Tether Settles $300M Celsius Claims, Raising Concerns Over Stablecoin Liability

- Tether agrees to a $299.5M settlement with Celsius Network over claims related to the 2022 bankruptcy.

- The settlement could redefine stablecoin liability in future crypto bankruptcies.

- Celsius claimed Tether improperly liquidated Bitcoin collateral, contributing to its insolvency.

- The settlement is part of the ongoing dispute involving approximately $4B in claims.

- Potential legal exposure for stablecoin issuers could reshape regulations in distressed crypto markets.

Tether, the issuer behind the world’s most widely used stablecoin, has agreed to a $299.5 million settlement to resolve claims filed by the Celsius Network bankruptcy estate. The legal dispute stems from Celsius’s dramatic collapse in 2022, which became one of the defining events of the crypto market downturn that year. The settlement was announced on Tuesday by the Blockchain Recovery Investment Consortium (BRIC), a joint venture between asset manager VanEck and GXD Labs, an affiliate of Atlas Grove Partners. BRIC was appointed as the asset recovery manager and litigation administrator for Celsius’s bankruptcy proceedings in January 2024, after the company exited bankruptcy protection.

Celsius’s legal battle with Tether centered around accusations that the stablecoin issuer improperly liquidated Bitcoin collateral tied to loans denominated in USDt (Tether’s stablecoin). According to Celsius’s complaint, Tether sold the collateral when Bitcoin’s price was nearly equal to the value of Celsius’s debt, which allegedly wiped out the crypto lender’s position and contributed significantly to its insolvency. This settlement represents a partial resolution to the broader dispute, which had initially seen Celsius pursuing claims for approximately $4 billion. In August 2024, a court-approved adversary proceeding allowed the lawsuit against Tether to move forward, though it remains uncertain how this recent settlement will affect the overall litigation.

The newly agreed-upon $299.5 million settlement, while significant, is just a fraction of the claims Celsius had originally sought. The legal implications of this settlement go beyond the immediate case, raising important questions about the responsibility of stablecoin issuers when operating within the crypto ecosystem. Historically, stablecoin issuers such as Tether have argued that their role is purely transactional, focusing on the issuance and redemption of tokens rather than assuming liability for how those tokens are used by third parties across exchanges, lenders, or decentralized finance (DeFi) platforms. However, this case highlights a potential shift in that perception, as stablecoin issuers may now face increasing scrutiny over their actions in distressed markets.

The settlement could signal a growing area of legal risk for stablecoin issuers, as it suggests they may be held accountable for the role their tokens play in the broader ecosystem. This shift in perspective could result in tighter regulations and legal oversight, especially as more crypto companies face insolvency and bankruptcy proceedings. It could also lead to changes in how regulators view the responsibility of stablecoin issuers in maintaining market stability and protecting investors, which could shape the future of the industry.

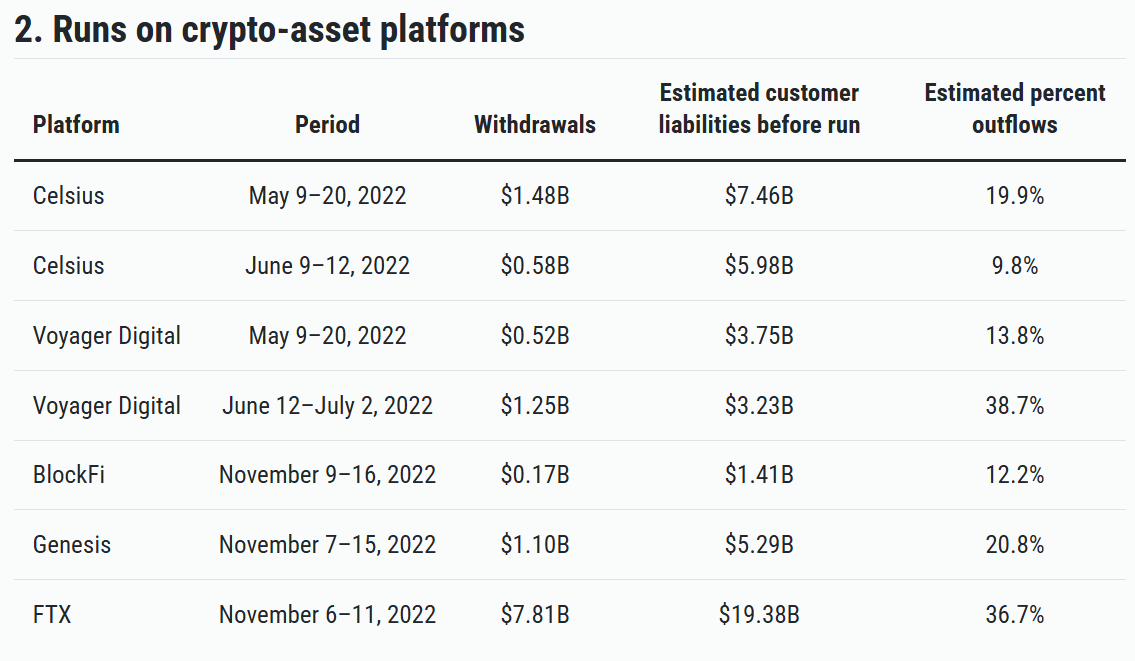

Celsius Network’s bankruptcy was part of a series of major failures that plagued the crypto industry in 2022, including the collapse of prominent crypto lenders like BlockFi and Voyager Digital. The market downturn was compounded by the eventual collapse of FTX, marking one of the darkest chapters in the history of crypto. During this time, confidence in the industry eroded, with a significant amount of capital leaving crypto platforms. A Federal Reserve Bank of Chicago analysis noted that nearly $13 billion was withdrawn from digital asset platforms between May and November of 2022, signaling a profound loss of trust.

In addition to the legal implications, the settlement may serve as a warning for other stablecoin issuers, as it may encourage further scrutiny and litigation. The rise of such lawsuits could lead to more complex regulatory frameworks for stablecoins, requiring issuers to navigate both legal and market risks more carefully. This settlement, though a step toward resolving one case, may serve as a bellwether for a broader legal shift within the cryptocurrency space.

Final Thought

The settlement between Tether and Celsius Network marks a pivotal moment in the ongoing debate over stablecoin liability and the responsibilities of issuers in distressed crypto markets. As the regulatory landscape evolves, this case could set significant precedents that affect the broader industry, particularly in how stablecoins are treated in bankruptcy proceedings and their potential legal exposure in future market downturns.