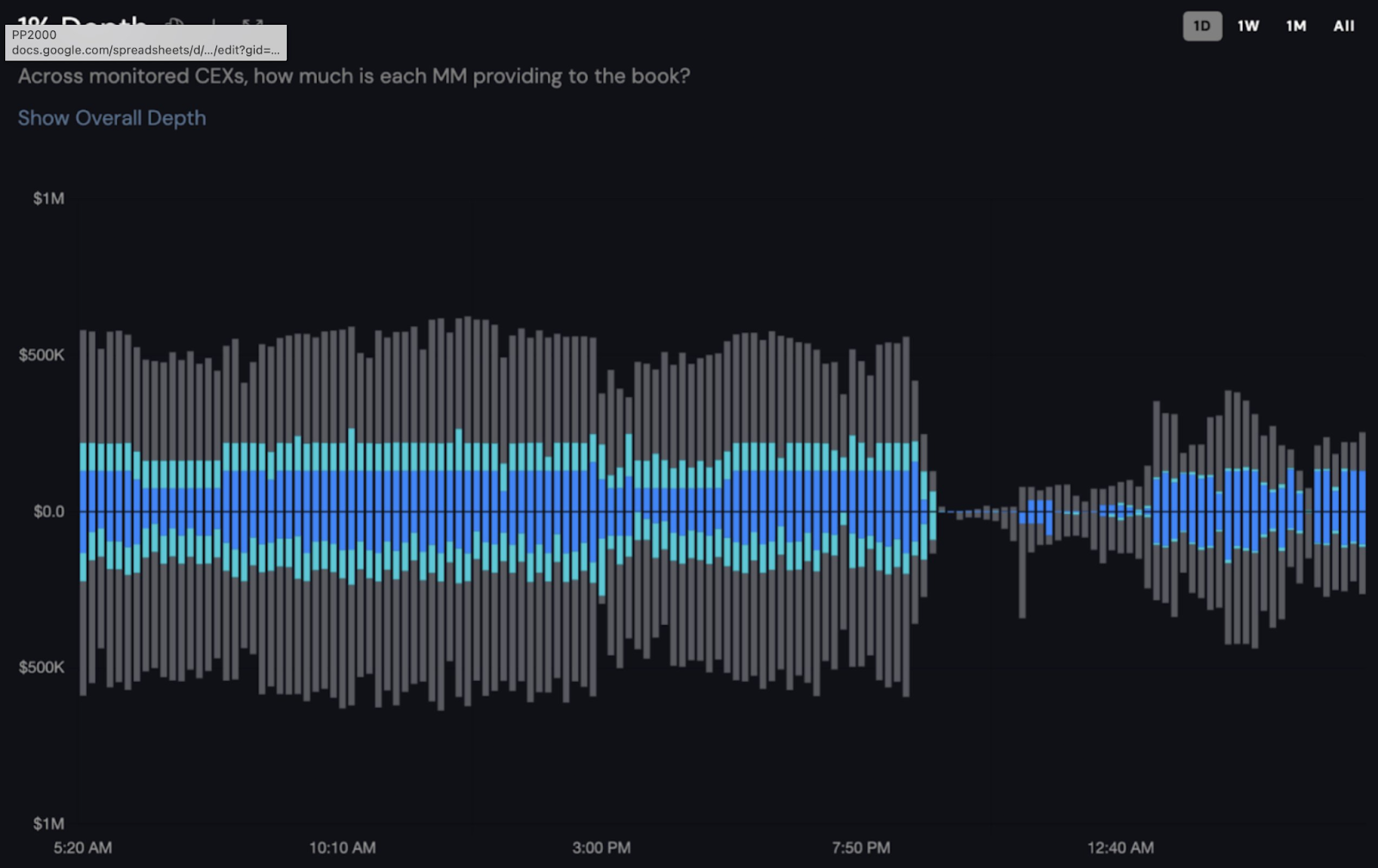

However, skepticism remains. Some traders have accused market makers (MMs) of deepening the crash by withdrawing liquidity at critical moments. Onchain researcher YQ reported that market makers began pulling bids around 9:00 pm UTC, roughly an hour after President Donald Trump’s tariff announcement against China rattled global markets.

By 9:20 pm UTC, most tokens had bottomed out, and market depth collapsed by 98%, leaving order books with as little as $27,000 in liquidity across tracked tokens. Coinwatch, another blockchain analytics platform, confirmed this figure and observed that two major market makers “pulled everything from the books” during the most volatile period.

The report also noted that while some liquidity providers returned within 90 minutes, others remained mostly inactive, compounding the volatility. In one case, a Binance-listed token with a $5 billion market cap saw two out of three market makers abandon their order books for nearly five hours.

Coinwatch said it is now in discussions with these firms to “accelerate their return into the order books”, aiming to restore stability and confidence.

Final Thought

While conspiracy theories continue to circulate, most data points to an over-leveraged market undergoing a necessary reset rather than a coordinated attack. The episode underscores both the fragility and resilience of crypto markets — where liquidity can vanish in seconds but recover just as fast, leaving traders debating whether it was “controlled deleveraging” or a manipulated meltdown.”