US Bitcoin and Ether ETFs See Rebound as Powell Signals Rate Cuts, Boosting Crypto Inflows

- US spot Bitcoin and Ether ETFs saw significant inflows on Tuesday after Federal Reserve Chair Jerome Powell’s rate cut signals.

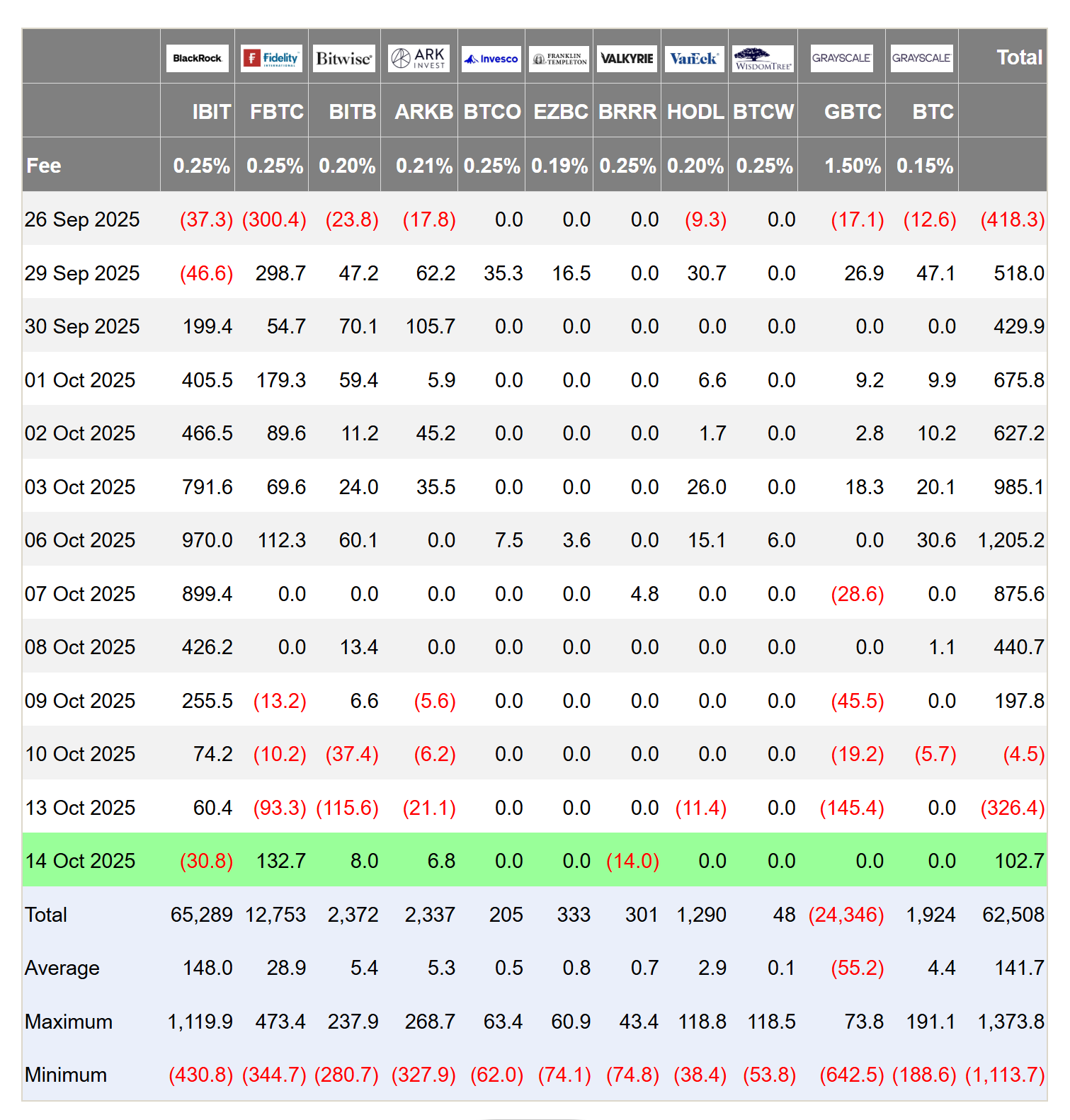

- Spot Bitcoin ETFs recorded $102.58M in inflows, reversing a $326M outflow.

- Ether ETFs mirrored the trend, with $236.22M in net inflows after a $428M outflow.

- Fidelity’s funds led the gains in both Bitcoin and Ether ETFs.

- Powell’s hints at rate cuts may drive further liquidity into digital assets.

US spot Bitcoin and Ether exchange-traded funds (ETFs) experienced a notable rebound on Tuesday, reversing the previous day’s significant outflows. According to data from SoSoValue, spot Bitcoin ETFs saw $102.58 million in net inflows, recovering from a sharp $326 million outflow just a day earlier. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the charge, with $132.67 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) posted a modest outflow of $30.79 million. As a result, the total net assets across all spot Bitcoin ETFs reached $153.55 billion, representing 6.82% of Bitcoin’s market cap, with cumulative inflows standing at $62.55 billion.

Ether ETFs mirrored the performance of Bitcoin, recording $236.22 million in net inflows after Monday’s steep $428 million outflow. Fidelity’s Ethereum Fund (FETH) topped the list of gains, attracting $154.62 million in inflows. Grayscale’s Ethereum Fund and Bitwise’s Ethereum ETF also saw positive inflows of $34.78 million and $13.27 million, respectively. This recovery suggests a renewed interest in digital assets, particularly as rate cut signals from the Federal Reserve have prompted capital to flow back into riskier assets, including cryptocurrencies and ETFs.

Federal Reserve Chair Jerome Powell’s comments on Tuesday played a crucial role in this turnaround. Powell indicated that the US central bank might be nearing the end of its balance sheet reduction program and preparing for possible rate cuts as the labor market shows signs of weakness. He suggested that the Federal Reserve may soon halt its “quantitative tightening” process, with reserves above the level consistent with ample liquidity. This development has created a positive sentiment in the markets, with many expecting a rate cut as early as October.

Vincent Liu, Chief Investment Officer at Kronos Research, commented that an October rate cut would likely lead to a surge in market liquidity, benefiting both crypto assets and ETFs. The prospect of lower interest rates is expected to stimulate further demand for digital assets, as investors seek efficient capital in a softer rate environment. As liquidity flows back into the market, ETFs are poised to benefit from increased investor interest, potentially boosting their value in the coming months.

Despite recent market turbulence, crypto investment products have shown remarkable resilience. Inflows into these products amounted to $3.17 billion last week, even amidst a flash crash caused by renewed US-China tariff tensions. According to CoinShares, crypto products only saw $159 million in outflows, even as $20 billion in positions were liquidated across exchanges. This resilience, combined with easing US-China tariff tensions and growing demand for digital assets, has contributed to strong momentum in the sector, with total inflows for 2025 already surpassing last year’s total.

Final Thought

The recent rebound in US Bitcoin and Ether ETFs reflects the broader market sentiment following Federal Reserve Chair Jerome Powell’s comments on potential rate cuts. As the market anticipates a more favorable interest rate environment, digital assets are likely to continue seeing strong inflows, with ETFs playing a key role in this growth. This trend highlights the growing resilience of crypto assets and their potential to benefit from liquidity shifts in traditional financial markets.